Finance

Heritage Bank Revoked Licence: CBN Pays FirstBank

Published

8 months agoon

The Nigeria Deposit Insurance Corporation (NDIC) yesterday announced the commencement of the liquidation of the defunct Heritage Bank Plc, following the revocation of its operating licence by the Central Bank of Nigeria (CBN).

The corporation said the move was in accordance with Section 55 sub-section 1 and 2 of the NDIC Act 2023, adding that depositors of the defunct bank that have alternate accounts within the industry would be paid up to the insured amount of N5 million per depositor using their Bank Verification Number (BVN) to locate their alternate account.

In a statement, NDIC Director, Communication and Public Affairs, Bashir Nuhu, said that the liquidation process was with immediate verification and payment of insured deposits to the bank depositors.

He said depositors with funds more than N5 million would be paid liquidation dividend upon realisation of the bank’s assets and recovery of debts owed to Heritage Bank.

The revocation is coming on the revelation that FirstBank’s total exposure to Heritage bank amounted to about N500 billion.

The CBN under former Central Bank Governor, Godwin Emefiele, got FirstBank to support Heritage Bank at the level of forbearance, clearing of their checks and instruments. “This led to their massive indebtedness to FirstBank to the tune of N500 billion,” a source with knowledge of the matter revealed.

THISDAY reliably learned last night that before the announcement of the revocation of Heritage Bank’s licence was made, CBN paid off First Bank’s exposure to Heritage. Since its intervention was at the behest of the apex bank under Emefiele.

The NDIC further advised all depositors of the defunct bank without alternate bank account in the industry to visit the nearest branch of the bank with proof of account ownership, verifiable means of identification such as driver’s licence, permanent voter’s card, national identity card, together with their alternate account and BVN for the verification of their deposits and subsequent payment of insured sums.

Nuhu, also the bank’s creditors to visit the nearest branch of the bank to file their claims or via the online platform, adding that the process of payment of creditors would commence immediately after all depositors have been paid.

He also advised debtors that are yet to complete the repayment of loans to contact the corporation’s Asset Management Department (AMD) or visit the NDIC website for more details.

The NDIC however, assured the entire banking public of its commitment to the continued safety of depositors’ funds in all licensed banks.

It therefore, urged depositors to continue their banking businesses without fear as banks whose licenses have not been revoked remain safe and sound.

The CBN had earlier announced the revocation of the operating licence of the failed bank with immediate effect.

In a statement issued by CBN acting Director, Corporate Communications, Mrs. Hakama Sidi Ali, the apex bank said the move was in accordance with its mandate to promote a sound financial system in Nigeria and in exercise of its powers under Section 12 (1l of the Banks and Other Financial Act (BOFIA) 2020.

The central bank pointed out that the Board and management of the bank had not been able to improve the bank’s financial performance, a situation which constitutes a threat to financial stability.

This followed a period during which the CBN engaged with the bank and prescribed various supervisory steps intended to stem the decline.

Sidi Ali said, “Regrettably, the bank has continued to suffer and has no reasonable prospects of recovery, thereby making the revocation of the license the next necessary step.”

Specifically, the CBN said the action became necessary due to the bank’s breach of Section 12 (1) of BOFIA, 2020.

The CBN acting director further explained that the central bank took the action to strengthen public confidence in the banking system and ensure that the soundness of the financial system was not impaired.

She said the NDIC had also been appointed as the liquidator of the distressed bank in accordance with Section 12 (2) of BOFIA, 2020.

She explained, “We wish to assure the public that the Nigerian financial system remains on a solid footing.

“The action we are taking today reflects our continued commitment to take all necessary steps to ensure the safety and soundness of our financial system.”

However, reacting to the licence revocation by the CBN, Founder/Chief Executive Officer of Proshare Nigeria Limited, Mr. Olufemi Awoyemi, argued that at least four other banks “are in situations requiring swift CBN intervention; therefore, the #CBN and the #NDIC will have to shift regulatory/intervention gear sticks to ensure that the banking system works with minimal disruption.”

He pointed out that the revocation of Heritage Bank’s licence did not come as a surprise.

“For a bank under forbearance, this was a long time coming (as we recall the number of reports on same and challenges with similar entities under the same program), given the numerous follow-ups done by Proshare.

“Neither the CBN nor NDIC took to Proshare’s recommendations; with the wheels now turning full circle with the CBN’s recent decision to liquidate Heritage Bank, the crackling of regulatory noise has been tuned up. Therefore, we remain unsurprised and ask why it took so long for the regulators (CBN and NDIC) to see the merit in the recommendations proffered,” he added.

According to him, almost five years after, and sequel to the multiple interventions by the CBN, including its forbearance position, nothing changed.

“Eventually, it would appear that the CBN took the first option we proposed. The action today compels the need to interrogate the institutional decision-making capacity and capability in the face of the obvious financial system and organisation shortcomings,” Awoyemi said.

Also, Head, Financial Institutions Ratings at Agusto & Co, Mr. Ayokunle Olubunmi said, “Heritage Bank has been struggling for a while now. The bank’s capital has been persistently below the CBN minimum threshold.

“I believe that the revocation is meant to send a message to the banks that the CBN will not hesitate to revoke the licence of any bank in breach of the CBN regulations. It could also sanitise the banking industry to an extent.”

He noted that the revocation could improve confidence in the financial system since the banks know that their licences could be withdrawn and would have to comply with the various regulations.

Olubunmi, further stressed that the recent increase in the NDIC coverage would provide some comfort to depositors.

Also, a banker who pleaded anonymity said the distressed bank had not reported their financials in five years, adding that he perceived two other banks have negative capital and bad financials which may go the route of license revocation.

The source said, “Heritage Bank had not produced their financials for years and over the years there had been various investors that had tried to acquire the bank but once they did their due diligence they backed out. Things have been so bad that they don’t have senior staff for certain pertinent positions such as Chief Risk Officer and Treasurer. So, things have been bad in the bank for a while.”

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

Against all Odds, FirstBank Eyes Another Decade of Growth

-

FirstBank Clarifies Misleading Reports, Reassures Customers of Gold Standard Banking Services

-

Expanding Footprint-Nigeria’s FirstBank Sets Sights on Ethiopia, Angola, Cameroon

-

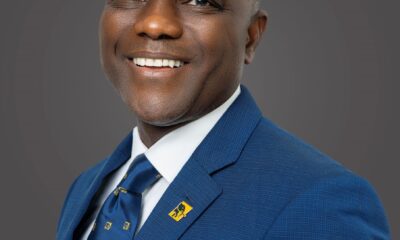

ALEBIOSU: IN LINE WITH OUR VISION, FIRSTBANK IS WELL-POSITIONED TO BREAK NEW GROUNDS IN 2025 AND BEYOND

-

FirstBank’s Decemberissavybe Lights Up Lagos With Davido Concert

-

FirstBank Kicks Off Decemberissavybe 2024 With Kenny Blaq’s Reckless’ Musicomedy