- Senate Rejects Kaduna’s $350m Loan Request

The Senate has rejected the request by the Kaduna State Government to obtain a $350m loan from the World Bank.

The rejection was based on the recommendation of the Senate Committee on Local and Foreign Debts and supported by the three senators from the state.

In the report, which was presented by the Chairman of the committee, Senator Shehu Sani (APC, Kaduna-Central), it was recommended that the facility be disapproved as it would worsen the debt profile of the state.

Listing the findings of the committee, the report stated that the Development Policy Operation (budget support) of $350m for Kaduna State was approved by the World Bank in 2016 and captured in the 2016-2018 borrowing plan of the Federal Government as approved by the National Assembly.

It also said the credit facility had an attractive low financing data of 1.25 per cent interest and moratorium of five years and a 25-year tenor.

It added that the facility was already captured in the 2016-2018 Medium-Term Expenditure Framework.

The committee, however, stated, “According to the latest Debt Management Office figures, Kaduna State has a total debt stock of $232.1m, and approving the current loan request of $350m for Kaduna State will bring its total debt stock to $582.1m.

“If this loan request is approved, the new total debt stock of $582.1m for Kaduna State will be unsustainable and necessarily attract huge financial burden to the meagre federal allocation to the state.

“With the new borrowing, the debt service to revenue ratio of Kaduna State will further be increased and thus impact negatively on the ability of the state to meet other basic needs of its people. The new debt stock will likely further erode the economic viability of the state.”

The committee recommended thus, “The Senate do reject the request of $350m for Kaduna State as contained in the 2015-2018 External Borrowing (Rolling) Plan of Mr. President (Muhammadu Buhari).”

In his additional comment, Sani said if the loan facility was approved, the people of the state, who were 50 years old, would be 75 years old by the end of the repayment period.

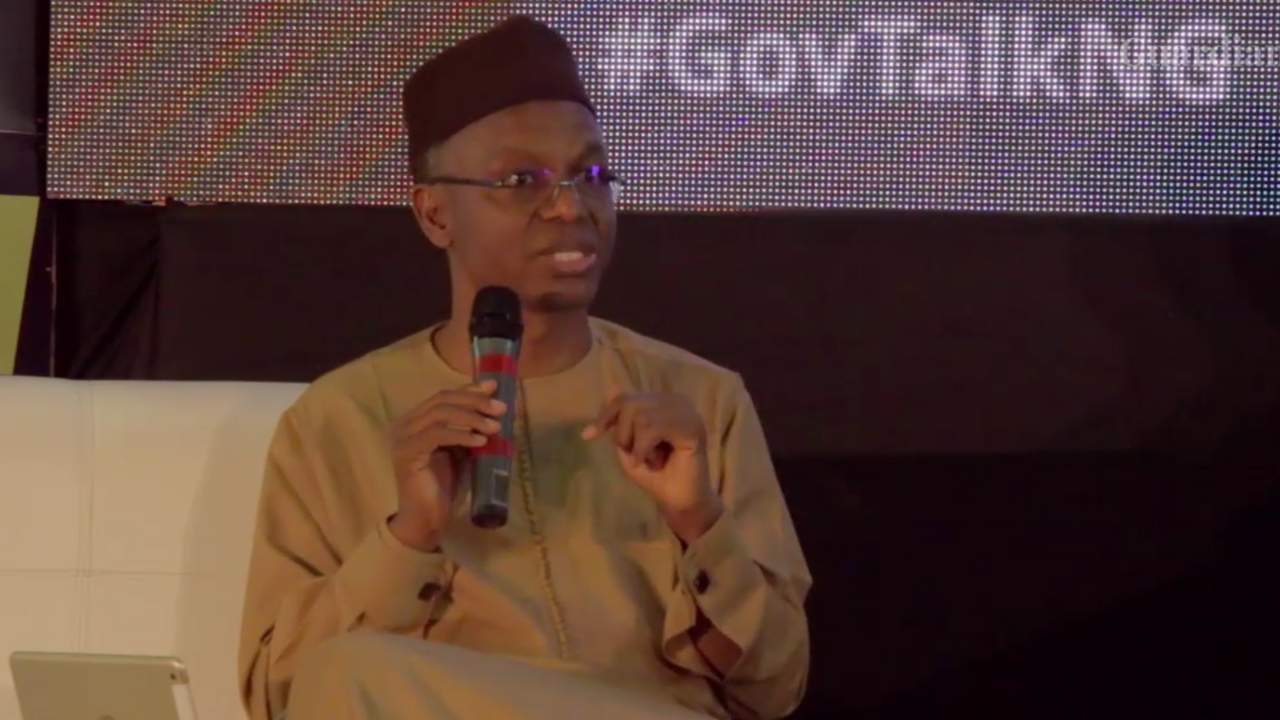

He added that while the debt profile of Kaduna was $232.1m between when Nigerian gained independence in 1960 and 2018, the state’s debt stock would rise to $582.1m under Governor Nasir el-Rufai’s administration alone.

The Deputy President of the Senate, Ike Ekweremadu, who presided over the plenary, asked for the opinion of the other two lawmakers from Kaduna State, Senator Suleiman Hunkuyi (APC, Kaduna-North) and Danjuma La’ah (PDP, Kaduna-South), and they also expressed their opposition to the request.

Both senators also criticised el-Rufai’s administration.

“I crave the indulgence of my colleagues that the application of that loan, among other things, is indeed a misplaced priority as we have clearly seen. I strongly stand behind the prayer of the chairman of the committee that this chamber do reject that request for the loan,” Hunkuyi stated.

La’ah, on his part, said his constituents did not give him the authority to support the approval of the loan.

He noted, “I met with the representatives of Kaduna State and asked them, ‘What is this loan all about? What projects is this loan meant for? Who are those to execute them? Who are the contractors? Where will the projects be sited?’ Those questions were not answered.

“I realised that the money received by Kaduna State is much but they are busy retiring and sacking people (workers), and they are now requesting for a loan. To do what? If the loan must be given, there must be a specific reason for it. But if you are collecting a loan without giving a reason, then it should not be given.

“I am not in support of it because my people are not in support of it. This loan should not be granted as far as we are concerned in Kaduna State, most especially the Southern Kaduna.”

The Deputy Majority Leader, Senator Bala Ibn Na’Allah, said there was “a very serious lesson” to learn from the aftermath of the report.

Making a veiled reference to the political crisis between el-Rufai and senators from the state, he stated, “In a democratic society, you do not look at the representatives of the people; you look at the people that they are representing.

“Three senators have so far spoken on this matter and they all happen to be senators from Kaduna. And it appears that apart from the recommendation by the committee, the three senators appear to be in agreement that the recommendation of the committee should be upheld by this Senate.

“It appears that the wisdom of the Senate will be to uphold the respect that our senators deserve and to go by their thinking. This is how I think, regrettably so.”

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago