- Nigeria to Get Major Economic Boost from TABEF

Businesses in different sectors of the economy are about to enjoy a major boost as Turkey promised more investment in Africa. The promise was made at the just concluded Turkey –Africa Business Economic Forum, TABEF 2016 in Instabul. This is in line with the country’s resolve to create an enabling environment for future collaborations.

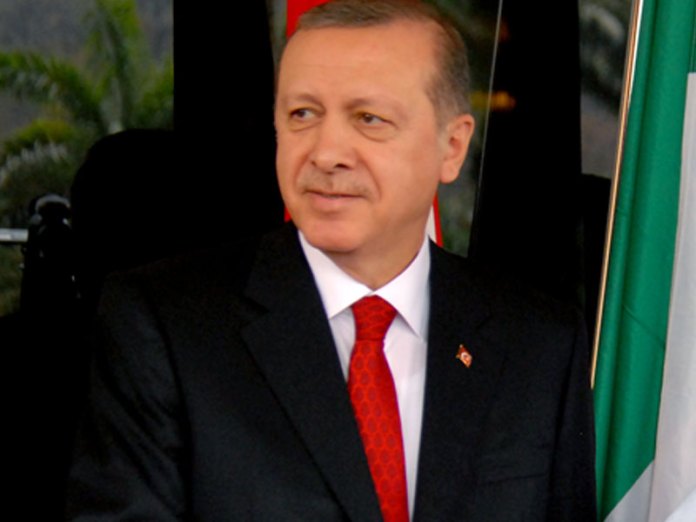

Speaking at the event, the Turkish President, Recep Tayyip Erdogan, said Turkey will in the coming days focus on helping many businesses in Africa with a view to promoting “closer cooperation with our regional allies, develop solutions to shared challenges and explore mutually beneficial opportunities…We share a common fate. We consider the priority of the African continent as our priority. There is a nice African proverb that says one day’s rain cannot get deep into the soil. We would like to remain friends forever.”

The event which was attended by major stakeholders in the Nigerian economy ranging from construction, energy, food and healthcare promised a massive turn around that will boost trade in Africa.

Emphasising on the benefits of the forum to Nigeria’s economy, Dr. Nneka Ebru Okpe, Co-founder and Lead Consultant at IntraSolutions Consultancy; one the major facilitators of the Nigerian-Turkey business partnership, said that events like this and the last economic forum on business collaboration between Turkey and Abia state government in Abuja should be encouraged as to increase foreign direct investment in the country.

According to her, “Turkey is ready to do business in Africa and we can already see this by the country’s willingness to expand the scope. Many opportunities are opened to both government and private sector businesses to thrive under this relationship”

Erdogan promised to establish an embassy in every country of the African continent. The President also said that Turkey’s foreign direct investments in the continent have reached $3.9 billion while the trade volume between Turkey and the continent increased to $17.5 billion in 2015 from $7 billion in 2005.”

Dr. Okpe said “ All these are pointers that in the next few years, recession or not, Nigeria will experience a tremendous investment partnership in the area of hospitality, agriculture, energy and manufacturing amongst others” By the involvement of IntraSolutions, Abia state has already started to enjoy the benefit of the relationship in the area of shoe and garment making; even before TABEF held. One thing that they are sure about is that the relationship will spread across the country with many state governments and private sector investors benefiting a great deal.

Also present was Mr. Pierre Edde ( Eko Atlantic city ) who made a pitch for investors on the benefits of investing in Eko Atlantic City. Edde lamented the total neglect of mortgage scheme by government.

Expatiating on the immense benefit available to the government in making housing available for its citizenry, the Eko Atlantic City boss said “the Nigerian mortgage system is at an alarmingly low level at just 0.05% of the country’s GDP. Banks alongside the government will need to revamp the mortgage system to afford individuals the ability to purchase homes, especially in face of the current economic recession in the country,”

On ways to boost the real estate sector in the country Edde stated that government and financial institutions should work together towards improving the mortgage system, as it is critical to the growth of the sector. This, he emphasised, is the only way the sector can be able to really improve on its contribution to the nation’s GDP.

The Turkish Cooperation and Coordination Agency, or TIKA, remains active across the continent and implements hundreds of humanitarian and development projects to provide better healthcare, promote agriculture, protect the environment and facilitate commerce.

The forum, jointly organized by the Turkish Ministry of Economy, the African Union Commission, the Foreign Economic Relations Board (DEIK) and the Turkish Exporters Assembly (TIM), aims to provide a platform for the business circles of Turkey and African countries to create a long-lasting cooperation, according to the forum’s official webpage.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago