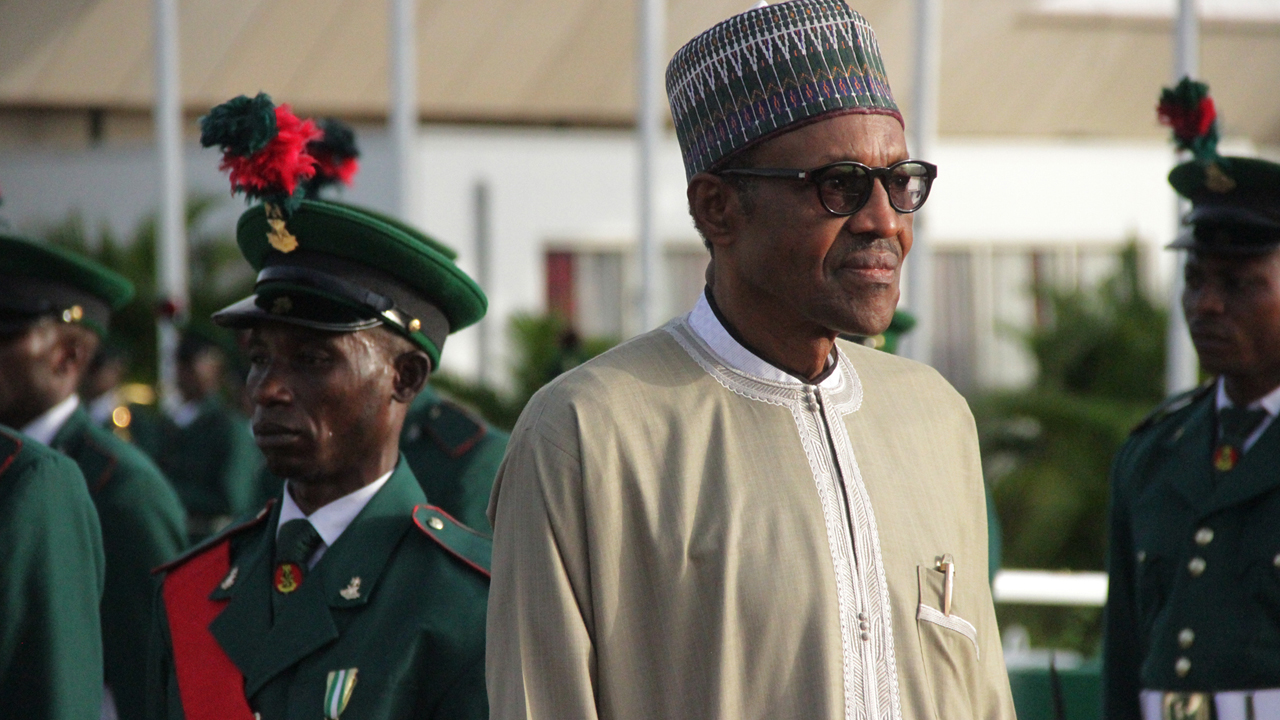

- AfCTA: Nigeria Can no Longer Sign Agreements Without Understanding, Says Buhari

President Muhammadu Buhari on Monday said Nigeria could not afford to go back to the days of signing agreements without understanding and planning for the consequences of such actions.

Buhari said this while inaugurating the committee saddled with the responsibility of assessing the impact and readiness for the Africa Continental Free Trade Area Agreement.

The presidential committee has the Minister of Industry, Trade and Investment, Dr Okechukwu Enelamah, as its chairman, and the Chief of Staff to the President, Abba Kyari, as co-chairman.

The President recalled that a few months ago, he directed a nationwide stakeholders’ engagement on the AfCFTA to understand the true impact of the agreement on Nigeria and Nigerians, considering the existing domestic and regional policies relating to trade.

He listed the key issues raised by stakeholders during the consultation as abuse of rules of origin; smuggling arising from difficulties in border controls; un-quantified impact of legacy preferential trade agreements; and low capacity and capabilities of local business to conduct international trade.

Buhari listed others to include high cost of finance; insufficient energy; and inadequate transport logistics infrastructure.

The President stated, “Our ERGP is addressing these issues. Nonetheless, we are determined to break away from the past practice of committing Nigeria to treaties without a definite implementation plan to actualise the expected benefits, while mitigating the risks. “We cannot go back to the days of signing agreements without understanding and planning for the consequences of such actions, and our country being the worse off.

“Your task as members of the AfCFTA Impact and Readiness Assessment Committee is to address the issues raised during the nationwide stakeholders’ consultations on the AfCFTA.”

He added, “You are expected to develop short, medium and long-term measures that will address any challenges arising therefrom.

“I look forward to receiving from you in 12 weeks, a clear roadmap for Nigeria as it relates to the AfCFTA.”

Buhari argued that many of the challenges facing Nigeria were caused by the country’s inability to produce its most basic needs.

He attributed the recent recession experienced in the country to overdependence on external factors.

He said the recession was a clear case of why Nigerians must aspire to be self-sufficient.

The President stated, “For too long, our domestic productive capabilities were neglected in favour of imports. Nigeria was using its hard-earned oil revenues to create jobs offshore instead of developing the manufacturing potential of our very vibrant, young and dynamic population.

“Many of our challenges today, whether relating to security, unemployment or corruption, are rooted in the fact that we have not been able to domesticate the production of our basic requirements.

“The recent recession, which was as a result of our overdependence on external factors, is a clear case of why Nigerians must now aspire to self-sufficiency.”

Buhari said the present administration’s Economic Recovery and Growth Plan focused on the revival of key job creating and import substitution sectors such as agriculture, mining, manufacturing and services.

To ensure that the ERGP is seamlessly implemented, he noted that the government had commenced a number of structural reforms through the Presidential Enabling Business Environment Council; the Industrial Policy and Competitiveness Advisory Council; and the Nigerian Office for Trade Negotiations.

According to him, the benefits of these reforms are being felt as the government’s economic policies are creating meaningful jobs for the young population, assuring national food security and improving the competitiveness of the economy to position export trade as an engine for economic growth.

However, Buhari said while the government must look inwards for certain solutions, it had not lost sight of regional and international trends, especially on trade where global dynamics were shifting and changing at a rapid rate.

This, he said, meant that as the government planned for the long-term, it must also be flexible enough to respond to short-term shocks that could upset economic diversification and backward integration plans.

Earlier, Enelamah gave the terms of reference of the committee.

He said, “Following consultations, the terms of reference of the Presidential Committee on the Africa Continental Free Trade Area Impact Assessment and Readiness are: assess the potential cost and impact of the Africa Continental free Trade Area AFCTA for Nigeria in relation to the benefits; identify the short, medium and long-term measure to prepare Nigerian businesses for the take-off of the AfCTA trading group and a backup plan that covers selected scenarios; and view the trade remedy options to safeguard the Nigerian economy form predatory and failed trade practices.”

The minister added that an updated trade policy was being prepared for Nigeria and the draft would be ready for review by the end of the year.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago