Fund Raising

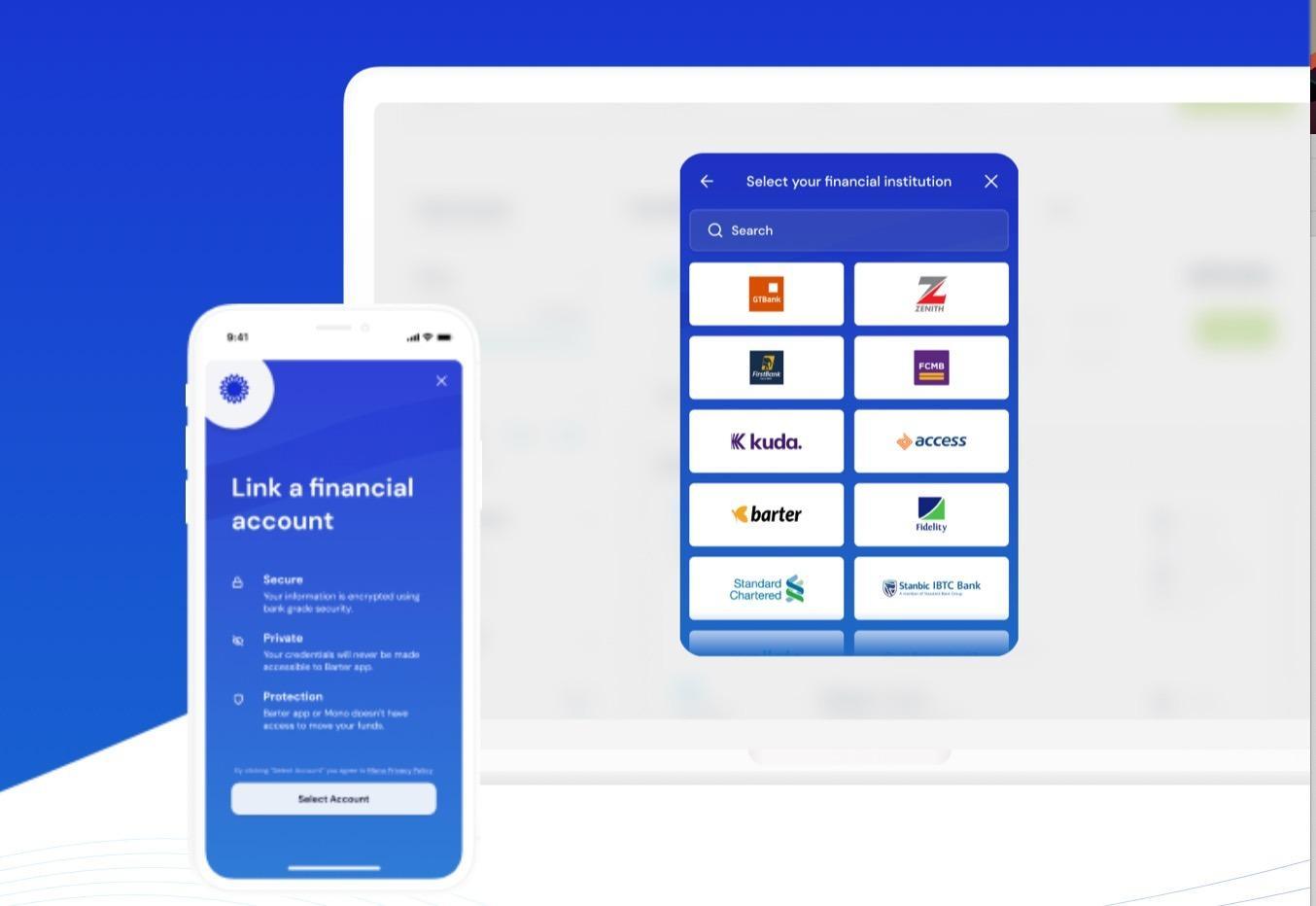

Nigerian Open Banking Startup Mono Secures $15M In Series A Funding Round Led by Tiger Global

Fund Raising

Nigerian Mobility Pioneer Moove Raises $76 Million in Game-Changing Financing Round

Fund Raising

Zuvy Secures $4.5 Million to Revolutionize SME Financing in Africa

Nigerian startup Zuvy raises substantial funding to transform the landscape of small and medium-sized enterprise (SME) financing in Africa, addressing the critical challenges faced by businesses in accessing capital

Fund Raising

Nigerian Health Tech Startup Helium Health Secures $30 Million in Funding to Expand Offering in Africa

Nigerian health tech startup Helium Health has secured $30 million in series B funding to expand its offering across Africa.

-

Education4 weeks ago

Education4 weeks agoFederal Government Approves 133% Allowance Boost for NYSC Members, Now ₦77,000

-

News3 weeks ago

News3 weeks agoBbnaija’s Wanni Wins Innoson Car Challenge, Secures First Vehicle with Twin Sister

-

Business3 weeks ago

Business3 weeks agoNigerian Businesses Slash Dollar Exposure as Naira Depreciation Deepens

-

Technology3 weeks ago

Technology3 weeks agoOpenAI’s Valuation Soars to $157 Billion After $6.6 Billion Funding Round

-

Investment4 weeks ago

Investment4 weeks agoVice President Shettima Calls on Global Investors to Trust Nigeria’s Economic Reforms at UNGA

-

Investment3 weeks ago

Investment3 weeks agoFG Secures $200m Afreximbank Investment For Creative Industry

-

Telecommunications4 weeks ago

Telecommunications4 weeks agoTelecom Firms Face N56 Billion Monthly Diesel Bill Amid Power Woes

-

Banking Sector3 weeks ago

Banking Sector3 weeks agoUnity Bank, Anwbn Empower Women Entrepreneurs With Ai, Digital Marketing Skills