- Forex Weekly Outlook March 27 – 31

The US dollar slid to its lowest in 4 months on Wednesday following Donald Trump failed health care bill that has raised questions about his administration’s ability to push its pro-growth agenda through congress. This uncertainty has rendered the US dollar unattractive and led to massive sales of the currency across the board, as investors are beginning to doubt the feasibility of Trump’s proposed tax cut and increase job creation.

In the U.k, inflation rose more than forecast in February to 2.3 percent, the highest since 2013. While, investors are waiting for Theresa May to officially trigger article 50 of Lisbon treaty on March 29, experts are projecting the slowdown in consumer spending to further decline to about 2 percent this year from 3 percent recorded in 2016.

Also, inflation in the region is expected to reach a new height as uncertainty surrounding the U.K economic outlook ahead of Brexit continues to weigh on new job creation, business sentiment, costs of import goods and profits of companies that generate the bulk of their revenues from overseas.

Overall, the US dollar has given back almost all it gained through popular ‘Trump Rally’ after last week failed health care bill. However, the US economy remained strong and projected to meet and sustained 2 percent inflation target going forward. But the uncertainty surrounding economic policy remains.

Likewise, the Euro-area economy has revamped strongly following the surge in global commodity prices. Therefore, I expect the euro single currency to dip during the official Brexit process but not as much as the British pound.

This week, CADJPY and NZDPY

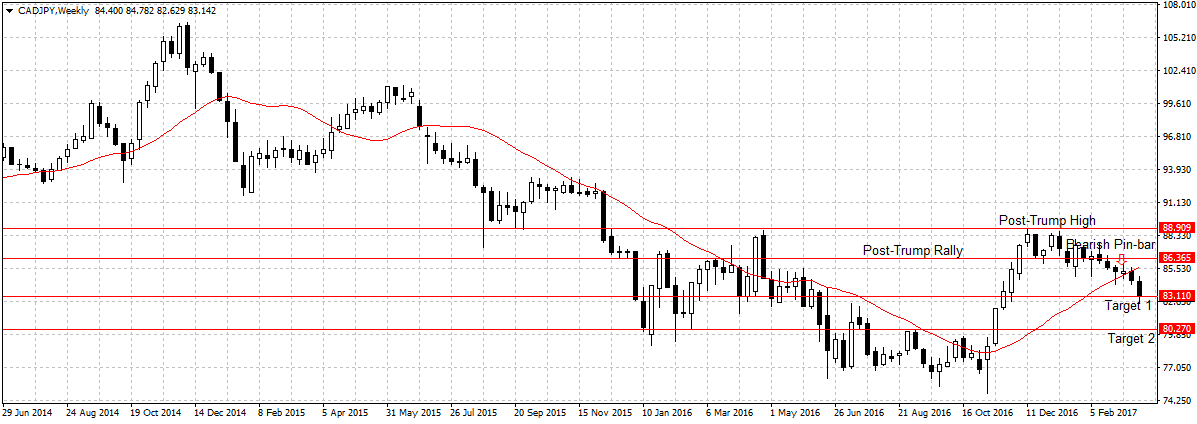

CADJPY

This pair plunged 133 pips to meet our last week’s target 1 at 83.11 support levels. However, due to the increased uncertainty regarding OPEC 2nd production cut amid the surge in the US shale production. I am expecting a break below 83.11 support to increase the attractiveness of this pair and open up 80.27 support levels (2nd target). This is partly because the Canadian dollar is crude oil driven and of recent has started reacting to US positive policy owning to the trade relationship between the two nations.

Also, the Japanese yen is likely to continue its gain this week, especially with Theresa May officially triggering article 50 on Wednesday and the US uncertainty reaching a new peak after failed health care bill. Therefore, I remain bearish on this pair with 80.27 as the target.

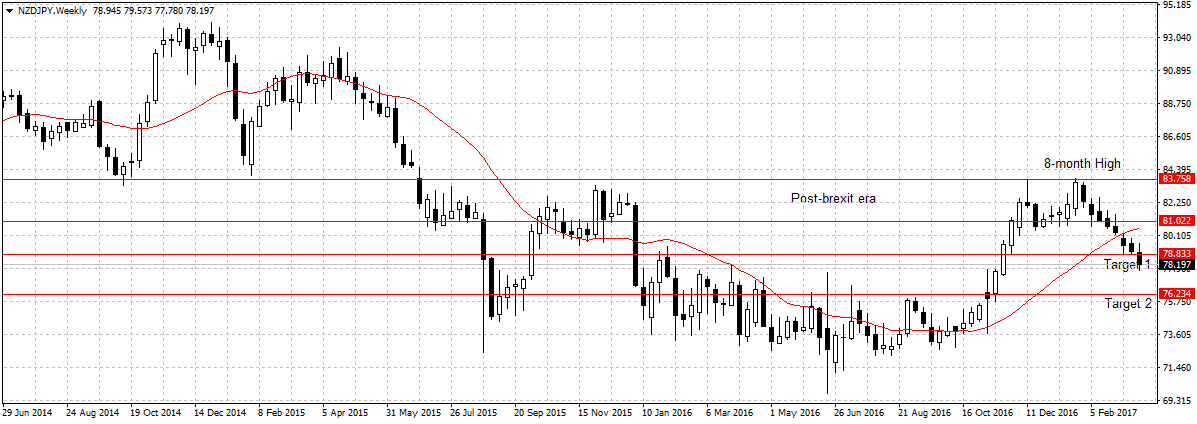

NZDJPY

Since I first mentioned this pair sell potential in February. It has given us about 283 pips and closed below our first target of 78.83 last week. However, I am projecting continued gain of the Japanese yen as investors and businesses scramble to avert possible volatility following official Brexit initiation on Wednesday, hence, leading to a surge in demand for haven assets. So this week I remain bearish on this pair with 76.23 as the target as stated in the February analysis.

Last Week Recap

GBPJPY

This pair has plunged 153 pips since last week but yet to hit our first target as stated in the last analysis.

This week, I remain bearish ahead of Brexit and all the uncertainty attached to it. I will be looking to add to my sell position below 134.90 support levels.

EURNZD

A sustained break of 1.5469 is needed to validate bullish continuity as stated last week.

However, because of the uncertainty surrounding Brexit and the entire euro-area this week. I will be standing aside once our first target is met at 1.5469.