Tesla Inc. has announced plans to slash over 6,000 jobs in Texas and California as part of CEO Elon Musk’s directive to trim more than 10%...

Numerous factors impact and influence forex trading. Many have to do with macro and microeconomic factors, but politics also plays a significant role, too. It can...

Dangote Petroleum Refinery has once again sent ripples through Nigeria’s fuel market by further reducing the prices of diesel and aviation fuel. In a bid to...

NNPC and Newcross Exploration and Production Ltd are working together to increase production at the Awoba Unit Field to 12,000 barrels per day (bpd) within the...

A Delta Air Lines flight from Atlanta to Lagos was diverted to Togo following the midair death of a yet-to-be-identified passenger. The unfortunate incident occurred approximately...

Amidst a backdrop of global economic shifts and geopolitical recalibration, gold prices dipped below the $2,300 price level. The decline comes as investors carefully analyse signals...

Despite ongoing tensions in the Middle East, oil prices remained resilient, holding steady above key levels on Tuesday. Brent crude oil traded above $87 a barrel...

As of April 23rd, 2024, the exchange rate for the US dollar to the Nigerian Naira stands at 1 USD to 1,250 NGN in the black...

Health insurance is a crucial aspect of financial planning and ensuring access to quality healthcare. However, sometimes life gets busy, and you may forget to renew...

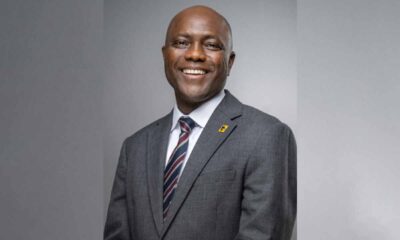

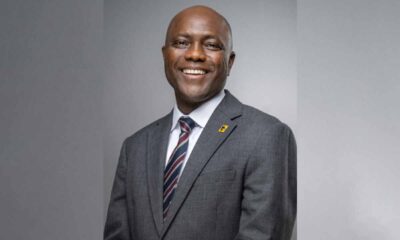

First Bank of Nigeria Limited, a subsidiary of FBN Holdings PLC, has announced the appointment of Mr. Olusegun Alebiosu as its Acting Chief Executive Officer (CEO)....