A recent report has highlighted the significant potential of Nigeria’s burgeoning tech start-up scene, but also outlined a series of limitations that need to be addressed for the segment to emerge as a true engine of the country’s recovery from Covid-19.

As OBG has explored, Fourth Industrial Revolution technologies have taken root across sub-Saharan Africa, with many states leveraging digital solutions in order to drive their coronavirus recoveries.

Nigeria is a frontrunner in this regard. For example, Lagos is home to one of the three most important tech clusters in the region, with the other two being in Nairobi, Kenya, and Cape Town, South Africa.

Indeed, according to a recent report by fDi Intelligence, a division of the Financial Times, the Nigerian city has the highest number of start-ups in Africa.

Published in April, the inaugural African Tech Ecosystems of the Future rankings put South Africa in first spot in terms of its overall tech ecosystem, as well as in many individual metrics, among them economic potential, start-up status and business friendliness.

Nigeria was ranked sixth overall, with the report also highlighting various challenges that remain to be surmounted if the country’s start-up scene is to become globally competitive: “Although Lagos is renowned for its start-up ecosystem, there is a significant disconnect between the city’s tech ecosystem, its surroundings and the wider country, which suffers from chronically poor infrastructure and education, and recurring political instability and security issues.”

There are also certain regulatory hurdles to overcome.

For example, many of the country’s most prominent start-ups operate within the financial technology (fintech) space, partly in consequence of the limited formal banking facilities available; Nigeria was the leading country for Bitcoin and cryptocurrency adoption last year, according to statistics firm Statista.

However, in recent months the Central Bank of Nigeria has been cracking down on cryptocurrency, despite stating that it is not moving towards an outright ban.

This was intended to bring the booming market under control and prevent the technology’s misuse. But critics have said that it will stifle innovation and limit the potential of tech start-ups.

Driving expansion

Despite such hurdles, there are encouraging signs that authorities are serious about boosting the Nigerian digital sector.

At the end of 2019 the Ministry of Communications was rebranded as the Ministry of Communications and Digital Economy. This was followed in early 2020 by the launch of the National Digital Economy Policy and Strategy 2020-2030.

This signal document lays out eight pillars that will be used to transform Nigeria into a leading digital economy. These are: developmental regulation; digital literacy and skills; solid infrastructure; service infrastructure; digital services development and promotion; soft infrastructure; digital society and emerging technologies; and indigenous content development and adoption.

Meanwhile, a 5G network is set to be rolled out across the country, following successful trials in the cities of Lagos, Abuja and Calabar.

While the onset of the coronavirus pandemic came shortly after the launch of the new policy, it would seem that the vision it enshrines is already yielding results: in the fourth quarter of 2020 the Nigerian digital sector grew by 40.7%, a trend that continued into the first months of this year.

A further incentive to growth of the digital sector is that – in common with many oil-producing countries – Nigeria is seeking to limit the prominence of hydrocarbons in its GDP mix, following a very troubled year for oil prices. An increase in the GDP contribution of digital companies could stand to pick up some of the slack when it comes to diversification.

Lasting changes

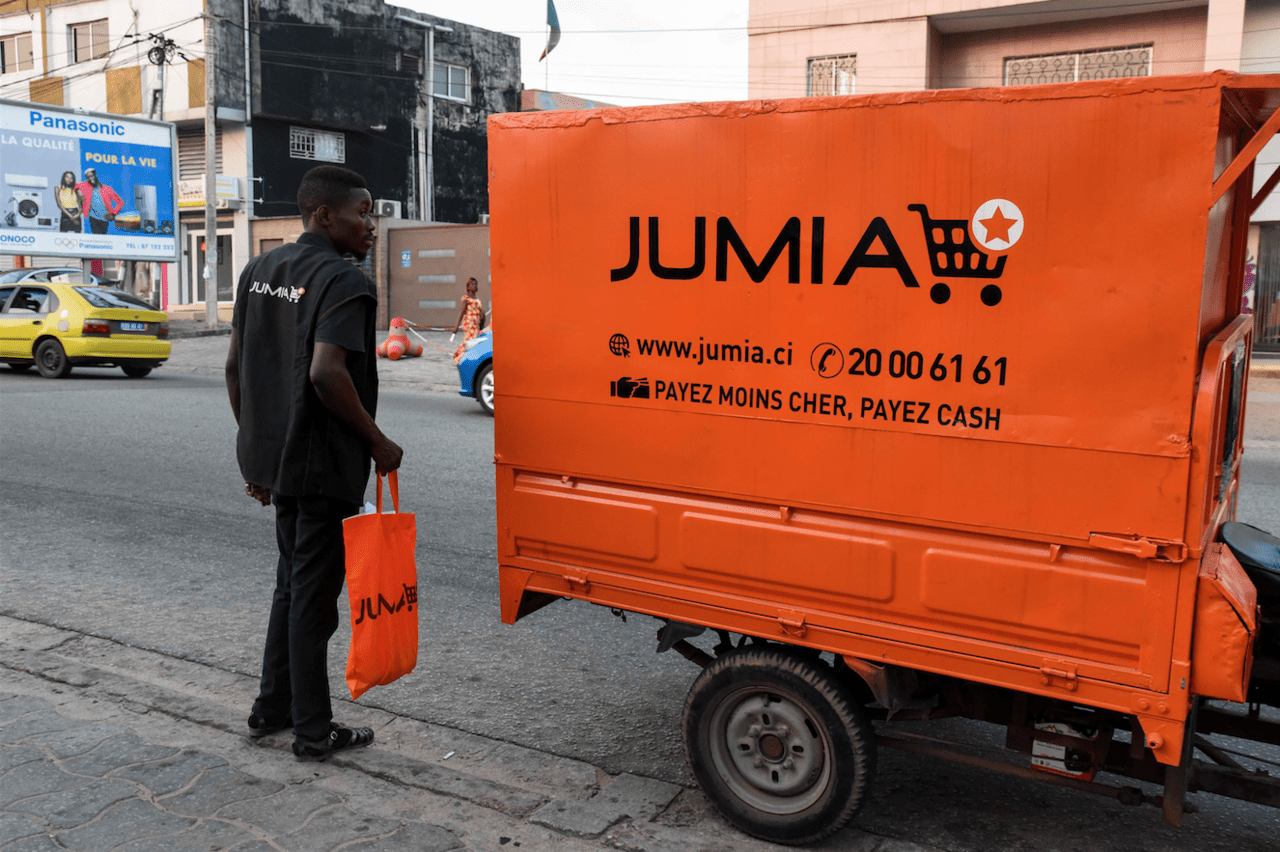

While much work remains to be done, there are already countless success stories of innovative start-ups that are changing the face both of Lagos’ tech ecosystem and Nigerian society as a whole.

For example, in one of the biggest pieces of Nigerian tech news in 2020, local fintech start-up Paystack was acquired by US-based giant Stripe in October, in a deal that was reportedly worth more than $200m.

Founded in 2016, Paystack processes more than 50% of payments made in Nigeria, and will now spearhead Stripe’s African expansion.

Elsewhere, Arone – based at the Roar Nigeria Hub of the University of Nigeria – builds drones that deliver medical supplies to more remote regions. This is particularly useful in the case of certain Covid-19 vaccines, which must be kept at low temperatures.

But the potential applications of drone technology go beyond health care. As Emmanuel Ezenwere, CEO and founder of Arone, recently told OBG, “drones can broadly improve logistics in places with high traffic congestion, such as Lagos and other big cities in Nigeria, as they can bypass traffic jams and deliver goods, household items and food supplies within 15 minutes. This will have a great impact on e-commerce.”

This is a prime example of how the increased digitalisation effected by coronavirus is being leveraged post-pandemic to drive innovative approaches to business in general.

Meanwhile, Nigerian start-ups are also driving renewable energy, a key component of the world’s “green recovery” from Covid-19.

At the start of last year Lagos-based company Rensource Energy raised $3m in equity investment from Proparco – a development finance institution partly owned by the French Development Agency – with the support of the EU, under the Africa Renewable Energy Scale-Up facility.

The funds will contribute to Rensource’s plan to develop, build and operate over 100 mini-grids, providing clean and affordable electricity to 250,000 small and medium-sized enterprises, and saving 30,000 metric tonnes of CO2 emissions every year.

Education4 weeks ago

Education4 weeks ago

News3 weeks ago

News3 weeks ago

Business3 weeks ago

Business3 weeks ago

Technology3 weeks ago

Technology3 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Investment3 weeks ago

Investment3 weeks ago

Telecommunications4 weeks ago

Telecommunications4 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago