- ‘Nigeria Earned N69.2bn from Solid Minerals in One Year’

Nigeria earned N69.2bn from solid minerals in 2015, representing an increase of 24 per cent on the N55.8bn generated from the sector in 2014, the Nigeria Extractive Industries Transparency Initiative announced on Sunday.

In its latest independent audit report, NEITI stated that the total production of solid minerals in the country stood at 39.27 million tonnes in 2015, representing a reduction of 17 per cent from the 47.1 million tonnes produced a year earlier.

It said the drop in the 2015 production figure was attributable to insecurity in parts of the country and more stringent approval process for explosives used in mining.

The report indicated that while the mineral production reduced, government’s revenues went up in the same year.

“This increase in revenue was due to the growth in taxes collected from the sector and review of royalty rates paid by companies, which came into effect within the year under review,” the report stated.

NElTl’s previous solid minerals audit reports had recommended an upward review of Nigeria’s royalty rates to align with the current industry realities.

The report also indicated that the value of solid minerals’ exports in 2015 stood at $9.733m, which was 1.45 per cent of the non-oil exports for the year.

Lead and zinc topped the chart with 79 per cent, valued at $7.7m; while 175 ounces of gold, valued at only $122,000, were exported during the period.

It stated that the solid minerals sector contributed 0.12 per cent to the country’s Gross Domestic Product in 2015, a marginal increase of 0.01 per cent on the 0.11 per cent contributed by the sector in 2014.

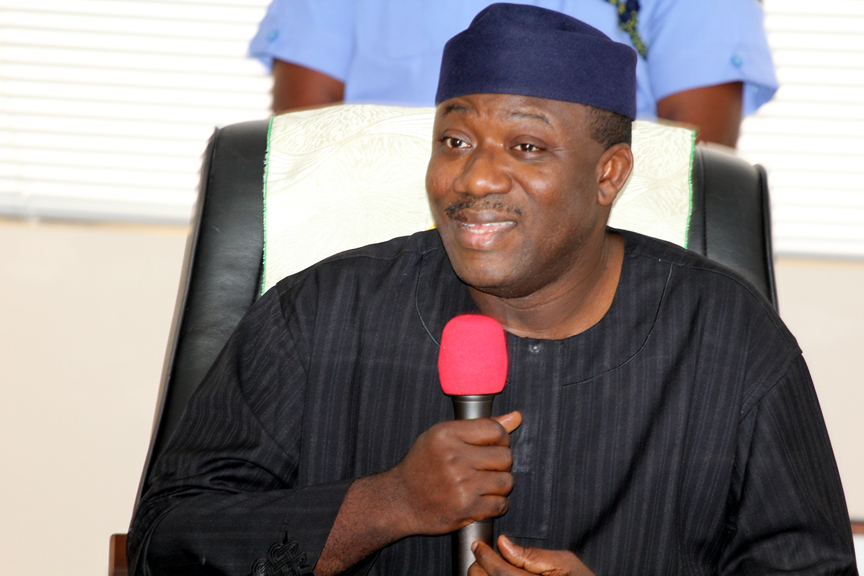

“This report shows evidence that the contribution of the solid minerals sector to government revenues and macro-economic indicators is beginning to improve, even if marginally,” the Executive Secretary, NEITI, Waziri Adio, said.

The report highlighted the specific contributions by companies and states to the sector’s revenue growth and development.

Cement manufacturing companies were the major revenue contributors to the sector, accounting for over 60 per cent; while construction companies and real mining companies contributed about 31 per cent and eight per cent, respectively.

The report stated that three states, Ogun, Kogi and Cross River, and the Federal Capital Territory accounted for about 70 per cent of the production volumes in 2015, with Ogun State topping the table with 36 per cent.

According to the report, a total of 4,305 mineral titles were valid in 2015. Of this figure, 204 titles were mining leases; 657 were for small-scale mining; 1,865 for quarrying licences, while exploration licences accounted for the remaining 1,579.

It noted that 1,220 of the 4,305 mining titles were issued in 2015 alone.

The agency also stated that the NEITI 2015 oil and gas report would be released next month.

The solid minerals audit report recognised the progress being made by the government towards repositioning the sector to be a major driver of the economic and revenue diversification agenda of the present administration.

To sustain this growth and further enhance the capacity of the sector to contribute to the economy, the report called for the speedy release of the N30bn Solid Minerals Development Fund recently approved by the Federal Executive Council to the intended beneficiaries in order to support some of the activities already stipulated in the road map for the sector.

The report suggested that a ban should be placed on the importation of some minerals such as gypsum, barite and kaolin, which Nigeria had in good quality and quantity.

NEITI stated that its first intervention in the solid minerals sector began with the conduct of a study in 2011, followed by an independent audit of the sector in 2012, which covered 2007-2010.

The six cycles of audit so far conducted by NEITI in the sector show that Nigeria earned a total of N271.77bn between 2007 and 2015.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago