Stock Market

Nigerian Stock Exchange Leads Global Stocks, Year-to-date Gain Increased to 30% Last Week

Nigerian Exchange Limited

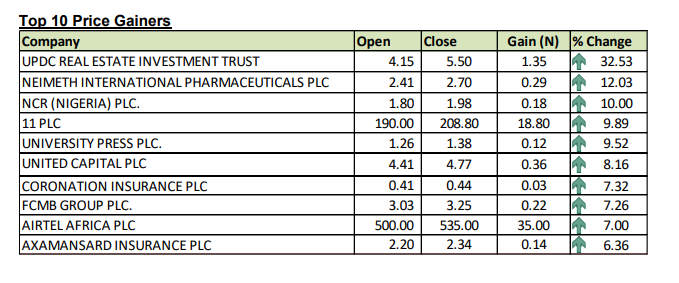

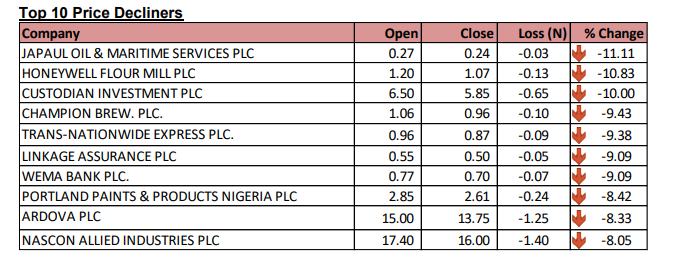

Nigeria’s Market Falls 1.09% Amid Decline in Key Sectors

Dividends

Zenith Bank to Pay N109.88bn Dividends to Shareholders for 2023

Nigerian Exchange Limited

VFD Group Plc’s Rights Issue Listed on NGX’s Daily Official List

-

Forex2 weeks ago

Forex2 weeks agoZiG to the Rescue: Zimbabwe Shifts Gear with New Currency Backed by Gold

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 9th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Exchange Rate at Black Market Today, March 21st, 2024

-

Billionaire Watch1 week ago

Billionaire Watch1 week agoNigerian Billionaire Tony Elumelu Contemplates Acquiring NPFL Club

-

Company News4 weeks ago

Company News4 weeks agoNNPC Gears Up for Public Listing, Embraces Full Commercialization

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 8th, 2024

-

Naira1 week ago

Naira1 week agoNaira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, March 26th, 2024