- Oil Price Plunges to Four Year low on Monday

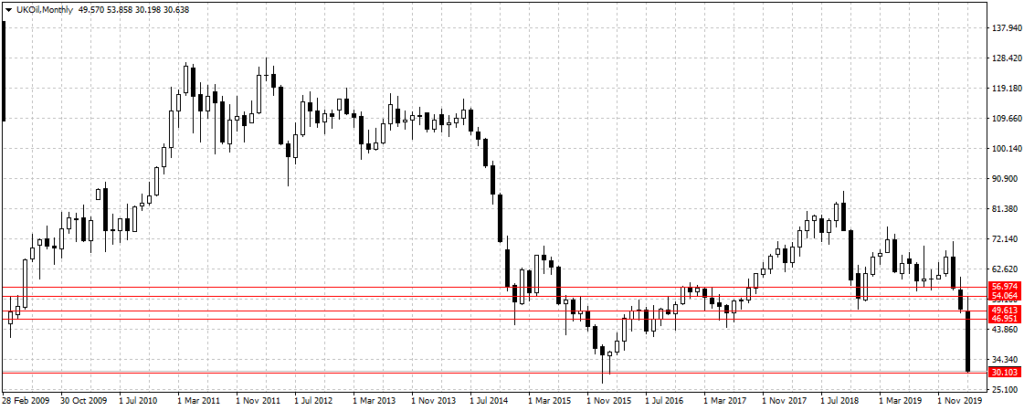

Global oil prices plunged further on Monday to a four-year record low as global risk remains high.

The Brent crude oil, against which Nigerian oil is measured, declined from $31.26 per barrel recorded last week when the commodity dipped by 30 percent to $30.19 per barrel on Monday during the Asian trading session, the lowest in since November 2015.

“The relative weakness in Brent shouldn’t come as too much of a surprise, given the severity of the breakout across Europe,” said ING analyst Warren Patterson.

“Another factor offering relatively more support to WTI is news that President Trump has ordered Strategic Petroleum Reserves to be filled up at these lower price levels.”

The US West Texas Intermediate (WTI) crude oil also extended its decline from last week close of $33.24 a barrel to $29.57 per barrel on Monday.

This was after several reports revealed the rising number of victims of coronavirus both in Africa and the rest of the world. The World Health Organisation (WHO) on Wednesday declared the outbreak a global pandemic forcing many nations to restrict flights from certain regions to curb the spread of the deadly virus.

This was after several reports revealed the rising number of victims of coronavirus both in Africa and the rest of the world. The World Health Organisation (WHO) on Wednesday declared the outbreak a global pandemic forcing many nations to restrict flights from certain regions to curb the spread of the deadly virus.

The number of infected people rose to 38 in South Africa while it is over 700 in the UK and over 1,200 in the United States of America. The US Federal Reserves had lowered interest rates by 50 basis points two weeks ago to sustain new job creation and stabilize price, however, the global health crisis was too much for deployed stimulus as over $11 trillion was erased from the global financial market last week.

In Nigeria, Nigerian Stock Exchange erased N1.8 trillion last week following the continuous sell-off of open positions as investors fear the Central Bank of Nigeria would devalue the Naira due to weak foreign reserves and low oil prices.

The local currency traded at N410 to a US dollar at some parallel markets last week despite the CBN saying there was no devaluation in its plan and blamed criminal speculators for the sudden increase in the exchange rate.