The SnackFix small-scale cereal bar production system from Swiss technology group Bühler is the ideal solution for small and medium enterprises (SMEs) to add value to locally produced grains in Nigeria and assist the country to address food security, says Manuel Murrenhoff, Managing Director, Bühler Nigeria.

On-the-go snacking consumption in Nigeria is rising steadily, presenting opportunities for SMEs to enter the market. “In terms of bars, fruit, and sweet snacks alone, this market segment is expected to exceed half a million tonnes by 2025,” says Murrenhoff. The main driver is the burgeoning population, estimated at 223.8 million in 2023, a 2.41% increase over 2022, and expected to grow to 377 million by 2050.

“The economically active part of the Nigerian population is quite sizeable and very mobile, which is boosting on-the-go snacking consumption,” says Murrenhoff. In addition, with half of the population living below the poverty line, there is more than ever the need to drive consumption of the full range of locally grown grains to keep final product prices in check.

“With the price of wheat projected to rise to record heights, Nigeria cannot possibly feed the growing population by importing wheat and other products. On the one hand, there is a shortage of forex and on the other hand, prices are escalating globally. That is where innovation, using local grains, plays an important role in food security, especially as these can be successfully incorporated into ready-to-eat foods,” says Murrenhoff.

Iyore Amadasun, Sales and Channel Business Manager at Bühler Nigeria, says that Bühler’s Snackfix, designed for food producers seeking a share from the on-the-go snack segment, promotes the processing of locally sourced grains for snacks while maintaining the highest food safety standards.

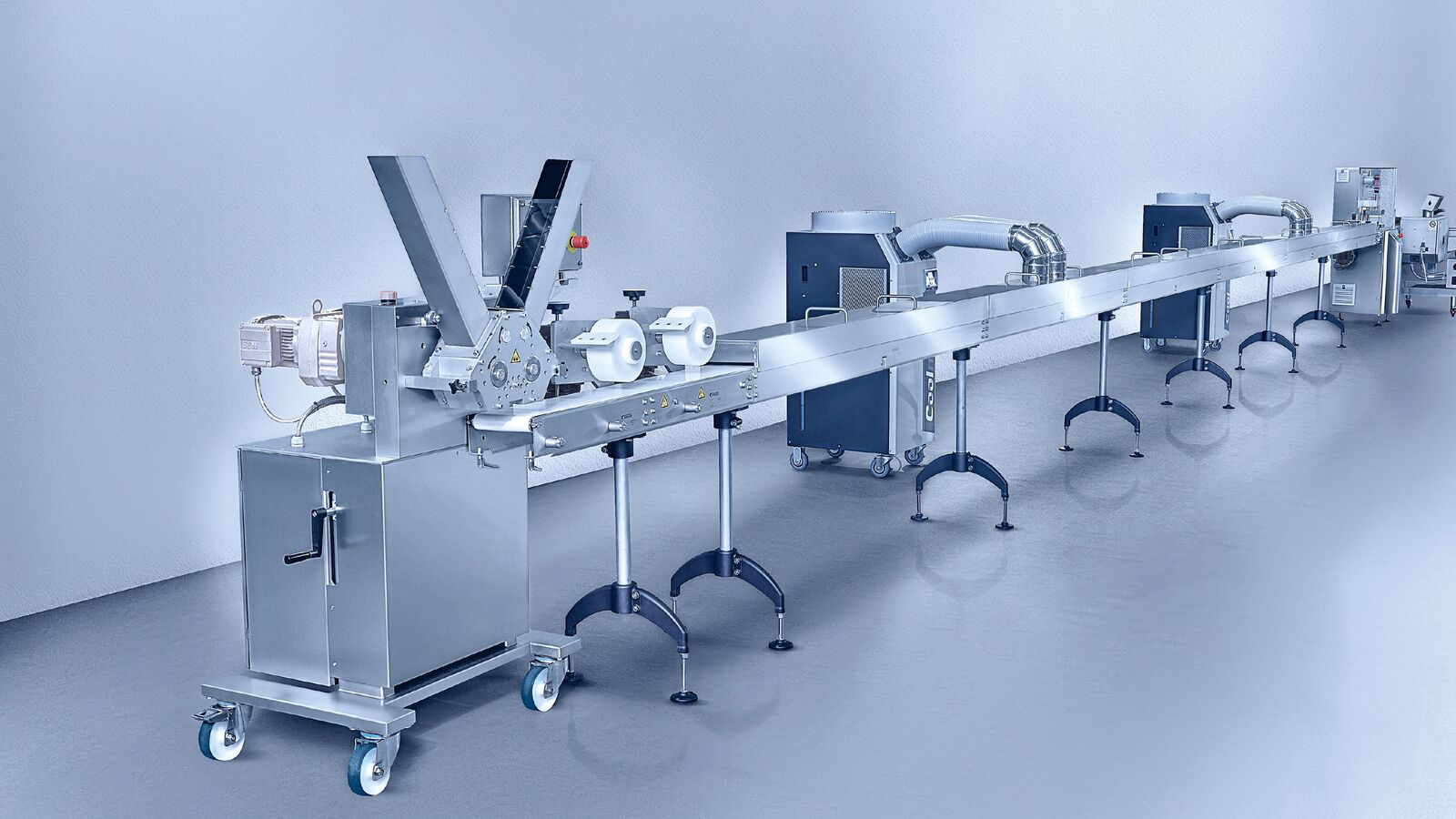

SnackFix is a multi-grain solution that allows SMEs to innovate across the spectrum of locally produced grains in Nigeria. The technology presents an entry-level, plug-and-play solution that is compact, cost-effective, and easy to commission and operate.

SnackFix includes a continuous mixer, a cooling tunnel, and a cutting system, all in one – everything needed for quality production. The combination allows SMEs to manufacture a huge variety of cereal bars at a volume of up to 130 kg per hour.

Customers benefit from Bühler’s experience in product development using a wide range of locally produced grains including, for example, sesame seeds, cashews, and peanuts. “We can help newcomers in the market achieve the best recipe to satisfy functional and indulgence consumer requirements in this segment and then supply them with a customised solution,” says Amadasun. In addition, Bühler has an innovation centre and laboratory in Switzerland to assist with different formulations and product development.

“The ready-to-eat market is of strategic importance to Nigeria, as it can adapt local grains for snacking consumption, promote healthy eating habits, and at the same time assist with Food Security,” says Amadasun.

With offices in Lagos and Kano, Bühler Nigeria is a leader in grain and food processing and offers solutions for grain drying and storage, flour milling, rice milling, cacao and chocolate processing, wafer and biscuit, pasta and noodles, feed, and aqua feed milling. Bühler Nigeria also provides support in the form of solutions for ink and coating applications and flexible packaging systems.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago