Stock Market

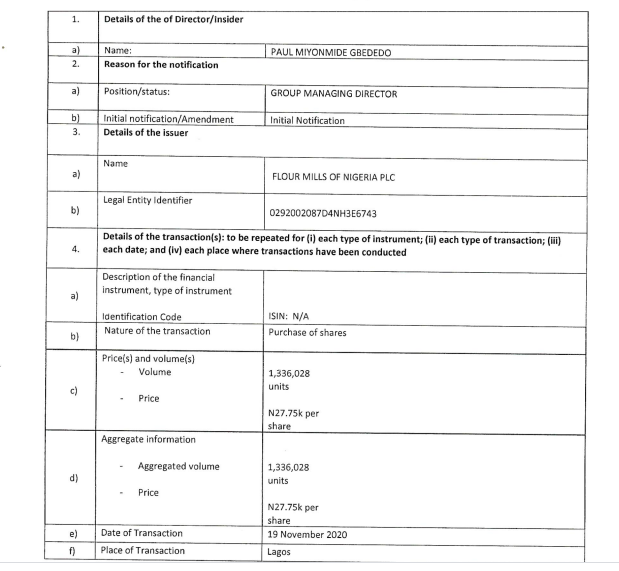

Insider Dealing: Flour Mills MD Invest N91.642 Million in Flour Mills

Nigerian Exchange Limited

Nigerian Stock Market Dips Again, All-Share Index Falls to 97,978.02

Nigerian Exchange Limited

Nigerian Equity Market Sheds N89bn Amid Rate Hike Fallout

Nigerian Exchange Limited

Nestle Nigeria Leads Gainers as Equities Market Appreciates 0.11% Despite MPC Decisions

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 30th, 2024

-

Naira3 weeks ago

Naira3 weeks agoBlack Market Dollar to Naira Exchange Rate Today 6th May 2024

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Exchange Rate Today 4th May 2024

-

Naira3 weeks ago

Naira3 weeks agoBlack Market Dollar to Naira Exchange Rate Today 8th May 2024

-

Travel4 weeks ago

Travel4 weeks agoAir Peace Flight Makes Emergency Landing Due to False Fire Warning

-

Naira3 weeks ago

Naira3 weeks agoBlack Market Dollar to Naira Exchange Rate Today 7th May 2024

-

Naira1 week ago

Naira1 week agoBlack Market Dollar to Naira Exchange Rate Today 16th May 2024

-

Jobs4 weeks ago

Jobs4 weeks agoFederal Government Approves 25-35% Pay Rise for Civil Servants on Eve of May Day