Google has terminated 28 employees who participated in protests against the tech giant’s involvement in Project Nimbus, a joint venture with Amazon to provide AI and cloud services to the Israeli government.

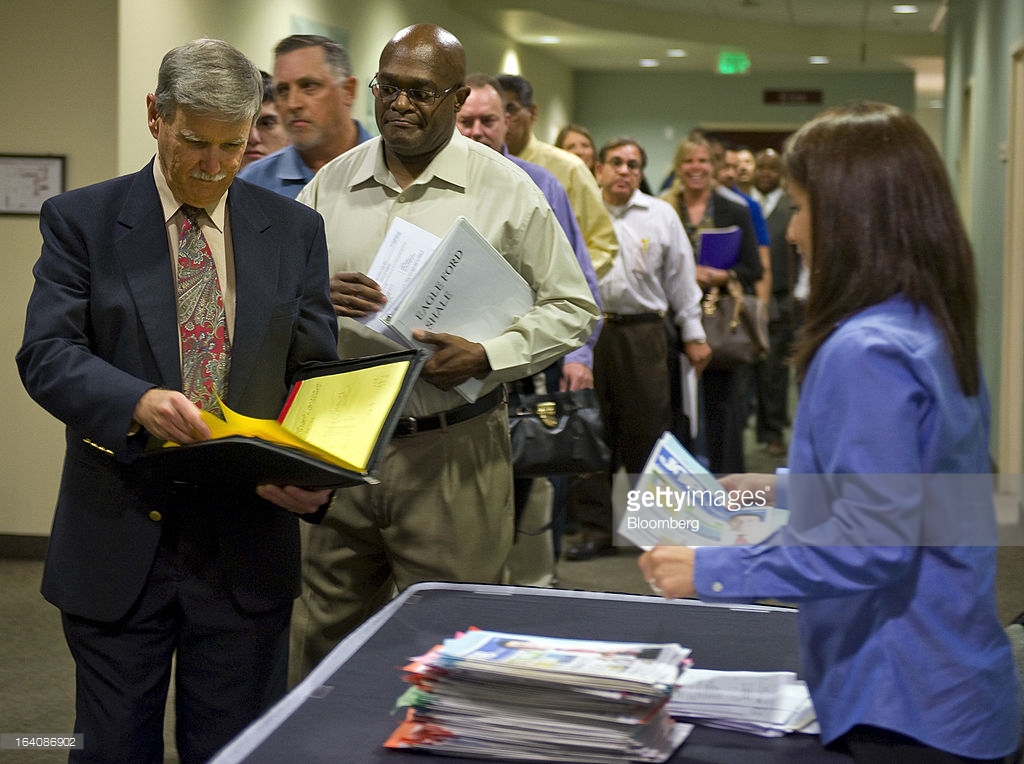

The protests, organized by the No Tech for Apartheid group, took place across Google offices in New York City, Seattle, and Sunnyvale, California.

The demonstrations, which included a nearly 10-hour sit-in, culminated in the arrest of nine protesters on trespassing charges.

Subsequently, several workers received notices of being placed on leave, only to be informed of their dismissal by the company the following day.

Google cited the protesters’ interference with other employees’ work and refusal to vacate the premises despite multiple requests as the primary reasons for their termination.

The company’s response has reignited discussions about the balance between corporate policies, employee activism, and human rights advocacy.

Critics argue that the dismissals infringe on employees’ rights to engage in collective action related to working conditions, a stance supported by US labor laws.

Tech workers have increasingly voiced concerns about how the products they develop are used, highlighting ethical considerations in their industry.

The situation underscores the challenges faced by tech companies in managing internal dissent and navigating complex geopolitical issues.

Google’s handling of the protests has sparked internal debates about the company’s stance on the Middle East conflict and its approach to employee engagement.

Despite the firings, support for the protesters and their cause has grown, indicating ongoing tensions within the organization.

Google’s actions signal a broader reckoning within the tech industry regarding the responsibilities of corporations in addressing social and political issues.

As employees continue to advocate for change within their companies, the fallout from the Project Nimbus protests serves as a reminder of the ongoing struggle to balance corporate interests with ethical imperatives and employee rights.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago