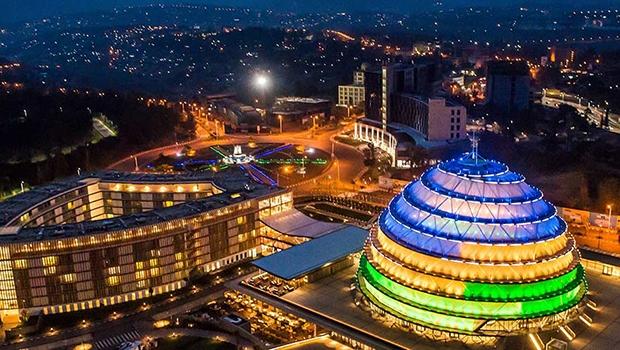

When it comes to doing business in Africa, the continent has grown and improved dramatically over the last decade or so, but the majority of nations are still dealing with inefficient tax collection and business registration, corruption, lack of infrastructure, and other issues. Yet Rwanda, together with partners like NRD Companies and others, has managed to transform itself into one of the leading economies in the developing world.

A country not long ago plagued by civil war and political instability, Rwanda is currently ranked second in the Sub-Saharan region and 38th globally in the World Bank’s Ease of Doing Business rankings. It is the only low-income country ranked among the first 100 countries.

But it took more than a decade of successful reforms to reach the stage the country is now at. Richard Kayibanda, who has been Registrar General at Rwanda Development Board (RDB) since 2018, talks about Rwanda’s transformation in more depth.

What were the most inefficient procedures that stalled business development in Rwanda a decade or two ago?

The most inefficient procedures were to do with business registration. Before implementing reforms in 2008, the legal system was outdated, with some legal aspects dating back to the 1960s. On top of that, all services were delivered manually, and many government institutions had overlapping responsibilities, which furthered unnecessary costs and overregulation. During this period, the country struggled to incentivize local entrepreneurs to start businesses or attract foreign investors.

What were the main challenges when registering a business prior to the reforms?

You needed an Article of Association (AoA) to register a business, which a lawyer could only do. The drafting of AoAs took approximately two days and cost at least US$300. Additionally, the documents required authentication by a public notary at the cost of US$150 and took at least one week to complete. So, in total, you are looking at more than two weeks and more than US$450 just to legally open your business. The cost of opening a business was largely prohibitive.

When did the first catalyst for change come about?

The first significant indicator of the changes coming came in 2007. The government established the Doing Business Steering Committee, bringing together representatives from different ministries and public agencies to lead the way towards implementing business-related reforms. Since then, Rwanda has introduced more than 50 legal and institutional reforms to improve the business environment. This has made the country the top reformer in the world in the last ten years.

What were the most important areas that the reforms aimed to improve?

The main goal was to introduce a digitized and automated version of the registry to incentivize business creation. An equally important objective was to make the process as timely and cost-efficient as possible. The new business registration system introduced free online registration for all companies. It presented the option to register a business without Articles of Association and removed the minimum capital requirements.

The online business registration, acting as a one-stop-shop for everything business registration-related, also made post-registration procedures like VAT registration online faster and enforcing contracts easier. In a few years, registering a business in Rwanda became free and fast: four procedures and five days compared to nine procedures and 16 days in 2008.

Did the changes require outside partnerships? If yes, who were your partners? Why did you choose them?

We have had many partners throughout our reforming journey. We partnered with NRD Companies to work on the technological part of the project. Since 2009, the company has helped Rwanda with the design, implementation, operation, and monitoring of the Rwandan commercial registration services. This included company registration, business information, registration of secured transactions and registration of intellectual property rights.

What made NRD stand out was that they recognized the importance of educating and informing society about such a significant change in their lives. NRD Companies prepared an awareness and outreach campaign, which allowed us to navigate the transition as smoothly as possible. They also offered continuous technological support after the project was implemented. We are still in contact with them and are invited to share our experience with other countries from time to time.

Seems like the reform framework and the digitization of business-related services has been successful. Rwanda is now the second-fastest growing economy in Africa, with 10.3% growth per year in the last 15 years. What advice would you give to other countries eyeing similar reforms?

The first thing I would say is that government support is essential. Resistance from stakeholders and beneficiaries is something you will most likely face in your journey, so having backing from the government helps ease the process. Also, reforms and infrastructure cost money. Additionally, sufficient ICT knowledge is paramount.

But at the end of the day, big changes are always accompanied by significant challenges, so try to be one step ahead of time and plan everything accordingly. I think soon we will see an increasing number of governments around the world introducing technological solutions to spur societal, political, and economic growth.

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago