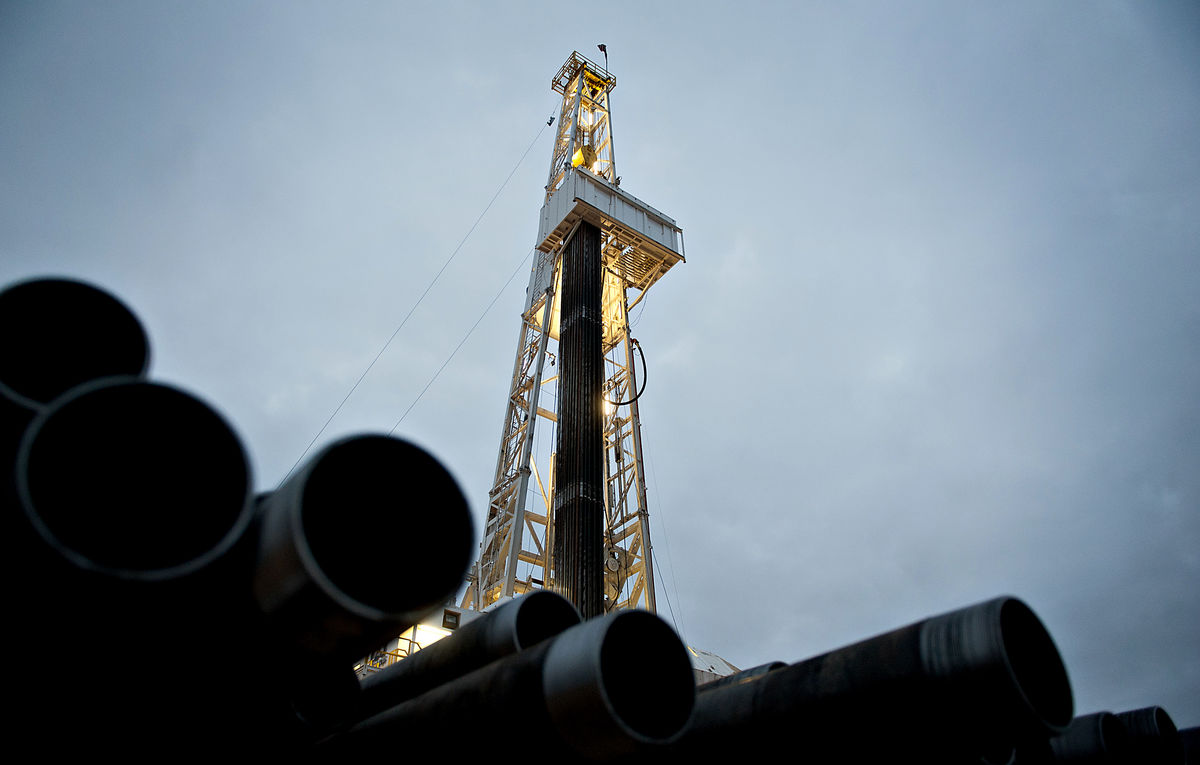

The shortfall in the daily crude oil production allocation by the Organisation of Petroleum Exporting Countries (OPEC) to Nigeria is making the country to lose a whooping sum of $2.5bn monthly, the Nigeria Employers’ Consultative Association (NECA) has said.

Recall that Nigeria’s crude oil production increased by 4.2 per cent to 1.23 million barrels per day in December 2022, but NECA maintained that the production is still short.

Hence, the country has been losing about $2.5bn monthly for failing to meet the 1.8m barrel per day crude oil production allocation by OPEC.

The Director-General of NECA, Adewale-Smatt Oyerinde, in a statement noted that a 0.57 million barrel per day shortfall has been translating to about $2.5bn monthly loss for Nigeria.

Oyerinde revealed that oil theft appeared to worsen and the unsustainable subsidy on petroleum products had joined to reduce the government’s revenue, leading to absurd debt accumulation.

He said that misalignment between the fiscal and monetary policies, which were dwindling investors’ confidence, has made the country unattractive for Foreign Direct Investments.

While expressing the need for the government, especially the incoming one to show the political will to implement policies that will drive the economy back on a growth trajectory, Oyerinde said, “Crude oil production grew in the month of December 2022 by 4.2 per cent month-on-month to 1.23m barrel per day, but remained significantly short of the 1.8m barrel per day allocated by OPEC to the nation, amounting to about $2.5bn loss monthly at an average of $100pb.

“Deliberate efforts must be made to reverse some of the current policies and implement new ones. All leakages associated with government revenue must be blocked (oil theft, skewed concessions, fuel subsidy, etc.). A wholesome review of the tax administration to make it more equitable and investor-friendly should be initiated,” he further submitted.

The NECA boss, however, lamented that while governments in other climes were reducing tax rates in order to enhance economic activities, promote sustainable consumption and attract investors, Nigeria cannot continue to over-tax its businesses and citizens.

According to him, there is a misplacement of priority by the present administration which caused the underdevelopment and deterioration of critical sectors such as education, health and infrastructure in the country.

He said, “With over 50 different taxes, levies and fees and Company Income Tax hovering around 35 per cent, raising taxes in order to increase revenue will be counterproductive. As the nation nears the mark of N77trn in debt with negligible impact on infrastructural development, the incoming government must develop strategies to diversify the revenue base through the revival of the country’s lagging non-oil sectors.

“While there have been projections for a global recession in 2023, the time for a major paradigm shift in our economic philosophy is now. Over the last decade, the country has spent over N10tn on fuel subsidy, about N15.5tn on Capital Expenditure, N2.5tn on Health and about N3.9tn on Education. This is a misplacement of priority and shows that critical developmental items such as education, health and infrastructure have suffered due to crass misplacement of our economic priorities.”

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago