- Forex Weekly Outlook June 12-16

The uncertainty in the global financial markets weighed on the foreign exchange outlook amid a series of political uprising across top financial nations. While the diverse policies formulated to aid economic growth towards Central Banks’ target have not been outright effective, the data from the U.S, Euro-area, Japan, etc remain solid, even as commodity dipped across the board.

EURUSD

The euro single currency has gained about 7 percent against the U.S dollar this year, however, the European Central Bank president Mario Draghi on Thursday lower inflation forecast to 1.6 percent through 2019, while revising upward the economic growth rate and maintaining the same size of bond-buying program. This indicates that the apex bank has no exit strategy for QE yet, especially after confirming there is still downside risk to growth—which further creates mixed outlook of the Euro single currency.

Again, while the US dollar has been battered by the US political uncertainty, the recent economic data remained moderately strong. Also, the FBI James Comey testimony did little to nothing to alter the US dollar strength. But the weak job data and slow wage recorded in May are likely to prevent the Federal Open Market Committee from raising rates on Thursday.

Technically, it is unlikely this pair will break the 8 months high recorded at 1.1299 price level after ECB mixed economic outlook of the Euro that prompts sell-off of this pair. Therefore, I will be looking to sell this pair below the 1.1190 levels that double as the 20-day moving average for 1.1117 targets, and expect a sustained break to attract enough sellers to sustain the selloff towards target 2 as shown above.

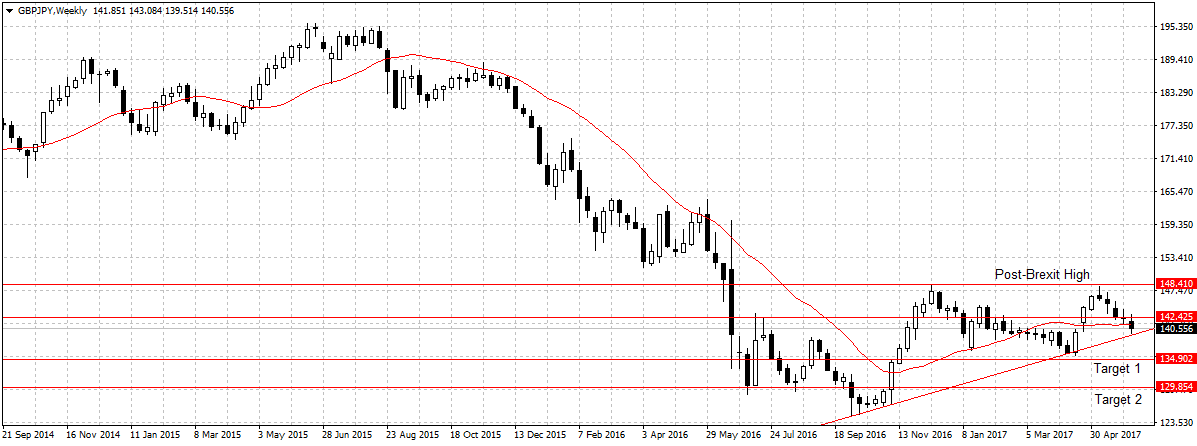

GBPJPY

The Pound Sterling plunged after Theresa May’s Conservative Party failed to secure 326 seats needed to form a majority government on June 8. Pushing risks exposure and market uncertainty to a new height after economic data showed consumer spending that contributes 70 percent of the economy and housing prices declined.

On the other hand, the Japanese Yen continued to gain from strong economic growth and relatively stable politics. Even though, the Bank of Japan governor Haruhiko Kuroda said Japan is far from meeting its inflation target of 2 percent, the haven currency is like to continue to gain against the Pound ahead of Brexit talk and U.K political uncertainty.

Since I first mentioned this pair sell potential last week, it has dropped 187 pips, however, that is below our first target of 134.90. Therefore, this week I remained bearish on this pair for two reasons: One, the last week candlestick closed below the 20-day moving average, and further validated the pound sell-off. Two, the politics in the U.K and poor fundamental will plunge long term investment that will gradually hurt earnings and job creation. Eventually, weak business confidence and high consumer prices will hurt domestic demand and the Pound strengths.

Accordingly, I will be looking to add to my sell order below the ascending channel at 139.33 for 134.90 take profit this week.

USDJPY

Please note that after our first target was hit on USDJPY last week. The pair rebounded to 110 price levels. Therefore, this week I will be standing aside to better monitor price action.