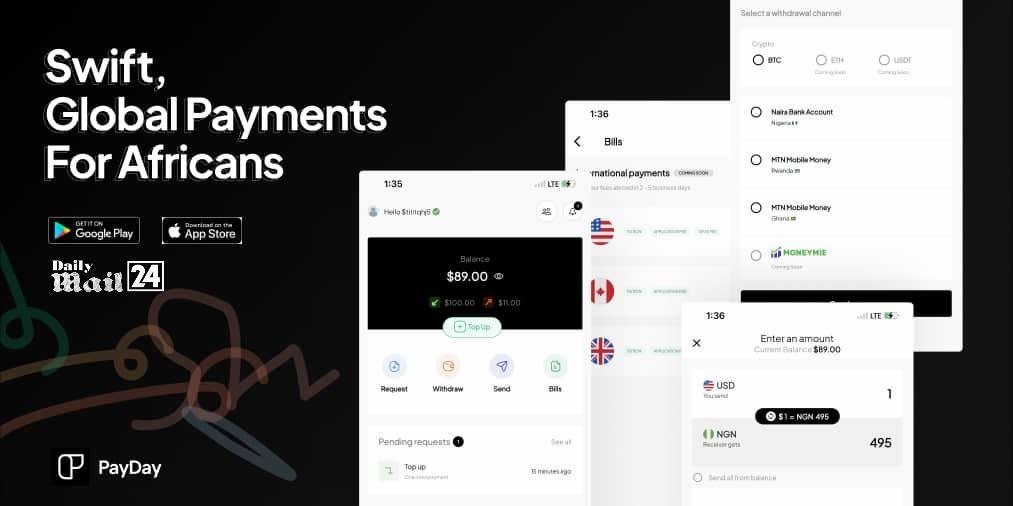

Payday, an African fintech startup has secured a one million dollars pre-seed fund to continue with its efforts to enable swift global payments for Africans.

After the cold launch in June 2021, Payday has grown exponentially with over 5,000 users and $1.4 million in transactions successfully processed within the first three weeks with most of its users coming through referrals and “word of mouth”.

With the vision to become the “Paypal for Africa”, Favour Ori, founder and CEO of Payday said, “several investors including LoftyInc Capital, Microtraction, Magic Fund, Ventures Platform, Voltron Capital, CcHub Syndicate, Helicarrier Inc, Greencap Equity, Midlothian Angel Network, Emergence Capital, Olugbenga Agboola (GB), have backed the company to achieve this goal”.

Other investors include; Charles Odita, Eke Eleanya, Adegoke Olubusi, Edmund Olotu (Bloc), Prosper Otemuyiwa (Eden), Dimeji Sofowora, Perseus Mlambo (Union54), Abdul Hassan (Mono), and Onyekachukwu Somtochukwu Eyisi.

Payday is facilitating sending and receiving money globally from Africa and enabling payments between foreign employers and clients. As well as issuing Virtual Mastercards, and paying tuition and other fees in the United States, Canada, and the United Kingdom.

With the investment, Favour Ori told benjamindada.com that “Payday will expand into new territories and also hire talents for their Engineering, Product, Compliance and Growth roles to scale its operations and also acquire additional licenses”.

According to Ntoudi Mouyelo-K, the Chief Investment Officer (CIO) of Rwanda Finance Limited, “Payday’s continental ambition will benefit from KIFC premier Pan-African financial network. The number of African and international investors supporting Payday is a recognition of Mr. Ori’s innovative solution developed from Rwanda and it illustrates the attractiveness of Kigali International Financial Center as a new home for fintech in Africa”.

Mouyelo-K who is leading the agency in charge of the promotion and development of Kigali International Financial Center (KIFC) has welcomed the establishment of Payday in Rwanda.

Meanwhile, Temi Awogboro, General Partner at MAGIC Fund said “Magic is delighted to be an early backer of Favour and the Payday team in achieving their audacious vision of enabling swift borderless online payments services for Africa, thereby connecting its users with vast opportunities around the world.”

According to her, “this aligns with our founders-backing-founders thesis and we are excited by the opportunity to support the team as they positively disrupt the space.”

“Africa is home to some of the most talented and ambitious entrepreneurs we see in the world today, and they are solving problems for one of the biggest markets on the planet’ Sunil Sharma, Managing Director of Techstars Toronto said ‘sending money remains complicated, time-consuming and expensive but we believe Payday Africa has the vision to liberate Africans and the global diaspora to send and receive money quickly and affordably”

Payday’s team is made up of bankers and engineers with the co-founder and CEO of Co-Creation Hub, Bosun Tijani, Gossy Ukwanwoke and Olalekan Olude as advisors.

Bosun believes that “Payday’s solution is extremely timely and it backs up Africa’s agenda of a single market. Making it seamless and easy to pay people in their local currency and through multiple checkouts, the option is a strong boost for AfCFTA”.

Forex2 weeks ago

Forex2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago