Technology

Microsoft Plans To Expand Cloud Gaming Product Service To TVs

Fintech

US Continues to dominate Global FinTech Landscape in Q3 2024, Witnesses Funding of $2.7B

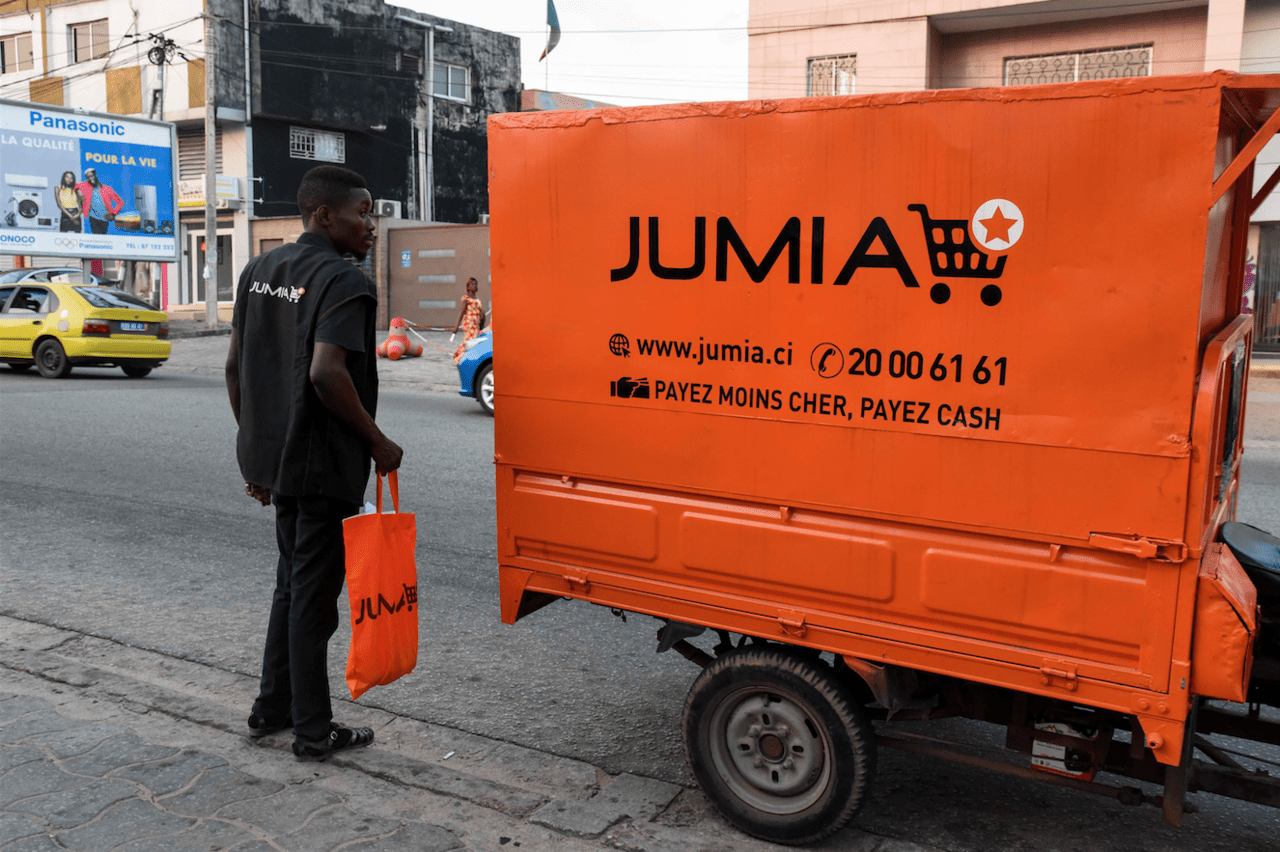

E-commerce

South Africa, Tunisia Record Job Losses as Jumia Shuts Down Outlets Over Diminishing Returns, Hopes on Nigeria, Others

Telecommunications

MTN, Telecom Firms Urge Government Support for Tariff Hike Amid Economic Downturn

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Exchange Rate Today 24th, September 2024

-

News3 weeks ago

News3 weeks agoBbnaija’s Wanni Wins Innoson Car Challenge, Secures First Vehicle with Twin Sister

-

Education4 weeks ago

Education4 weeks agoFederal Government Approves 133% Allowance Boost for NYSC Members, Now ₦77,000

-

Social Media4 weeks ago

Social Media4 weeks agoTelegram to Expose Users Who Use Platform For Criminal Activities, Share Data With Relevant Authorities

-

Technology4 weeks ago

Technology4 weeks agoNokia Partners With Zain Iraq to Boost Network Capacity With Advanced Microwave Technology

-

Dividends4 weeks ago

Dividends4 weeks agoAccess Holdings to Pay N15.99 Billion Interim Dividend, Aig-Imoukhuede to Receive N1.151 Billion

-

Investment4 weeks ago

Investment4 weeks agoCoca-Cola $1billion Investment: Manufacturers Association Shares Two Cent

-

Economy4 weeks ago

Economy4 weeks agoFG Awards N158bn Lekki Port Service Lanes Construction to Dangote