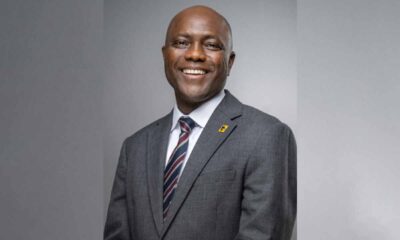

The Group Managing Director/Chief Executive Officer of Zenith Bank Plc, Dr. Ebenezer Onyeagwu, has been named the ‘Best Banking CEO of the Year in Africa’ at the International Banker 2024 Banking Awards, retaining this title for the second consecutive year.

This award, published in the Spring 2024 issue of International Banker Magazine, United Kingdom, coincides with Dr.

Onyeagwu’s completion of his five-year tenure as Group Managing Director/Chief Executive Officer on May 31, 2024.

Speaking on receiving the award, Dr. Onyeagwu expressed his gratitude to the publishers of International Banker for the honour.

He stated, “It is indeed an honour to be recognised as the ‘Best Banking CEO of the Year in Africa’ for a second consecutive year. This award is a testament to our team’s collective efforts and our commitment to innovation, growth, and delivering value to our customers and stakeholders. It also reflects our dedication to sustainability and high ethical standards, which are integral to our overall strategy. I am immensely proud of our accomplishments and look forward to future opportunities for the bank as I hand over the baton to my successor and begin the mandatory regulatory cooling-off period.”

Dr. Onyeagwu dedicated the award to the Founder and Chairman of Zenith Bank Plc, Dr. Jim Ovia, CFR, for his mentorship, which was crucial to his success as Group Managing Director/CEO; to the bank’s management team and staff for their unwavering commitment over the past five years; and to the bank’s customers for their loyalty.

Throughout his distinguished tenure, Dr. Onyeagwu has received multiple awards, including Bank CEO of the Year (2019, 2023) by Champion Newspaper, Bank CEO of the Year (2020–2023) by BusinessDay Newspaper, CEO of the Year (2020 and 2021) – SERAS Awards, and CEO of the Year (2022) – Leadership Newspaper, and Banking CEO of the Year, Africa (2023) – International Banker.

Appointed as the Group Managing Director/Chief Executive Officer on June 1, 2019, as part of Zenith Bank’s succession planning strategy, Dr. Onyeagwu has led the bank to achieve significant milestones in financial performance, financial inclusion, corporate governance, and sustainability.

These achievements have earned the bank numerous local and international awards, including being named Best Bank in Nigeria for the fourth time in five years from 2020 to 2022 and in 2024 by the Global Finance World’s Best Banks Awards; Best Bank for Digital Solutions in Nigeria by the Euromoney Awards 2023; being listed in the World Finance Top 100 Global Companies in 2023; and being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the 14th consecutive year in the 2023 Top 1000 World Banks Ranking published by The Banker Magazine.

Zenith Bank has also been honoured as Best Commercial Bank in Nigeria for three consecutive years from 2021 to 2023 by the World Finance Banking Awards; Best Corporate Governance Bank in Nigeria by the World Finance Corporate Governance Awards 2022 and 2023; Bank of the Year (Nigeria) by The Banker’s Bank of the Year Awards in 2020 and 2022; and Best in Corporate Governance Financial Services Africa for four successive years from 2020 to 2023 by Ethical Boardroom.

Other recognitions include Most Sustainable Bank in Nigeria at the International Banker 2023 Banking Awards, Best Commercial Bank in Nigeria, and Best Innovation in Retail Banking in Nigeria at the International Banker 2022 Banking Awards.

Additionally, Zenith Bank was named the Most Valuable Banking Brand in Nigeria in the Banker Magazine Top 500 Banking Brands 2020 and 2021; Bank of the Year 2023 and Retail Bank of the Year for three consecutive years from 2020 to 2022 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards; Bank of the Decade (People’s Choice) at the ThisDay Awards 2020; Bank of the Year 2021 by Champion Newspaper; Bank of the Year 2022 by New Telegraph Newspaper; and Most Responsible Organisation in Africa 2021 by SERAS.

In recognition of his significant contributions to the financial services sector in Nigeria and across Africa, Dr. Onyeagwu was awarded a Doctorate Degree in Business Administration by the University of Nigeria, Nsukka, on March 25, 2023, during the university’s 50th convocation ceremony.

Published by Finance Publishing Limited, the International Banker is a leading global source of authoritative analysis and opinion on banking, finance and world affairs. Its influence, integrity, accuracy and objective opinion have earned it global recognition.

The International Banker Awards strive to recognise the most worthy financial institutions around the world – those not just doing their jobs well but exceptionally well – those operating at the industry’s cutting edge and setting new performance levels to which others will aspire.

The 2024 Banking Awards focused on various criteria, including the provision of much-needed capital for economic growth, cutting-edge innovation to enhance security and efficiency, commitment to sustainability and ESG principles, as well as intelligent investing to maximise profits and shareholder value.

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira6 days ago

Naira6 days ago

Jobs4 weeks ago

Jobs4 weeks ago