- Forex Weekly Outlook October 24-28

The US dollar strengthened last week after the European Central Bank cleared speculation that the institution will commence tapering soon, boosting the attractiveness of the greenback that saw the currency reaching a 7-month high last week. Also, Other factors contributed to the dollar rally, for instance, the inflation rate rose 0.3 percent in September from 0.2 percent in August — the fastest pace in five months. While, on a yearly basis, inflation climbed 1.5 percent, a 0.5 percent short of Fed’s 2 percent target. It’s highest in two years.

Accordingly, some analysts have said this has bolstered the odds of the Fed’s raising rate this fourth quarter, while the odds are there. It is nibble to note the discrepancies in these data, for example, the housing starts fell (9%) for the second straight month in September, even with the surged in building permits (6.3%) received by builders. This signaled that the increase in costs is holding builders and other investors back, this is evident in the increase in unemployment benefits (260,000) for the week ended October 15 after spending several weeks near 43-year low.

Again, industrial output rose 0.1 percent in September, below 0.3 percent forecast — with capacity utilization increasing just 0.1 percent to 75.4 percent. All these pointed to Fed Chair Yellen Janet’s Boston speech that economic growth is now determined by global demand, hence, her reluctant to raise rates without evidence of sustainability, especially with Brexit fallout impacting overseas orders and rising oil prices increasing cost of living. While, the possibility the Fed might move is there, so is the likelihood of the Fed not moving this fourth quarter. This week, investors will look to validate released data with the third quarter GDP due this Friday, consumer confidence, core durable goods and pending home sales.

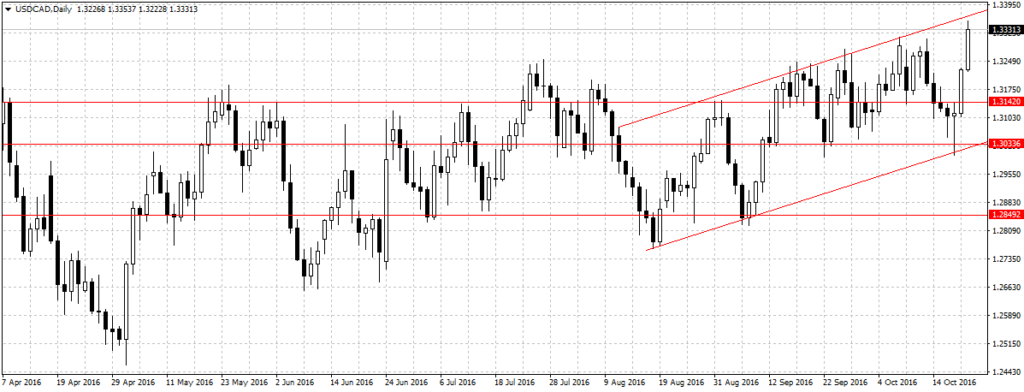

In Canada, the loonie plunged to a 7-month low against the US dollar on Friday, following a failed trade deal with the European Union and largely dovish monetary policy report. According to the Bank of Canada (BOC) growth in exports is expected to slow in the second half of the year through 2017 and 2018, while the economy continued to struggle with weak consumer spending (-0.1%) and low inflation rate (0.1%). As it is, Canada needs more than its oil and domestic consumption to grow its economy — considering the fact that the economy annual growth is gradually moderating to about 1.5 percent, below two percent.

But with about 500 million EU consumers and trade deal estimated at $70 billion per year shut to the embattled nation, the focus is now on China, India and Trans Pacific Partnership deals. This is one of the reasons the Bank of Canada Governor Stephen Poloz and his team are expected to ease further in order to facilitate exports and support spending.

In the Euro-Area, the European Central Bank (ECB) left its interest rate unchanged and maintain the same assets buying program, while suggesting that it is unlikely the bank stop its quantitative-easing program without gradually reducing its purchasing size. Which means, the current monetary easing program is likely to be extended beyond the scheduled end-date of March 2017. This, prompt investors to desert the Euro-single currency as they expect more from Mario Draghi led team, and subsequently plunged the 19-nation single currency to its lowest in 7 months against the US dollar. So, this week the Euro-single currency should extend its decline as uncertainties surrounding Brexit, Italy referendum and Greece crisis continued to weigh on the region’s growth prospect and business confidence amid weak exports. Also, this week, investors will look to assess President Mario Draghi speech due on Tuesday, alongside a series of manufacturing PMI from the region and German Ifo Business Climate report to determine the direction of ECB going forward.

Overall, the US dollar remains strong this week, and as the odds of the Fed raising rate increases I expect the demand for dollar to respond likewise. However, global financial markets remain resilient with increasing global risks and uncertainties as investors continued to seek less risky assets while monitoring monetary policies. This week, AUDUSD, NZDUSD and AUDNZD top my list.

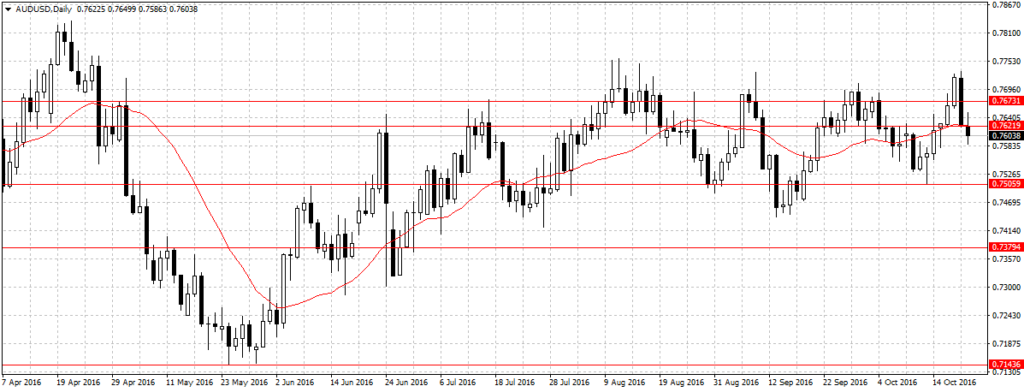

AUDUSD

Two weeks ago, this pair tops our list, but after hitting our first target at 0.75059 it rebounded, reaching as high as 0.7733 last week. This week, with the odds of the Fed’s raising rates jumping to 66 percent from 29 percent in the previous week, this pair is likely to continue its downward trend towards our 0.75059 support, especially knowing that the non-commercials net long positions held for the dollar is $19.3 billion. But if Australia’s third quarter inflation rate due on Wednesday is better than 0.5 percent predicted, this pair might retreated temporarily before it continues its bearish run. Hence, traders are advised to keep an eye on the change in Australia’s economic outlook this week.

Click to enlarge

This week, with the bearish engulfing pattern formed/completed on Thursday, and further validated by Friday’s bearish pin bar close, below 20-day MA. I am bearish on this pair with 0.7505 as the target as long as 0.7621 resistance holds.

NZDUSD

Also, two weeks ago I mentioned this pair bearish potential, but it retreated 44 pips to our 0.6989 support (target). This week, I am bearish on this pair because, one, it is overpriced and high foreign exchange is hurting New Zealand consumer prices, two, the odds of the Fed raising will boost dollar attractiveness over Kiwi and increasing the chance of our 0.6989 target been attained this week.

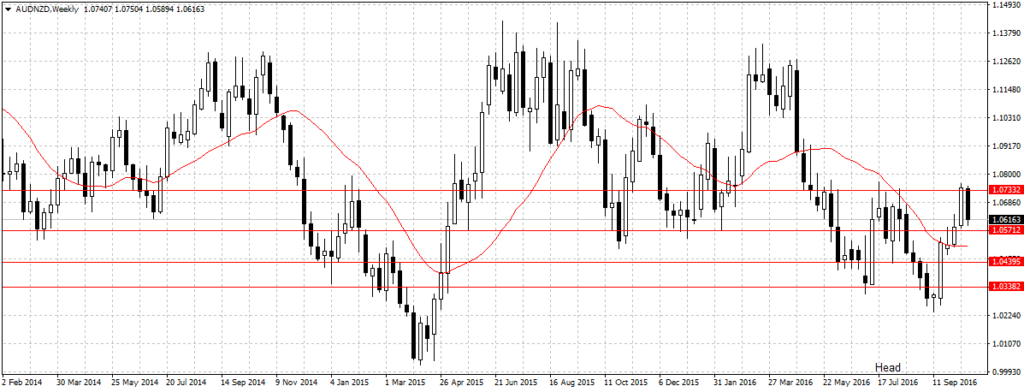

AUDNZD

This pair, closed as dark cloud cover pattern last week. Indicating a seemingly selling pressure of the haven asset. While caution is advised trading this pair, I am bearish on AUDNZD as long as the price remains below 1.0733 resistance with 1.0439 as the target. Partly because I doubt the possibility of the Australian economy meeting its inflation target in the third quarter with high foreign exchange. Nevertheless, caution is advised.

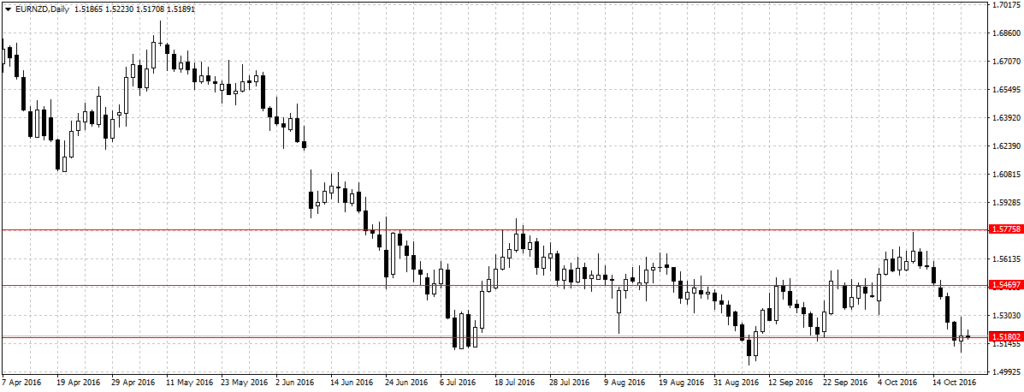

Last Week Cap

Last week, our EURNZD target hit at 1.5180, giving us 289 pips.

Also, USDCAD target hit at 1.3033 before rebounding to a 7-month high.

CADJPY

This pair dropped after the Canada-EU deal failed, reaching almost a month low against the Japanese Yen. This week, this pair has turned bearish as shown by the chart, and as long as the price remained 78.10 resistance I am bearish on this pair with 77.05 as the target.