- Nigeria’s External Reserves Decline by $460m in Two Months

Nigeria’s external reserves continued to decline in the last two months despite a claim of improved capital inflows through the I&E forex window.

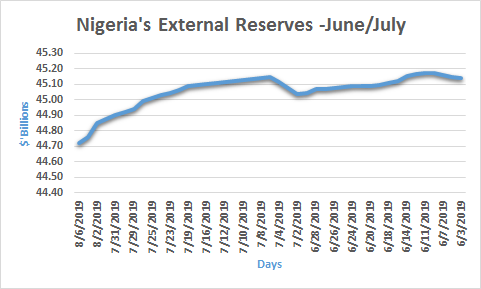

The latest data from the Central Bank of Nigeria (CBN) showed external reserves declined from over $45.18 billion recorded in June 2019 to $44.72 billion as of August 6th, 2019. This represents a decline of $460 million and suggested that the weak demands for Nigerian oil in the global market might have started weighing on the foreign reserves.

In June, the reserves rose to $45.18 billion, the highest in the last two months but declined by almost $170 million to $45 billion on July 25th before plunging by another $290 million to $44.72 billion.

In June, the reserves rose to $45.18 billion, the highest in the last two months but declined by almost $170 million to $45 billion on July 25th before plunging by another $290 million to $44.72 billion.

Apart from the weak global demand for Nigerian crude oil, oil price plunged below $60 a barrel on Wednesday to $57.31 following president Trump decision to seized Venezuelan government assets in the USA, one of the world’s key oil producers.

The move increased global risk and uncertainty as investors in the energy sector pulled back, especially knowing the US and China are still not getting anywhere with the trade agreement.

The move increased global risk and uncertainty as investors in the energy sector pulled back, especially knowing the US and China are still not getting anywhere with the trade agreement.

However, with oil now trading below the Federal Government’s $60 per barrel benchmarked in the 2019 budget, the budget deficit will surge or CBN will have to source for an alternative to bridge the difference in projected funding.

This may not be unconnected with CBN recent policy to restrict milk importers from accessing forex from the apex bank to ease about $1.2 billion to $1.5 billion pressure on the foreign reserves, the amount spent on milk importation yearly.

It should also be recalled that the CBN had previously restricted palm oil importers from approaching the apex bank for foreign exchange in May, citing needs to conserve the foreign reserves and stimulate local production.

The current global events are pointing to a cautious central bank struggling to sustain its ability to intervene in the foreign exchange market in order to maintain Naira stability despite claiming that investors exchanged $35 billion through the I&E forex window in the last two years.

With oil price now trading below the 2019 budget benchmark, the apex bank would have to restrict more items from official windows. A move that could once again widen foreign exchange rates, especially in the black market and automatically increased consumer prices of import-dependent products.