- Forex Weekly Outlook May 8-12

The US dollar gained against currencies of emerging economies last week after data showed the US economy added more jobs than projected. The economy which added 211,000 jobs in April, improved its unemployment rate to 4.4 percent, the lowest pre-recession.

However, the wage remains slow, rising just 0.3 percent in April to 2.5 percent year-on-year. While, a senior White House Adviser, Gary Cohn, has said the administration would like to bring back manufacturing and service jobs that pay high. It is uncertain how the administration intends to slowdown consumer prices and at the same time sustain growth with unemployment already at its lowest rate since before the financial crisis.

Likewise, further fiscal boost is expected to prompt the Federal Reserve to raise borrowing cost faster than previously anticipated. If that happens, it could slow down Trump’s job creation and growth plans.

In Canada, new job creation dropped significantly in April to 3,200 from 19,400 created in March. This is far less than the 10,000 projected by economists. Also, the pace of annual wage rate increases dropped to 0.7 percent April, making it the lowest since the 1990s.

Although, the unemployment rate improved to 6.5 percent in the same month, the report showed there were about 45,500 workers that left the labor force in the same period. Half of whom were youth.

While the surge in commodity prices and business confidence in the US, Canada’s largest trading partner, has aided economic growth in Canada. The weak economic data could be a one-time thing, especially with the French-election going on. However, a positive win for Macron will further boost growing Canada’s economy as the trade pact signed with European Union a month earlier will bolster economic outlook going forward.

OPEC, last week global oil prices plunged to 5-months low following a report that hedge and money managers have started cutting their bullish positions as most analysts believe rising U.S. oil production would hinder OPEC strategy at curbing prices from reaching $45 a barrel. While, experts have said OPEC need to do more than the 1.8 million barrels a day it cut last year and extend production cut at least for another 6 months, it is uncertain if Libya and Nigeria that were previously exempted but has upped production now would be included.

Therefore, the uncertainty surrounding OPEC policy and surge in the U.S. oil production will continue to weigh on currencies of commodity-dependent economies.

In the UK, the manufacturing sector surprisingly rose more than expected in April, expanding from 54.2 in March to 57.3. According to the IHS Markit’s report, growth in new orders and exports also gathered space, however, there were concerns that rising inflation rate and the surge in the cost of imported goods would impact retail sales and job creation in the sector.

Overall, the US dollar remains strong, while the French election has offered a new support line for the Euro single currency—especially after Brexit. However, drop in commodity prices continue to weigh on emerging currencies and expected to continue until OPEC reach an accord to moderate price.

This week, I will be looking at USDJPY and NZDCAD pairs.

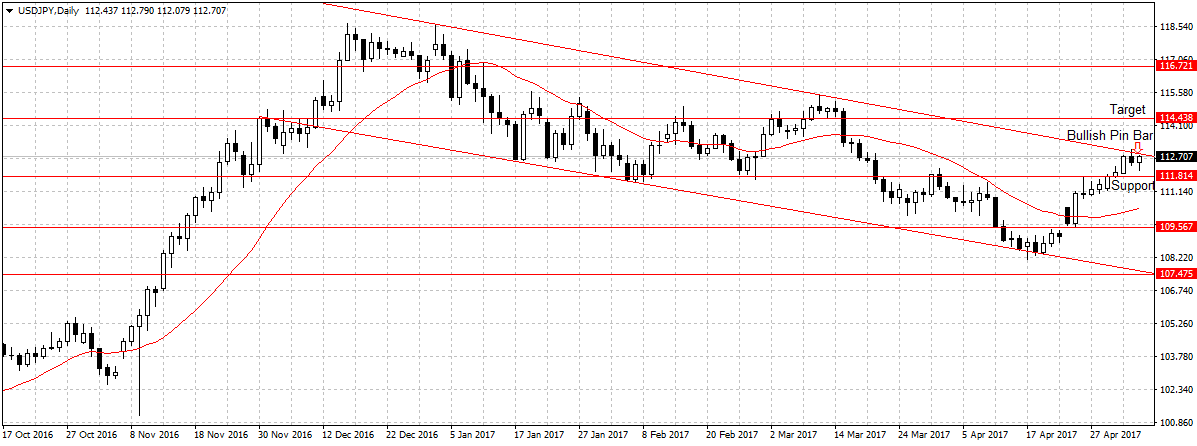

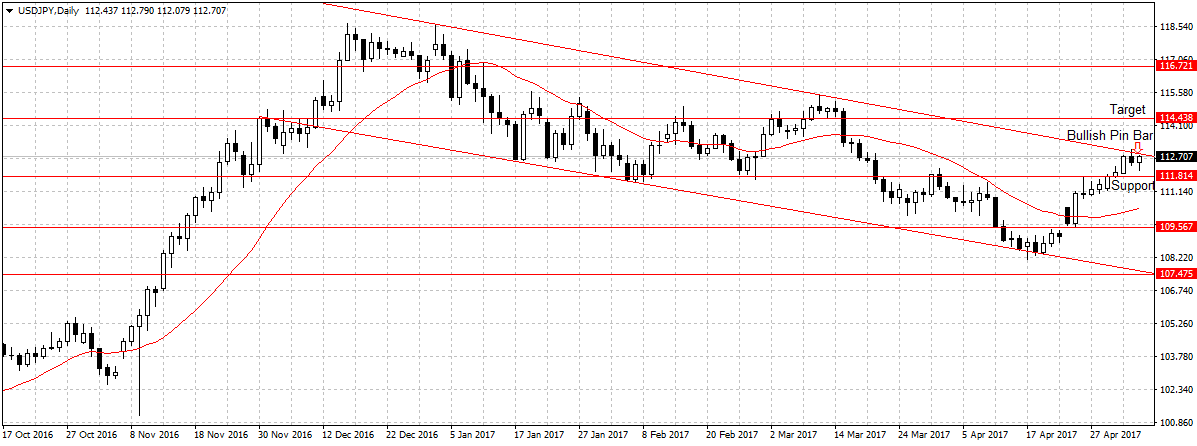

USDJPY

After the Bank of Japan lowered its inflation forecast last month. The Japanese yen dipped against the US dollar, losing over 300 pips. But with the U.S. labour market adding more jobs than projected and the Trump tax policy expected to increase consumer prices faster than anticipated, the Federal Reserve will likely raise rates soon. Hence, the reason the U.S. dollar is rising against the yen.

Technically, this pair closed as a bullish pin bar last week. Suggesting that the pair may cross the 113 resistance levels, above the descending channel. While, further bullish run of this pair depends on market’s perception of the U.S. economic policy. A sustained gain above the channel will open up 114.43 targets.

However, failure to sustainably break 113 resistance levels, would attract sellers below the channel and open up the 111.81 support levels, then 110.13 support.

NZDCAD

First, currencies of emerging economies are affected by the drop in prices of global commodities and positive US economic data. Second, the Canadian economy of late has started reacting to US economy and seems to be directly proportional relationship wise. Therefore, with the US economy boosted by positive economy data and possibility of the Fed raising rate three times this year, the Canada’s manufacturing sector remains viable.

Last month, I mentioned this pair sell potential. But after the US labour market (NFP) disappointed in March the pair rebounded before closing as a bearish pin bar last week. This week, I will be looking to sell this pair below 0.9382 support levels with 0.9298 support as the first target, I will expect a sustained break to open up 0.9108 as explained last month.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago