Investment

Abu Dhabi’s IHC Launches 2PointZero: $27 Billion Holding Firm Led by Royal Family Member

Investment

FG Warns Property Owners: Settle Ground Rent in 60 Days or Lose Certificates of Occupancy

Investment

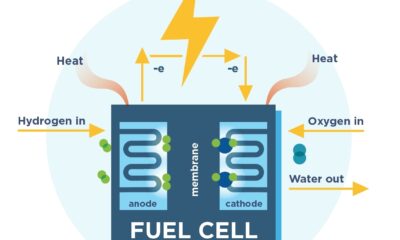

Deji Adeleke Boasts of Generating 15% of Nigeria’s Electricity, to Unveil $2bn Worth of Power Plant Next Year

Investment

British International Investment and Ecobank Sierra Leone Sign $25 Million Risk Sharing Agreement to Boost Private Sector Growth

-

Education4 weeks ago

Education4 weeks agoFederal Government Approves 133% Allowance Boost for NYSC Members, Now ₦77,000

-

News3 weeks ago

News3 weeks agoBbnaija’s Wanni Wins Innoson Car Challenge, Secures First Vehicle with Twin Sister

-

Business3 weeks ago

Business3 weeks agoNigerian Businesses Slash Dollar Exposure as Naira Depreciation Deepens

-

Technology3 weeks ago

Technology3 weeks agoOpenAI’s Valuation Soars to $157 Billion After $6.6 Billion Funding Round

-

Investment4 weeks ago

Investment4 weeks agoVice President Shettima Calls on Global Investors to Trust Nigeria’s Economic Reforms at UNGA

-

Investment3 weeks ago

Investment3 weeks agoFG Secures $200m Afreximbank Investment For Creative Industry

-

Telecommunications4 weeks ago

Telecommunications4 weeks agoTelecom Firms Face N56 Billion Monthly Diesel Bill Amid Power Woes

-

Banking Sector3 weeks ago

Banking Sector3 weeks agoUnity Bank, Anwbn Empower Women Entrepreneurs With Ai, Digital Marketing Skills