The growing rate of internet users in Africa has mandated its proper implementation towards the betterment of African people, while countries like Egypt, South Africa, Morocco, Kenya, etc. are taking advantage of internet opportunities, Nigeria with over 70 million (internetwordstats.com) internet users is yet to fully utilize its population and growing market to its advantage.

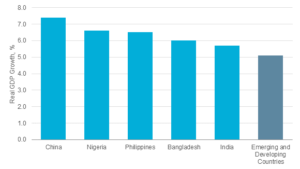

There are two main reasons why Nigeria is a key factor in actualizing the African entrepreneurial dream: one, Nigeria is the second fastest-growing key emerging market in the world (Euromonitor.com) and on track for a 7 percent growth rate in 2015 after a successful second-quarter report.

Real GDP Growth in Top 5 Fastest-Growing Key Emerging Economies in 2014

Source: Euromonitor International from national statistics/Eurostat/OECD/UN/IMF

Two, in a research conducted by British Council, Nigeria tertiary age (18-22 years old) population will lead the world through 2024 and grow from 16.1 million in 2013 to 22.5 million by 2024 which is equivalent to an average growth rate of 3.1 percent, far ahead of projected annual growth rate for Indonesia (1.3 percent), a country forecasted to be the next fastest-growing country. Equally, overall tertiary enrolment is projected to double from 2.3 million students in 2013 to 4.8 million by 2024.

However, Nigeria’s unemployment rate is expected to increase proportionally from 7.5 percent to 24.33 percent by 2020 (http://ieconomics.com). This implies that there would be more unemployed graduates by 2020 if nothing is done now.

According to research quoted by Facebook CEO, Mark Zuckerberg, for every 10 people who gain access to the internet 1 is raised out of poverty. Another research shows that on average small and medium enterprises (SMEs) employ between 2 to 100 employees. This is an important figure necessary to fill the void in the labour market and subsequently reduce unemployment, increase export revenue and empower the youths.

Sadly Nigerian internet sphere is limited by negative public perception due to a series of scams emanating from the region, which has hindered foreign investors from helping the youth with viable startups to access funds. Institutions like Paypal, Amazon, etc offer limited services to Nigerians as a measure to curb possible fraud. So is some financial institutions in the U.S and other countries won’t allow Nigerians to trade (forex) or transact on their platforms.

From all indications the internet has created more opportunities now than there was in the past, but the inability of the youth to access a pool of resources has forced many to conform to the seemingly blogging business like Linda Ikeji and the likes. Now, the issue is blogging is currently reduced to entertainment or propaganda as a means to generate traffic, statistically, it is less likely that the nation can create more jobs and reduce unemployment like Google Inc., Amazon, Bloomberg, etc. that way.

As the most populous black nation that accounted for 23.6 percent of African internet users. Not only entrepreneurs can create jobs by thinking creatively but also because the participation of more talented individuals can help solve vital societal issues and subdue negative perception, and as more start-ups strive to attain global standards using the power of technology, global accessibility becomes better, hence, global attention on the region would increase positively.

In June, Facebook Inc., announced the appointment of Nunu Ntshingila to manage over 120 million Facebook users in Africa, over 6.6 million of this population are Nigerians. This move further affirmed Africa as the next global target for future businesses and failure to emerge with the next phase of African/global entrepreneurs by creating sustainable businesses, would leave a vacuum for more foreign businesses to fill at the expense of the people’s interest.