Cryptocurrency

Bitcoin Pares Losses as U.S Federal Reserve Accelerate Stimulus Withdrawal Plans

Cryptocurrency

Binance Loses Ground in Global Bitcoin Trading Amid Regulatory Challenges

Cryptocurrency

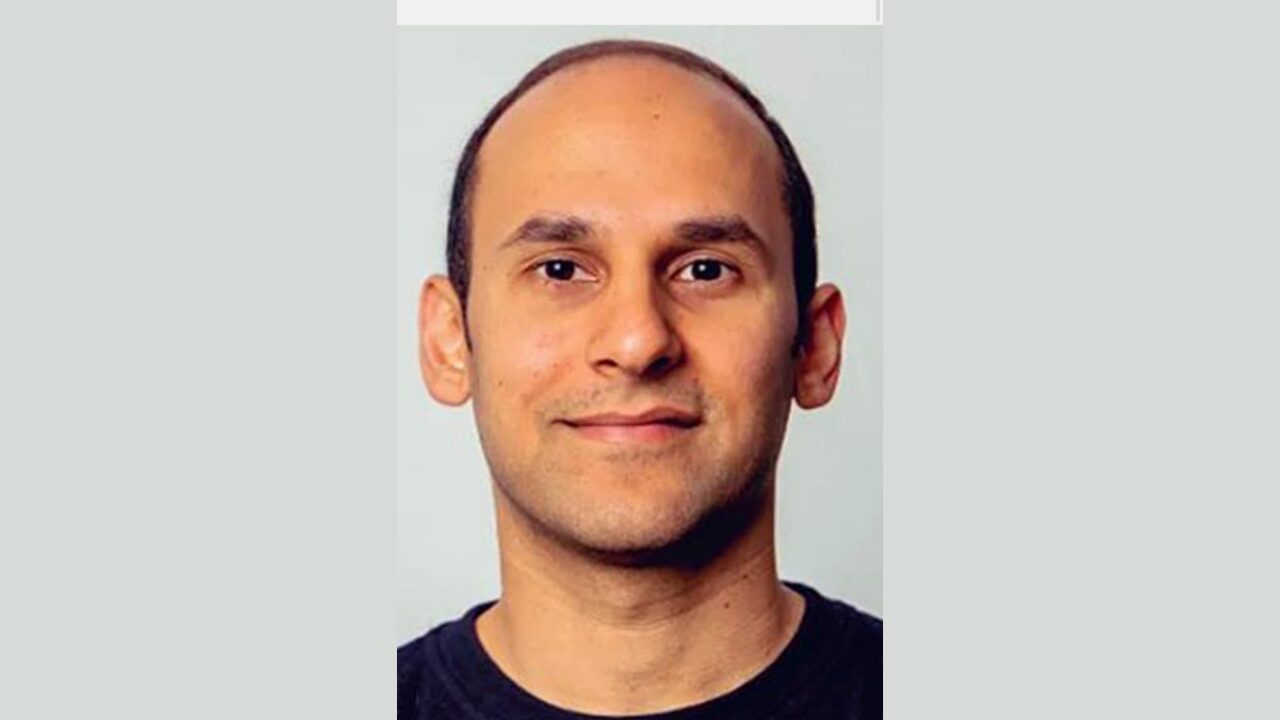

Binance Executive Nadeem Anjarwalla Arrested in Kenya, Faces Extradition

Cryptocurrency

Binance Set to Make a Comeback in India, Eyes Reentry with $2 Million Penalty

-

Forex2 weeks ago

Forex2 weeks agoZiG to the Rescue: Zimbabwe Shifts Gear with New Currency Backed by Gold

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 9th, 2024

-

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks agoNigerian Billionaire Tony Elumelu Contemplates Acquiring NPFL Club

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 8th, 2024

-

Naira2 weeks ago

Naira2 weeks agoNaira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, March 26th, 2024

-

Naira6 days ago

Naira6 days agoDollar to Naira Black Market Today, April 17th, 2024

-

Banking Sector4 weeks ago

Banking Sector4 weeks agoSafaricom, Access Holdings Forge Partnership to Revolutionize Remittance Corridor in Africa