- Nigeria’s Internet Subscribers Hit 119.5m in April

More Nigerians are taking advantage of growing internet opportunities and comfort that comes with mobile and financial technologies.

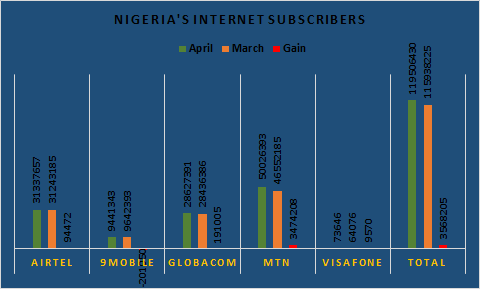

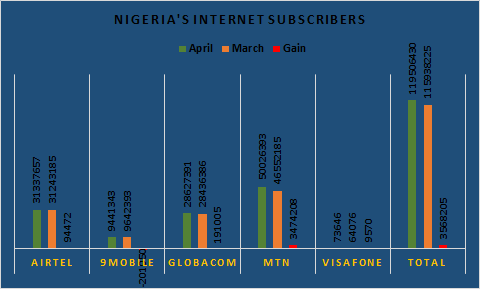

The number of internet subscribers in Nigeria rose from 115.9 million in March to 119.5 million in April, the Nigerian Communications Commission (NCC) reported. This represents an increase of 2.9 percent or 3.6 million new internet subscribers.

Breaking down the numbers, the newly listed MTN Nigeria gained the most in terms of numbers, gaining 6.9 percent or 3.5 million new internet subscribers in April to take its total internet subscribers to 50 million.

Followed by Nigeria’s indigenous telecommunication company, Globacom. Glo added 0.7 percent or 191,005 new internet subscribers to 28.4 million recorded in March to 28.6 million in April.

Airtel Nigeria impressed additional 94,472 new internet subscribers to take its total internet subscribers to 31.3 million, slightly ahead of Globacom.

Visafone added 9,570 new internet subscribers or 12.9 percent in April to increase its subscriptions to 73,646. The highest increase in terms of percentage.

The embattled 9mobile, however, lost 201,050 internet subscribers in April, plunging its total subscriptions by 2.1 percent to 9.4 million.

Growing internet opportunities and efficiency of financial technologies are compelling more Nigerians to subscribe to internet service.

A recent report put Africa’s internet users at 240 million, suggesting that Nigerians account for about 50 percent of the total number of Africans connected to the internet.

Dapo Alade, a software engineer and digital entrepreneur, attributed the increase to affordability.

He said: “This could be a result of affordable Android phones in the market. If you look at the statistics of accessibility channels, a large number of Nigerians access the internet through their mobile phones.”

Therefore, he said as more Nigerians continue to acquire internet-enabled mobile devices, internet subscription service will continue to flourish and with technology companies building engaging and easy to use mobile applications, minutes spend online will also increase.

Despite the surge in internet users, subscribers are complaining of the high cost of staying connected to the internet in Nigeria.

Bethel Ikoro, a business and economic researcher at Investors King, said internet subscription is still a challenge to many Nigerians going by the current rate of subscriptions.

According to her, a look at MTN Nigeria comment section on social media will show one that most of the quoted internet subscribers are not happy with their current service despite paying huge to stay connected.

She, however, said networks that “gives more data for the same rate like Glo, have sluggish networks.”

“Service providers need to do more to deepen internet growth in Nigeria. It is not enough to increase the number but efficiency through affordable and fast internet service can help ease the unemployment rate,” she stated.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Economy4 weeks ago

Economy4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Business3 weeks ago

Business3 weeks ago