Disturbed by the controversies that have greeted the redesigned naira notes, their availability at banks and limit placed on the amount individuals and cooperate organisations can withdraw, Nigerian Governors have expressed readiness to interface with the Central Bank of Nigeria.

The 36 governors noted that there were enormous problems that citizens have complained about since the latest redesign policy was made.

Top of these issues is the withdrawal limit policy of the nation’s bank where individuals can only withdraw N500,000 cash weekly while corporate firms can withdraw up to N5 million cash across all channels including Automated Teller Machines and Point Of Sale terminals.

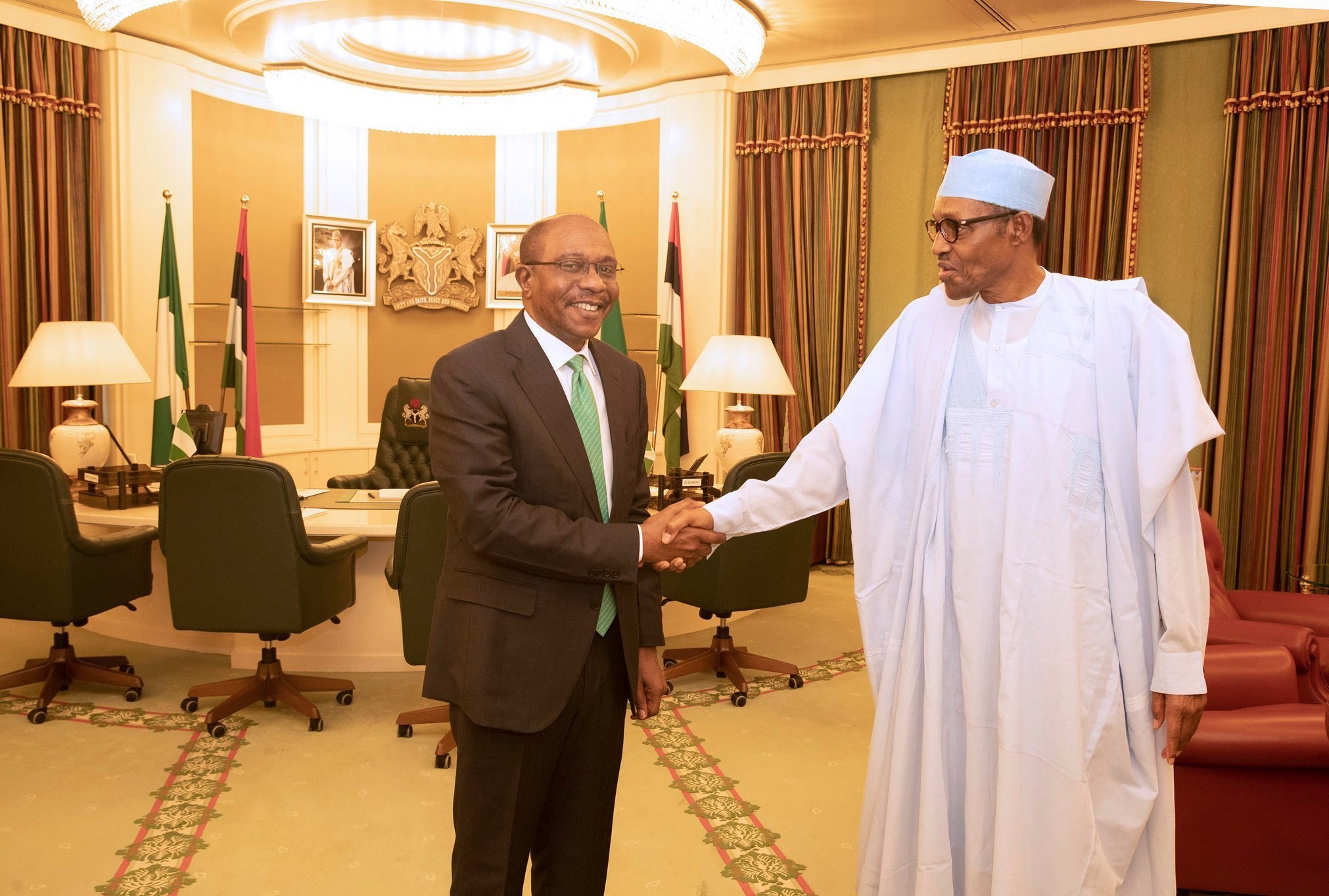

The governors disclosed that the CBN governor, Godwin Emefiele, had briefed them on the naira redesign, its economic and security implications, including the new withdrawal policy, adding that there was a need to discuss further with the apex bank with a view to addressing challenges.

Investors King had reported that on December 6, 2022, banks, and other financial institutions, payment service bank, primary mortgage banks and microfinance banks were directed by CBN to limit the maximum cash withdrawal over the counter by individuals and corporate firms weekly to N100,000 and N500,000 respectively.

Those interested in getting withdrawals that are more than the lower limit would require processing fees of 5% and 10% respectively for individuals and corporate firms.

But, the withdrawal limit generated condemnation from Nigerians, a situation that forced the apex bank to review the limit upward thus increasing individuals cash withdrawal to N500,000 cash weekly while corporate firms can withdraw up to N5 million cash.

In order to ameliorate the challenges that the redesigned naira notes may bring upon the nation’s financial system, the governors, under the umbrella of the Nigeria Governors’ Forum (NGF), at its first meeting in 2023 held on January 19, resolved to set up a committee that would meet with CBN.

They arrived at these resolutions which were contained in a communiqué issued on Saturday and signed by the NGF Chairman, the Sokoto State Governor, Aminu Tambuwal.

While declaring that they were that they were not against the essence of the naira redesign policy, the governors, however, said they had identified huge challenges that remained problematic to the Nigerian populace and to the nation’s monetary control.

According to the governors, the six-member committee set up for the task would be led by the Anambra State Governor, Charles Soludo.

Some of the mandate given to the committee is to interface with CBN and see how issues already identified would be resolved.

Members of the committee are the governors of Akwa Ibom, Ogun, Borno, Plateau and Jigawa.

The committee was tasked to work closely with the CBN leadership to ameliorate areas that require policy variation particularly the poorest households, the vulnerable in society and several other citizens of our country that are excluded in the policy.

The NGF further tasked the committee, saying, “collaborate with the CBN and the Nigerian Financial Intelligence Unit NFIU in advancing genuine objectives within the confines of our laws.”

They further decided to also collaborate with the CBN and the Nigerian Financial Intelligence Unit in advancing genuine objectives within the confines of Nigeria’s laws.

The governors said that the recent NFIU advisory and guidelines on cash transactions were outside the NFIU’s legal remit and mandate.

They called on the CBN to consider the peculiarities of states especially as they pertain to financial inclusion before arriving at its monetary decisions and policies.

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago