The Third Edition of the Zenith Bank Tech Fair, themed “Future Forward 3.0”, which was held on November 23-24, 2023, at the Eko Convention Centre, Eko Hotels & Suites, Victoria Island, Lagos has concluded.

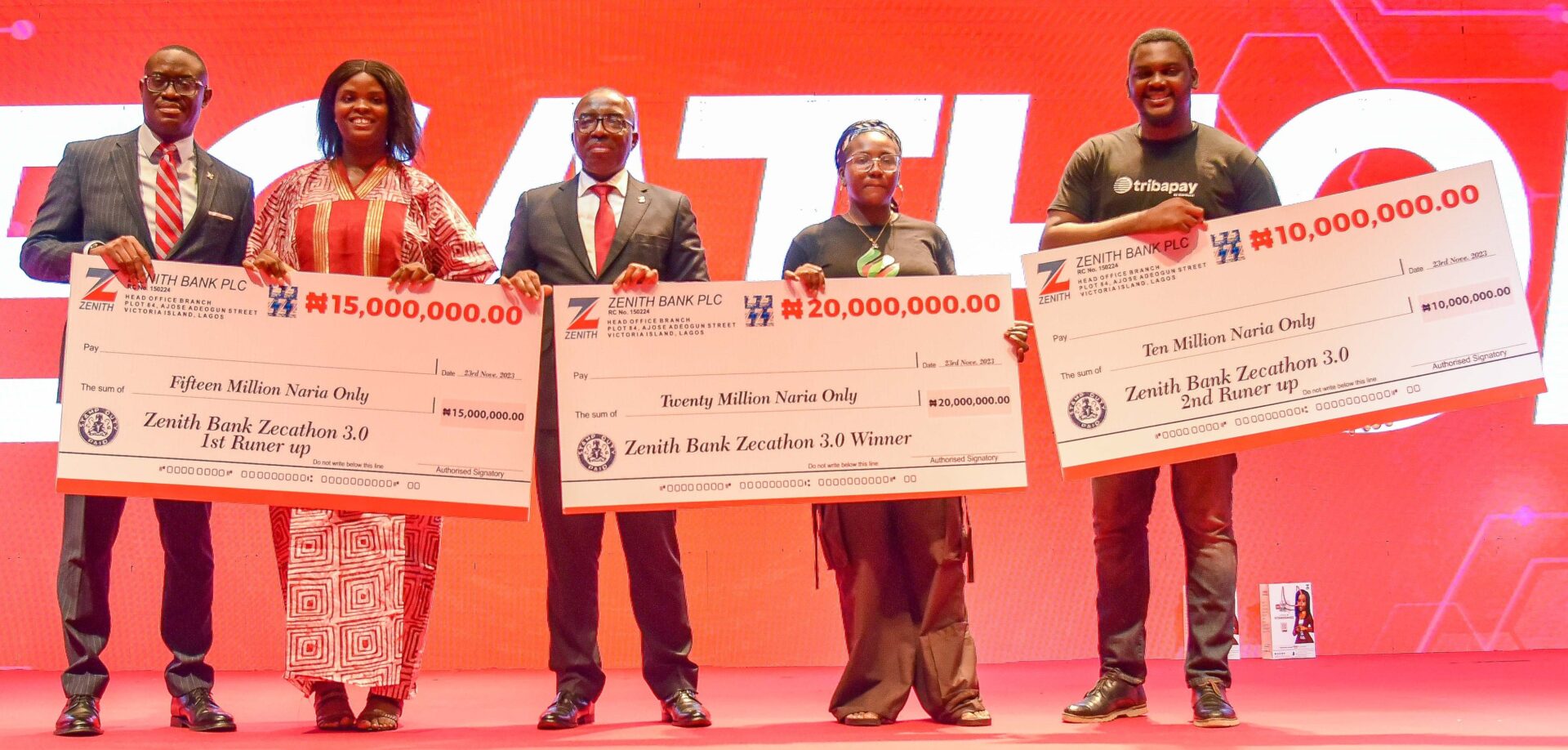

From the over 500 contestants that participated in the Zenith Hackathon (Zecathon), Sync, a team collaboration and workflow management platform that provides synergy, enables project management, task planning, messaging, payments, scheduling and people operations, emerged as the overall winner, taking home the grand prize of N20 million.

