Forex

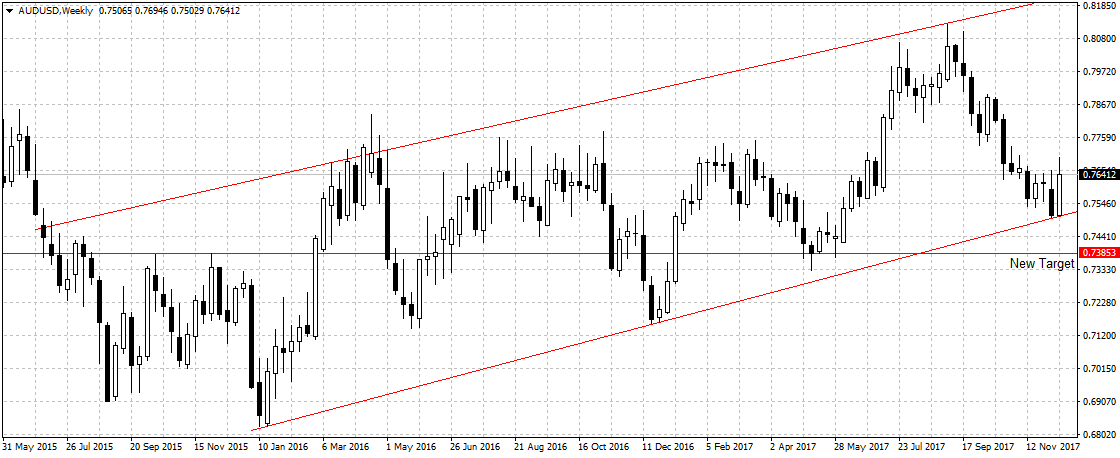

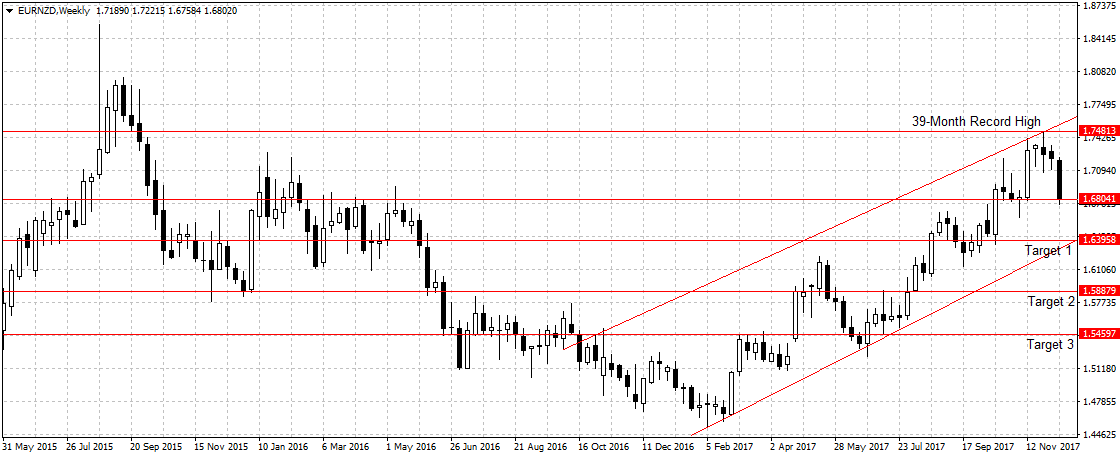

Forex Weekly Outlook December 18-22

Naira

Black Market Dollar (USD) to Naira (NGN) Exchange Rate Today 27th May 2024

The black market, also known as the parallel market or Aboki fx, US dollar to Nigerian Naira exchange rate as of May 27th, 2024 stood at 1 USD to ₦1,520.

Forex

CBN Revamps Regulatory Guidelines for Bureau De Change Operators

Naira

Black Market Dollar (USD) to Naira (NGN) Exchange Rate Today 23rd May 2024

The black market, also known as the parallel market or Aboki fx, US dollar to Nigerian Naira exchange rate as of May 23rd, 2024 stood at 1 USD to ₦1,500.

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 30th, 2024

-

Naira3 weeks ago

Naira3 weeks agoBlack Market Dollar to Naira Exchange Rate Today 6th May 2024

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Exchange Rate Today 4th May 2024

-

Naira3 weeks ago

Naira3 weeks agoBlack Market Dollar to Naira Exchange Rate Today 8th May 2024

-

Naira2 weeks ago

Naira2 weeks agoBlack Market Dollar to Naira Exchange Rate Today 16th May 2024

-

Naira3 weeks ago

Naira3 weeks agoBlack Market Dollar to Naira Exchange Rate Today 7th May 2024

-

Jobs4 weeks ago

Jobs4 weeks agoFederal Government Approves 25-35% Pay Rise for Civil Servants on Eve of May Day

-

Banking Sector4 weeks ago

Banking Sector4 weeks agoZenith Bank Shareholders Approve Holdco Structure