Zinox Secures $25m to Roll Out Digital Hubs

Zinox Technologies, a foremost Information and Communications Technology (ICT) company has secured a whopping $25 million counterpart funding with which it seeks to roll out a trio of digital hubs in Nigeria that will create jobs for over 500 Nigerians.

According to the technology company, construction work has commenced in one of the digital hubs in Port Harcourt, the Rivers State capital, and the fund will help speed up work and ensure that the project is completed in good time.

The hubs, among other things, will create employment and empower thousands of digitally-minded Nigerian youths in search of the right platforms to develop their skills.

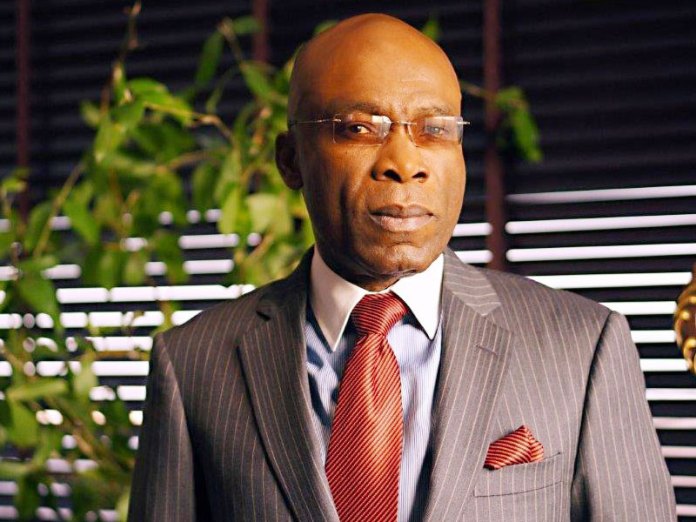

Chairman of Zinox Group, Leo Stan Ekeh made the disclosure when the acting Director General of the National Information Technology Development Agency (NITDA), Dr. Vincent Olatunji, led a team of the agency on official working visit to the Zinox headquarters in Gbagada, Lagos recently.

According to Ekeh, the other digital hub located in Abuja, which is nearing completion, would become active by early 2017.

“With the current improvements raising hopes of stability in public power supply by early 2017, the company plans to install the digital plants and commence production shortly,” Ekeh added.

“Our investment in digital hubs will provide jobs for 500 Nigerians, with more expected to benefit from other investments set to commence once the economy stabilises,” he said.

Ekeh said the Nigerian economy is in dire need of an alternative to crude oil, a role, which he said the ICT sector could effortlessly play in boosting the nations dwindling earnings. In the view of the Zinox boss, Nigeria has millions of young Nigerians of digital mindset with the potential to become dollar billionaires.

Referencing the case of Nigerian start-up and pioneer composite e-commerce outfit Yudala, which received little funding from investors and within one year is a leading e-commerce brand in Nigeria employing over 400 graduates, Ekeh disclosed that their strength is not cash but knowledge of the business backed with strong front and back-end technologies. Ekeh affirmed that thousands of such brilliant Nigerians exist in the country, even as he urged the government to partner technologically-minded companies in unearthing such raw digital diamonds in the country.

I had a similar experience when Zinox acquired an Ibadan-based software company Xputer. The young chaps behind Xputer were so talented and had huge capacity to develop amazing content but no individual, corporate or government saw any potential in them. Some of the apps developed by these young Nigerians are being used today by e-commerce companies in Nigeria which they would have paid millions of dollars for, had it been developed by foreign companies Ekeh said.

Responding, Olatunji affirmed the commitment of the agency in partnering with Zinox Technologies in the task of empowering the youth through the provision of requisite capacity-building programmes and initiatives.

Olatunji who expressed delight with the infrastructure and facilities on display at the Zinox headquarters during the tour of the company premises, disclosed that NITDA is keen to empower tech start-ups as a means of promoting opportunities in non-oil sectors, noting that a partnership with Zinox Technologies will go a long way in helping to achieve the aim.

“We cannot talk about the ICT sector in Nigeria and indeed in Africa without mentioning Zinox. Zinox has been in the forefront of the digital revolution on the continent and has continued to play a major role. You have shown extreme world class capacity and passion as a leader in the sector and this is why we have come on this visit to restate our commitment towards working with Zinox to achieve our objectives of empowering tech start-ups and boosting the revenue profile of the ICT sector,” Olatunji said.

With the digital hubs, we are looking to generate creative employment for our youth while creating the much-needed enabling environment and platform for more of these youths to develop their capacities and unleash their creative abilities. This is part of our contribution towards reducing the scourge of unemployment and boosting the revenue-earning streams of the government, Ekeh said.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago