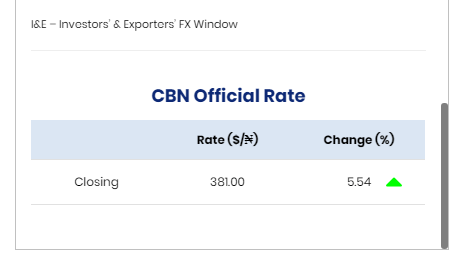

CBN Devalues Naira by 5.54% Against the US Dollar

The Central Bank of Nigeria (CBN) has devalued the Nigerian Naira once again, according to the available data on the FMDQ Group.

The apex bank devalued the local currency by 5.54 percent from N361 to N381 against the United States dollar, making it the second time in the last six months that the Naira would be devalued to commodate the change in economic fundamentals and the nation’s dwindling revenue generation.

The apex bank first devalued the Naira by 15 percent in March following more than 60 percent decline in global oil prices and substantial depreciation in the nation’s foreign reserves due to COVID-19 disruption.

This coupled with Nigeria’s weak fiscal buffer weighed on the nation’s economic outlook as experts, investors and businesses immediately started projecting that at some point the apex bank would be forced to devalue the local currency again.

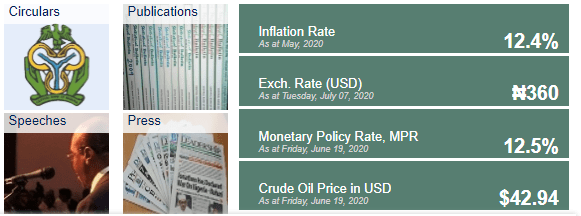

However, despite the central bank calling them speculators and hoarders with one motive, to profit from the nation’s economic situation. They insisted that with crude oil projected to remain between $35 to $45 per barrel through 2021 and foreign reserves already weak at $36.151 billion in a nation where over 90 percent of what its citizen consumes are imported, the apex bank will lose its ability to intervene at the nation’s foreign exchange, especially with foreign investors looking to move out about $5 billion.

While the central bank has not updated the quote on its official website from N360 to N380 as shown below, it has started selling to investors and exporters at N381, up from the old N361.

Again, this explained why the Naira-USD exchange rate slid to N461 on the black market in the last two weeks and remained between N460-N462 ever since.