- Senate President Saraki Pocketed Billions Of Naira From Paris Loan Refund

In one of the largest financial scandals in recent years, Nigeria’s 36 state governors and Senate President Bukola Saraki pocketed large slices of funds approved by the Federal Government to reimburse states for the excessive deductions charged to them on account of the Paris Club and other international loans.

SaharaReporters learned that the Governors’ Forum received a hefty sum of the funds. Our team of investigators discovered that some of the governors got as much as N400 million, while Mr. Saraki carted away N2.5 billion out of the first batch of payments made to the states.

Our investigation showed that the Nigerian Governors’ Forum decided to use phony consultants, who then illegally deducted five per cent of the funds paid to the states. Our team found that the Central Bank of Nigeria (CBN) paid the consultants without informing the Accountant-General of the Federation. Once paid, the consultants forwarded a part of their payment to the individual accounts of the governors, with some governors individually receiving as much as N400 million. Former officials of the Federal Ministry of Finance registered and floated two of the companies, GSCL Limited and Biztrust Limited, that masqueraded as consultants.

One of the sources on the investigation disclosed that Mr. Saraki was paid N2.5 billion through a finance consultancy run by one Mr. Okey Mbonu, a former managing director of Society Generale Bank, a family bank the Sarakis robbed into bankruptcy, the bank later morphed into Heritage Bank. Documents exclusively obtained by SaharaReporters’ investigative team showed that the Nigerian Governors’ Forum received a total of N11,550billion from the sum of N231billion that the Federal Government directed to be paid to states last December.

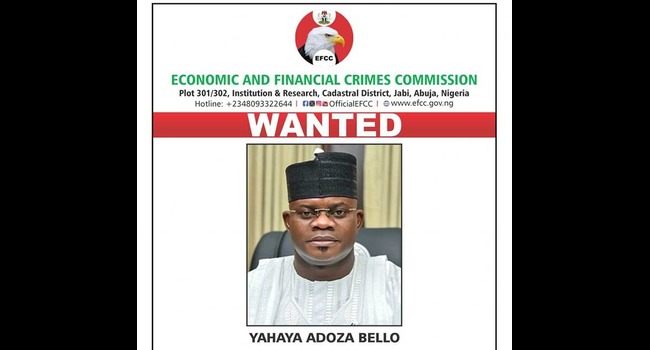

Last week, agents of the Economic and Financial Crimes Commission (EFCC) investigating the illegal payments and subsequent transfer to governors’ personal accounts arrested Ashishana Okauru, Director-General of the Nigerian Governors’ Forum. An EFCC source told our team that, during interrogation, Mr. Okauru admitted that money was funneled through the Nigerian Governors’ Forum to individual governors. He, however, refused to write a statement.

Two EFCC operatives said Mr. Okauru, a former Director of the Nigerian Finance Intelligence Unit (NFIU), an arm of the EFCC, was treated with great leniency and released. The sources also disclosed that Mr. Okauru’s former colleagues at the EFCC helped to keep news of his arrest secret.

The misappropriated funds arose after an accounting reconciliation indicating that the 36 states were overcharged for payments to the Paris Club. Late last year, all the state governments asked the Federal Government to repay what they were overcharged as external debt service payments between 1995 and 2002. The said funds were paid as first line charge deductions from states’ share of federal allocations. The debt service deductions were in respect of loans taken from the Paris Club, London Club as well as other multilateral loans obtained by the Federal Government and the states.

By the time Nigeria reached a final agreement for debt relief with the Paris Club in October 2005, some states had been overcharged. This led to a request by state governments for a refund of the amounts owed by the Federal Government. Based on the requests, President Muhammadu Buhari directed the Debt Management Office (DMO) to raise a team to scrutinize claims by state governments and reconcile them with available records.

For instance, Abia State submitted a claim of $95,437,810.59, Adamawa filed a claim of $92,255,322.54, while Akwa Ibom sought a refund of $255,713, 552.80. Anambra State asked for a refund of $92,374,232.23, Bauchi, $104,092,295.20, Bayelsa, $299,432,862.33, and Benue, $99,542,766.38. After the scrutiny of claims by the DMO, President Muhammadu Buhari approved payment of the sums of $23,859,452.65 (N7.2 billion) to Abia State, $23,063,830.64 (N7.034 billion) to Adamawa State, $63.928,388.20 (N19.4 billion) to Akwa Ibom, $23,093,558.06 (N7.043 billion) to Anambra State and $26,023,073.80 (N7.9 billion) to Bauchi State. Mr. Buhari also approved $24,885,691.60 (N7.6 billion) for Benue State and $74,858,215.58 (N22.8 billion) for Bayelsa.

The Federal Government and the states reached an agreement under which the Federal Government would immediately pay 25 percent of the amounts claimed by each state government. It was agreed that the balance due to each state would be revisited when the country’s financial conditions improve. However, SaharaReporters learnt that President Muhammad Buhari has approved the next tranche of payments to be delivered to the states in February.

In a statement, the Federal Ministry of Finance disclosed that President Buhari had urged the states to invest a minimum of 50 percent of the amount disbursed to them in people’s welfare, especially for the payment of salaries and pensions.

In order “to ensure compliance with the directive that a minimum of 50 percent of any amount disbursed is dedicated to this, funds will be credited to an auditable account from which payments to individual creditors will be made. Where possible, such payments will be made to Bank Verification Number-linked accounts and verified,” said the Federal Ministry of Finance. The total amount approved by the President, for payment in batches, was N522.74 billion.

Last December, Abia State was paid N5.093 billion, Adamawa N4.9 billion, Akwa Ibom N13.6 billion, Anambra N4.9 billion, Bauchi N5.5 billion, Bayelsa N15.9 billion, and Benue N5.3 billion. However, owing to the illegal deductions engineered by the respective governors, Abia State got N4.8 billion, Adamawa N4.6 billion, Akwa Ibom N12.9 billion, Anambra N4.6 billion, Bauchi N5.2 billion, Bayelsa N15.1 billion and Benue N5.3 billion.

Our investigation revealed that all the other states also had amounts paid to them chiseled off by the shenanigans of the Nigerian Governors’ Forum and its members through consultants. A source familiar with the process told SaharaReporters that the scam perpetrated by the governors was by far the largest he had ever seen.

This month, N99,003,694, 086.75 is slated to be paid to all the states. Documents obtained by our investigative team revealed that the members of the Nigerian Governors’ Forum were expecting to scoop a total sum of N4,950,184,704.34 from the payments.

A state like Zamfara, which expects to be paid N2,045,885,255.78, will receive N1,943,590,992.99, with the sum of N102,294,262 to be funneled to the coffers of the Nigerian Governors’ Forum and a part of it destined for the personal account of the state governor. A similar situation is bound to play out in Yobe State, due to be paid N1,974,027, 914.66. After the Nigerian Governors’ Forum has done its tricks, the state would be left with N1,875,326,518. Taraba, which is entitled to N2,031, 388,337.99, will receive N1,929, 818, 921.09 after illegal deductions made by consultants arranged by the Nigerian Governors’ Forum.

SaharaReporters

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago