Company News

Google Executives Pleads With Employees to Remain Motivated as Company Navigates Economic Downturn

Sundar Pichai in a recent companywide meeting stated that the current upheaval ravaging the company has also forced executives to cut their bonuses amid the mass layoffs of employees.

Company News

Oando PLC Refutes Allegations of Maltese Oil Terminal Ownership

Company News

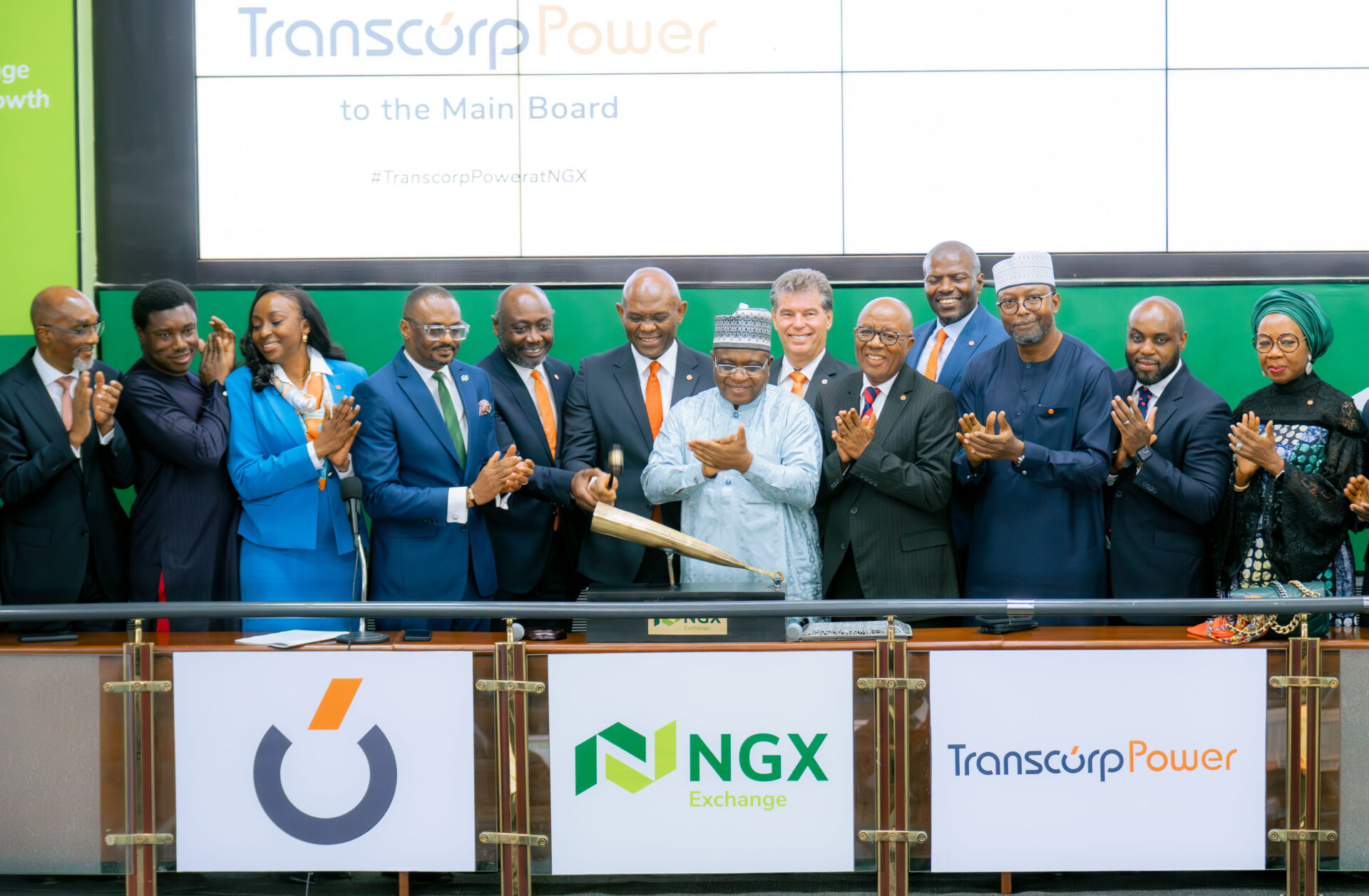

Transcorp Power Announces 214% Jump in Profit After Tax in H1, 2024

Merger and Acquisition

Oando PLC Secures Government Approval for Acquisition of Nigerian Agip Oil Company

-

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks agoWarren Buffett Donates $5.3 Billion in Berkshire Shares to Charities

-

News4 weeks ago

News4 weeks agoJoke Silva Quashes Death Rumors, Confirms Olu Jacobs is Alive

-

News4 weeks ago

News4 weeks agoNorth Israel Turns Into Ghost Towns Amid Hezbollah Missile Barrage

-

Bitcoin4 weeks ago

Bitcoin4 weeks agoBitcoin Slumps 13% in Q2, Prompting Investor Concerns

-

Naira4 weeks ago

Naira4 weeks agoNigeria’s Foreign-Exchange Woes Intensify with Prolonged Naira Decline

-

Treasury Bills4 weeks ago

Treasury Bills4 weeks agoCBN Treasury Bills Auction Oversubscribed by 338%, Raises N284.26bn

-

Forex3 weeks ago

Forex3 weeks agoNigerian Banks Face Sanctions for Rejecting Small and Old US Dollar Notes

-

Telecommunications4 weeks ago

Telecommunications4 weeks agoBroadband Penetration Rises to 43.53% in Nigeria, Says NCC