- Solid Minerals Sector Yields Only N2bn in 2016

Agriculture, mines and steel present the quickest means of diversifying Nigeria’s mono-economy, according to experts. Running with this idea, the Federal Government has emphasised mines and steel at every possible juncture. Despite this emphasis, the sector has only boosted the Federation Account by N2bn in 2016.

The minerals and mines sector has contributed N2bn to the Federation Account in 2016, according to information obtained from the Ministry of Mines and Steel Development.

Compared to the role expected of the sector in a diversified economy, the revenue made from the sector for sharing by the three tiers of government is negligible.

The Federal Government had never hidden the fact that it looks up to the solid minerals sector and agriculture for the much needed diversification of the economy, given the significant reduction in the earnings from the main base of the nation’s economy, oil.

In realisation of the nation’s need for diversification, the Muhammadu Buhari-led government has continued to emphasis the reed to exploit the solid minerals sector in order to increase the earning capacity of the country.

The government signified its interest in the solid minerals sector in the articulation of the 2016 budget. It increased the capital budget of the sector seven times, from N1bn in 2015 to N7bn in 2017.

While other ministries, departments and agencies may be writhing in unreleased capital budget for the year; that of the Ministry of Mines and Steel Development has been fully released; even with five months left to the end of the 2016 budget implementing year.

Experts therefore say it is disappointing that despite the emphasis, the mines and steel sector has contributed only N2bn to the Federation Account within the year.

However, given what had been the lot and performance of the sector in the previous year, some stakeholders believe the N2bn contributed by the sector to the federation account indicates a bright future for the industry.

Given that the sector contribuýted N700m to the federation account in 2015, N2bn represents almost 200 per cent improvement on the contribution of the solid minerals sector to the coffers of the nation.

President of the Miners Association of Nigeria, Alhaji Sani Shehu, said although the government did not do much to increase revenue drive in the sector, the N2bn contributed to the coffers of the government represented a significant increase.

He expressed confidence that the sector would do much better in the years ahead, beginning from 2017.

Shehu said, “When you compare N2bn to the N700m contributed by the sector in 2015, it is a significant improvement. There is high possibility that the sector would surpass the N3.5bn revenue which the government has projected for 2017.

“Do not forget that the revenues we get now are mainly from quarries and cement. The core mining activities have not started yielding revenues. So, there is the likelihood that the sector would now be yielding much more to the government beginning from 2017.”

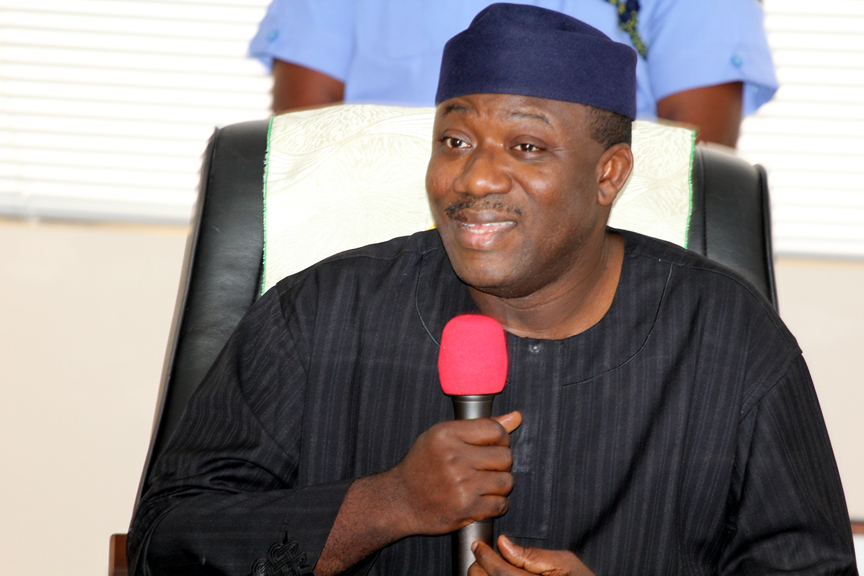

For the Minister of Mines and Steel Development, Dr. Kayode Fayemi, the most significant thing is that the right foundation is being laid to ensure increased productivity of the sector in the years ahead.

This, he said, included the articulation of the road map for the reform of the mining sector; the inauguration of the Mining Strategic Team; and the resolution of the legal tussle between the Federal Government and an Indian firm over the contentious concession of Ajaokuta Steel Mill.

To increase the participation of the state governments, even with the stipulation of the 1999 Constitution that mining is on the exclusive list, the Federal Government has sought innovative means to avoid constitutional breach.

Fayemi said, “In order to encourage beneficial participation of state governments in the mining sector, we have got approval for the implementation of the constitutionally guaranteed 13 per cent derivation for mineral revenue for states, similar to the derivation that oil-producing states currently enjoy from the federation accounts.

“While in principle, we cannot give states licences as separate legal entities, companies in which the states have an ownership interest can bid for and receive licences. We are also working closely to build the capacity of state governments in structuring Special Purpose Vehicles to participate in mining in their jurisdictions, without undermining private sector.”

On securing the finance required to lift up the sector, Fayemi had said, “We sought for N30bn intervention fund from the Federal Government, partly to focus on exploration, formalisation of artisanal miners, and providing access to funding for genuine miners. For the first time since 2004, we got approval for this amount by securing access to the revolving mining sector component of the Natural Resources Development Fund.

“We are working with the Nigerian Sovereign Investment Authority, the Nigerian Stock Exchange and others to assemble a $600m investment fund for the sector which we hope to conclude and operationalise by the second quarter of 2017.

“We have secured support from the World Bank for $150m for the Mineral Sector Support for Economic Diversification programme, a critical component of which is to provide technical assistance for the restructuring and operation of the Mining Investment Fund, which will make finance available to the ASM operators through development finance, micro-finance and leasing institutions.”

He added that the fund would help to bring back on stream previously abandoned proven mining projects such as tin ore, iron ore, coal, gold and lead-zinc.

So, will the mining sector begin to make significant contribution to the coffers of the nation? Will the nation make the much sought transition from a mineral-rich state to a mining destination?

Stakeholders believe that incremental revenues are possible but they add that the best this administration can do is to lay the necessary foundation blocks for eventual growth because the transition will take a little more time than anxious citizens are willing to allow.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago