- Eko Atlantic Completes 14 Bridges

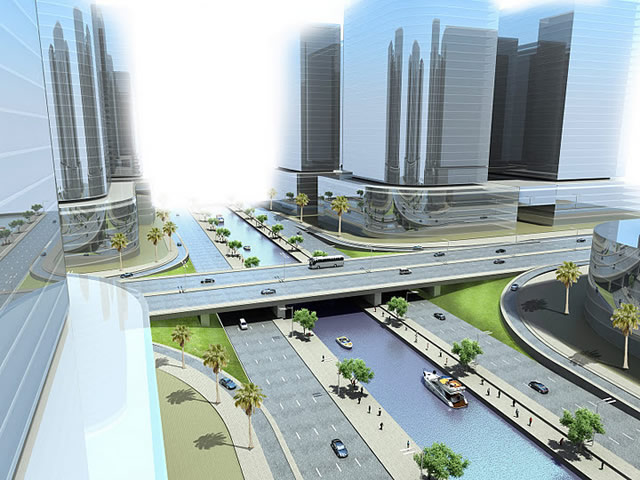

The promoters of Eko Atlantic City, one of the world’s most advanced new cities being built on the shores of the Atlantic Ocean in Lagos, said they have completed 14 bridge structures in just two years.

According to a statement released recently by the developers, the bridges extend over five million square metres, representing half of the entire planned city development.

The completion of these bridges, they said was “a hugely significant progress,” adding that they were built to international standards.

Work on the bridge project, they said started in December 2014 when the first bridge deck was cast and project completed on schedule in December 2016. The city, which is divided into 8 districts (Harbour Lights, Business Districts, Eko Drive, Marina, Ocean Front and Avenues), is planned for mixed-use with commercial, residential, entertainment and leisure activities to make the city a 24/7 lively environment.

The statement said, “With the new bridges all the districts are now accessible by road. The bridgeworks have formed a major element of the works and it has also enabled all major avenues to overpass the canal system running through the spine of the project.

“All bridges are between 2-6 lanes. For instance, Bridge 7 comprises a six-lane carriageway and is located on Avenue 1, thus defining the western boundary of the Business District, the commercial heartland of the city.

Spanning 52 metres overall in three sections, Bridge 7 is typical of the design utilised throughout all bridges and comprises a reinforced concrete cast in-situ deck with concrete piers and abutments. Also post-tensioning techniques were employed on the horizontal deck to achieve the span required.

“The last bridge was deliberately constructed to overpass the canal entrance to the South West Marina, defining the marine access to the Atlantic Ocean.”

Mr. David Frame, Managing Director of South Energyx Nigeria Limited (SENL), a subsidiary of the Chagoury Group said, “We are fully committed to ensuring that the project is completed on schedule. With the successful completion of all the bridges, all the major avenues within Phases 1 and 2 of the City are now fully interconnected, with the comprehensive road network of the city defined and all zones accessible.” He hinted that the company has a lot of announcements planned for the year as it achieves more key milestones in the project.

It would be recalled that the city in November last year unveiled the first of the Eko Pearl Towers, a residential building in its Marina District. The commissioning of the Tower which was done by the Lagos State governor, Akinwunmi Ambode came just a few months after the commissioning of the city’s Eko Boulevard, Nigeria’s first eight-lane city road.

Eko Atlantic City is arguably the single most ambitious and comprehensive mixed-use development plan to come on stream in the West Africa sub-region in recent times. Modeled after the skyscraper District of Manhattan Island in New York City, it is expected that the new city will be home to no fewer than 450,000 residents, with commuter volume expected to exceed 300,000 people daily. Self-sufficient and sustainable, it includes state-of-the-art urban design, its own power, clean water, advanced telecommunications, spacious roads and 110,000 trees.

The uniqueness of the initiative is that the residential units will be constructed as vertical high-rise apartment towers due to limited space for the traditional single family detached units.

According to data released by Residential Auctions Company (RAC), there are already over 1,000 units of apartments of various room sizes ranging from one bedroom to four bedroom penthouses already under construction. High- rise developments will provide just slightly over 560 apartment units with one tower completely sold out and the first set of units will be delivered as early as 2016.

Eko Atlantic is a planned residential and commercial city located on reclaimed land in Lagos. The project began in 2003 as a permanent solution to protect Bar Beach in Victoria Island from the effects of severe coastal erosion, and to safeguard Victoria Island from the threat of flooding.

Forex4 weeks ago

Forex4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Economy4 weeks ago

Economy4 weeks ago