This is in addition to a mentorship programme with Seedstars, a company dedicated to implementing high-quality capacity-building programmes for entrepreneurs in emerging markets.

The first runner-up, Skill Up With Kahdsole (SUWK), a social-tech startup that provides an end-to-end platform for learning technical and vocational skills to empower young people, won N15 million and a mentorship programme with Seedstars, while the second runner-up, Tribapay, a payment processing gateway that allows for cross-border payments and transactions in Nigeria and Ghana, won N10 million as well as a mentorship programme with Seedstars. Other finalists who took home N2 million each include Edupoint, Joovlin, Frootify, Izesan Limited, Natal Cares, Plychain.io, and Niteon.

In his welcome address at the Zenith Bank flagship Tech Fair, the Group Managing Director/CEO of Zenith Bank Plc, Dr. Ebenezer Onyeagwu, expressed his excitement for this year’s Hackathon, stating that it was indeed the high point of the overall event. According to him, “We have deliberately kept the best for the last. The high point of today’s event is the Hackathon. This is where we have the opportunity to see the immense creativity and talent in our youth as they come up with different innovative ideas.” He added that “the good thing about the Hackathon is that the pitches you see presented are completely different from the ones we have seen before and we intend to make it far more elaborate as we hope that as we go into the future, we should be able to bring back winners where they can tell the audience their journey and how they have progressed so far.”

The two-day Tech Fair which was described as a huge success by participants, featured presentations on the leading technological innovations that cut across different aspects of life, such as Artificial Intelligence, Contactless Payments, Cybersecurity, Cloud Computing, FinTech, Data Analytics, Financial Intelligence, and communication technologies, with the keynote address,” “Artificial Intelligence – Application & Bias “, delivered by Chris Lu, the renowned IT Specialist, business strategist and Managing Director for Huawei Technologies, Nigeria.

The event also featured a welcome address by Dr. Ebenezer Onyeagwu, Group Managing Director of Zenith Bank Plc and Chairman of Body of Banks’ CEOs, Nigeria, and a goodwill messages by the Honourable Minister of Communication, Innovation & Digital Economy, Dr. Bosun Tijani and Dr. Doris Anite, Hon. Minister of Industry, Trade & Investment (represented by Dr. Femi Adeluyi, National Coordinator for the National Talent Programme). Other eminent IT practitioners from top global brands who also made presentations include Demola Sanusi, Solutions Architect, Amazon Web Services; Temitope Aladenusi, Partner & Leader Cybersecurity, Deloitte; Andrew Uaboi, Vice President/Cluster Head, Visa West Africa; Dr. Blaise Ijebor, Director of Risk Management, CBN; Keelan Singh, Head, UiPath EMEA Banking and Financial Services; Shweta Juneja, Partner, McKinsey Digital; Wole Odeleye, Financial Services Technology Lead, Microsoft; Ope Ajayi, Founder & CEO, Cinemax; Elo Umeh, and Managing Director of Terragon.

The fair featured two panel sessions. The first panel, which examined “The next frontier: Digital Wallets, Contactless payments and BNPL (Buy Now Pay Later)”, had Chris Lu as the host, with five discussants, including Fey Wong, Country Director, Palmpay; Premier Oiwoh, Managing Director, NIBSS; Vincent Ogbunude, Managing Director, Verve; Ebehijie Momoh, Country Manager, MasterCard, and Managing Director of Network International, Adelola Agbebiyi.

The second panel explored the theme “The intersection of Fintech, eCommerce and SMEs – Collaboration for growth”. It was hosted by John Obidi and had five discussants, including Prince Nnamdi Ekeh, Chief Executive Officer, Konga; Tunde Kehinde, Managing Director, Lydia; Stan Martins, Regional Director, Meta; John Obaro, Chief Executive Officer, Systemspecs, and Seyi Banigbe, Founder of Bland2Glam.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago