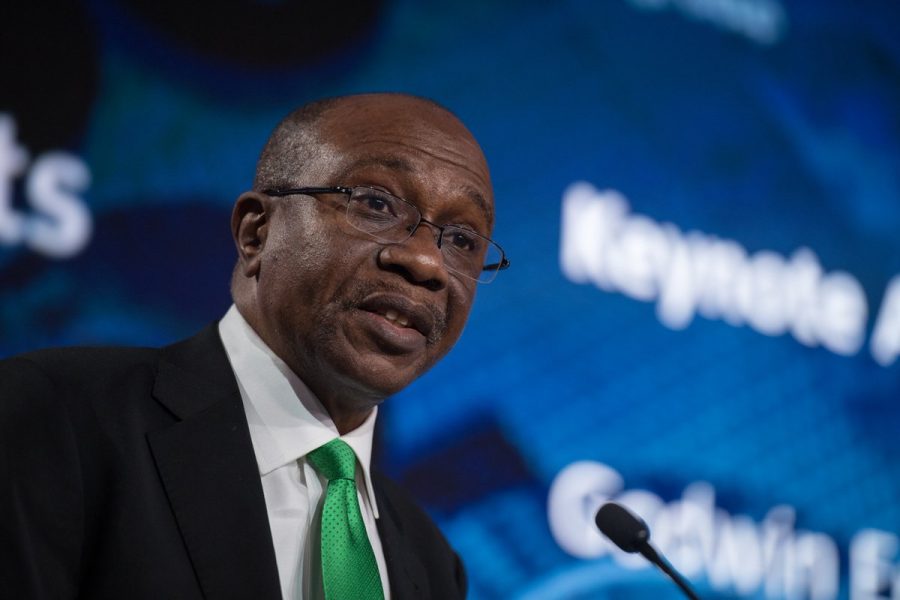

The Central Bank of Nigeria (CBN) has maintained its stance on crypto ban in the country even as Bitcoin now trades above $30k for the first time since June 2022.

The CBN Director Risk Management Department and Chief Risk Officer Blaise Ijebor recently disclosed that there are no ongoing plans by the apex bank to reverse its stance on crypto trading in the country.

In his words, “Our position has not changed on crypto, and I am not sure it will ever change. If you want to use digital assets, use eNaira. It has all the properties of a digital asset”.

Recall that in February 2021, the CBN ordered banks in the nation to stop transacting in and with entities dealing in crypto assets. Meanwhile, Nigerians have continued to trade crypto assets, despite the CBN restrictions.

In 2021, Nigeria was the largest trading crypto trading country 2021 with 16,000 daily trades.

On the other hand, Bitcoin saw its valuation stand at $30.30k on Saturday, April 15, when the entire crypto market crashed, due to the post-LUNA collapse and FTX contagion.

The fallout and resulting domino effect led to widespread problems in the crypto industry.

However, 2023 has so far been fruitful for the crypto industry, as it has gained nearly 84% so far, which saw Bitcoin emerge as the top-performing asset in the respective market in the first quarter (Q1) of 2023.

Ethereum also rallied and was closing in on the $2,000 level for the first time since last year August.

Bitcoin stalled in February but then regained momentum in late March following the failure of Silicon Valley and Signature banks when some investors questioned the stability of the current monetary system and regained their appetite for assets that hold their value.

Commenting on the recent surge in the price of Bitcoin, the CEO of Zebpay, a crypto exchange platform, Rahul Pagidipati said, “Bitcoin has been on an upward trajectory since the beginning of 2023.

On Jan 1st, Bitcoin began trading at roughly $16,500. As of 11th April, the asset has been trading above the $30,000 mark which is close to an 80% gain since Jan 2023.

This is the first time since June 2022, that Bitcoin has reached this level. If the asset sustains above the key psychological resistance level of $30,000, we might see the price rise further.”

Investors King understands that the rise of Bitcoin can be attributed to various factors such as banking sector instability, growing inflation in the US, and uncertainty surrounding stablecoin.

Many investors are betting against the declining value of the US dollar and are investing in Bitcoin as a hedge against inflation.

This has led to a surge in institutional adoption, with big players like MicroStrategy accumulating around 1,40,000 Bitcoins, one of the largest corporate holders as of date.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago