- Libra Cryptocurrency: Facebook Unveils Global Money

Facebook Inc has finally unveiled its much-awaited cryptocurrency on Tuesday.

The cryptocurrency called Libra will be managed by Libra Association, an independent group formed to ensure its transparency and evolve the new ecosystem.

According to Libra Association, global internet connectivity has empowered billions of people globally and with just $40 smartphone, people can access numerous information, high-fidelity communications, and a wide range of lower-cost convenient services.

While this connectivity has helped more people access the global financial system, 1.7 billion adults remained outside the financial system with no access to traditional bank. That is 31 percent of global population.

Again, for those who have access to financial services, transfers are slow and take an average of 3 to 5 working days for a single international transfer to be completed.

On cost, the company said it cost 7 percent on average to send money internationally and for unbanked, they pay $4 more to access cash. Meaning, more transactions are cash-based. To be precise, about 85 percent.

This explains why U.S. retail businesses lose an estimated $40 billion annually to cash theft.

According to the company, by addressing all the aforementioned, about $3.7 trillion will be added to developing economies and 95 million new jobs will be created. People’s earnings potential will increase by 20 percent while extreme poverty will drop by at least 22 percent.

Facebook and Libra Association plans to address these issues with Libra, a simple global currency and financial infrastructure that can empower billions of people.

The association on its new website said: “Moving money around the world should be as easy and cheap as sending a text message. No matter where you live, what you do, or how much you earn.”

What is Libra?

Libra, has explained by Investors King, is a stablecoin version of cryptocurrency built on blockchain technology.

Libra will be tied to a basket of fiat currency to regulate its movement and help eliminate challenges currently hurting Bitcoin and the rest of unregulated cryptocurrencies.

The team hope to push cryptocurrency to mainstream and allow comprehensive regulatory control while maintaining its unique decentralise nature.

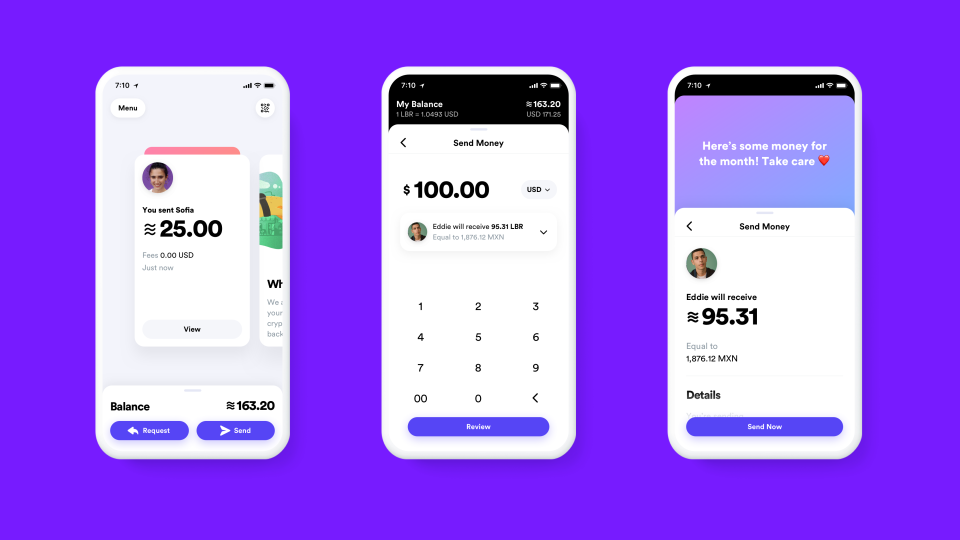

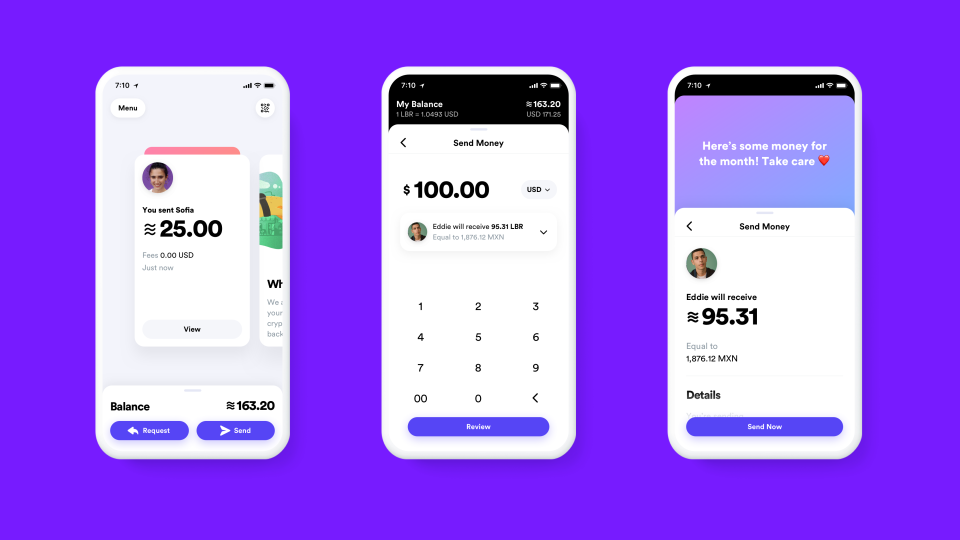

Calibra, Libra Digital Wallet

Facebook established a new subsidiary, Calibra, to provide financial services that will allow people access and participate in the Libra network.

Like other cryptocurrencies, Libra needs a digital wallet, therefore the first product Calibra will introduce is a digital wallet for Libra. The digital wallet will be available in Messenger, WhatsApp and as a standalone app.

Like other cryptocurrencies, Libra needs a digital wallet, therefore the first product Calibra will introduce is a digital wallet for Libra. The digital wallet will be available in Messenger, WhatsApp and as a standalone app.

The company expects to launch the app in the first half of 2020, the same period Libra will be officially launched.

Libra Association said the service will eliminate financial bottleneck and reduce cost of global transfer, currently put at an average of $25 billion yearly.

All these, the association said it hopes to address with Calibra, a digital wallet that people can use to save, send and spend.

Libra Association

Members of the Libra association will be responsible for managing Libra Reserve and development of Libra Blockchain.

The Founding Members of Libra Association that will work together to finalise the association’s charter and become “Founding Members” upon its completion are, by industry:

• Payments: Mastercard, PayPal, PayU (Naspers’ fintech arm), Stripe, Visa

• Technology and marketplaces: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft,

Mercado Pago, Spotify AB, Uber Technologies, Inc.

• Telecommunications: Iliad, Vodafone Group

• Blockchain: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited

• Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital,

Union Square Ventures

• Nonprofit and multilateral organizations, and academic institutions: Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago