FG Imports 5.26 billion Litres of Petrol in Q1, 2020

The latest report from the National Bureau of Statistics (NBS) revealed that Nigeria imported 5.262 billion litres of Premium Motor Spirit (PMS), popularly known as Petrol in the first quarter of the year.

On a daily basis, the report shows the nation consumed 57,824,651 litres of petrol during the period.

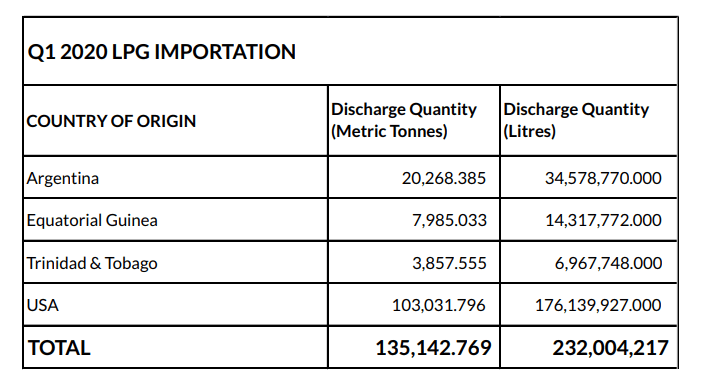

A further break down revealed that the country imported 1.655 billion of Automotive Gas Oil (AGO), 258.27 million litres of Aviation Turbine Kerosene (ATK), 28.33 million litres of Low Pour Fuel Oil (LPFO) and 135.14 million litres of Liquefied Petroleum Gas (LPG) in the first quarter of 2020.

Nigeria, Africa’s largest economy and exporter of crude oil, continues to import finished petroleum products despite efforts to curtail foreign reserves as the nation’s three refineries remained underproductive.

Experts have said the huge amount being spent on importation of petroleum products is one of the reasons the nation foreign reserves is constantly under pressure.

However, the completion of Dangote Refinery should address most of this issue, according to Aliko Dangote himself.

During the quarter, South West consumed the most, according to the ‘zonal distribution of truck out volume of LPG’ breakdown for the quarter.