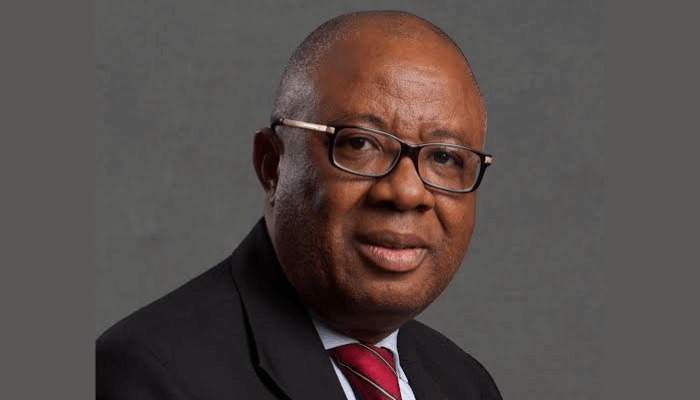

The United Bank for Africa Plc (UBA), Africa’s leading global bank, has announced the appointment of Emmanuel Nnorom as its new non-executive director, effective April 30, 2024.

This strategic appointment has received the approval of the Central Bank of Nigeria (CBN) as of May 13, 2024.

In an official statement, UBA highlighted the significance of Nnorom’s addition to the board. “Africa’s Global Bank, United Bank for Africa Plc (UBA), hereby announces the appointment of Emmanuel Nnorom as a non-executive director effective April 30, 2024.

The Central Bank of Nigeria (CBN) granted approval for this appointment on May 13, 2024.”

Tony Elumelu, Group Chairman at UBA, expressed his enthusiasm about the appointment.

“The appointment of Emmanuel Nnorom, a professional with considerable experience in the sector, emphasizes our Group’s commitment to strong governance and excellence. Nnorom brings a track record of working in critical sectors of the Nigerian economy, including power, and a pan-African perspective that complements our existing Board.”

With over 40 years of experience in financial services and audit, Nnorom’s extensive background includes significant board roles with listed companies.

He is a Fellow of the Institute of Chartered Accountants of Nigeria (ICAN) and an honorary member of the Chartered Institute of Bankers of Nigeria (CIBN).

Also, he is an alumnus of Templeton College, Oxford, further underscoring his vast expertise and qualifications.

UBA, which provides retail, commercial, and institutional banking services across several countries, including the United Kingdom, the United States of America, France, and the United Arab Emirates, continues to lead in financial inclusion and the implementation of cutting-edge technology.

This appointment comes at a time when UBA is celebrating record-breaking financial achievements. The bank recently reported over N2 trillion in revenue and a profit of N607.69 billion, the highest in its banking history.

Nnorom’s appointment is expected to bolster UBA’s board, bringing a wealth of knowledge and a fresh perspective to the bank’s operations. His experience in both financial services and critical sectors of the economy will be invaluable as UBA continues to expand its footprint and reinforce its commitment to excellence and strong governance.

As UBA continues to navigate the complexities of the global financial landscape, the addition of a seasoned professional like Emmanuel Nnorom signals the bank’s dedication to sustaining its growth trajectory and maintaining its position as a leading financial institution in Africa and beyond.

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Jobs4 weeks ago

Jobs4 weeks ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago