Telecommunications

Nokia Launches Next-generation AirScale 5G Portfolio Powered by ReefShark Technology

Telecommunications

Airtel Africa’s Subsidiary Repays $550m Bond, Achieves Zero-Debt Position

Telecommunications

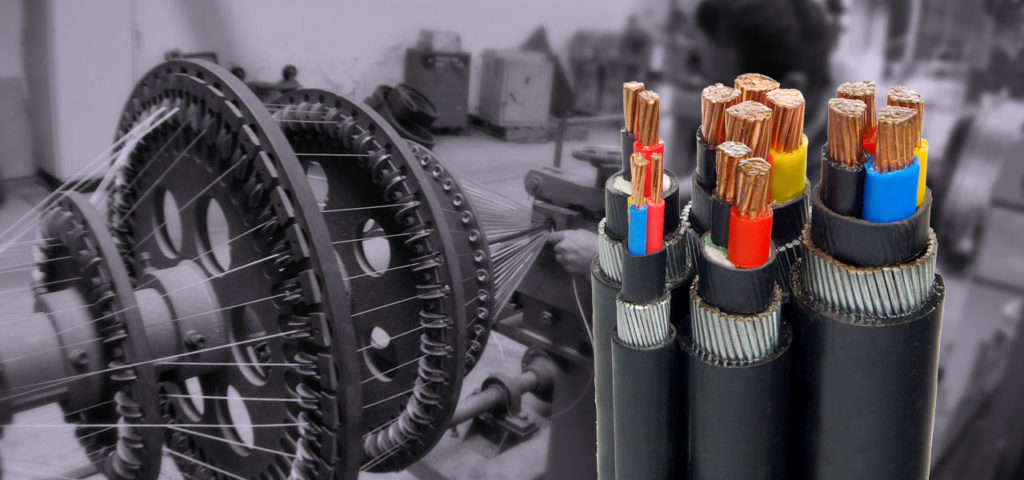

Nigeria to Expand Internet Access with 90,000km of Fibre Optic Cable

Telecommunications

Naira Devaluation Spurs Airtel Africa’s $549 Million Forex Loss

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 24th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 22nd, 2024

-

Travel4 weeks ago

Travel4 weeks agoSaudi Arabia Breaks 70-Year Alcohol Ban, Opening Shop for Diplomats

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 30th, 2024

-

Jobs4 weeks ago

Jobs4 weeks agoJob Cuts Hit Tesla: More Than 6,000 Positions Axed Across Texas and California

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 25th, 2024

-

Investment4 weeks ago

Investment4 weeks agoMinister Accuses Past NCDMB Leadership of Squandering $500m on Unproductive Projects

-

Travel4 weeks ago

Travel4 weeks agoDelta Air Lines Flight Diverts to Togo After Passenger Dies Midair