Nigeria’s naira extended its losing streak to a fifth consecutive day as it slipped to its weakest level since March despite the Central Bank of Nigeria’s (CBN) interventions.

The naira closed at 1,577.29 per dollar on Monday, down from Friday’s N1,563.8 per dollar on FMDQ.

This decline comes despite the CBN’s efforts to stabilize the currency by injecting $122.7 million through dollar sales into the market.

However, analysts argue that these amounts were insufficient to balance the robust domestic demand for the greenback.

“The CBN has been in the market selling $50 million from time to time, which is not enough,” commented Carlo Morelli, senior portfolio manager at Azimut Investment SA.

Morelli attributes the persistent pressure on the naira to capital outflows and a lack of investor confidence in the currency, despite the central bank’s commendable efforts in tightening monetary policy and reducing naira liquidity.

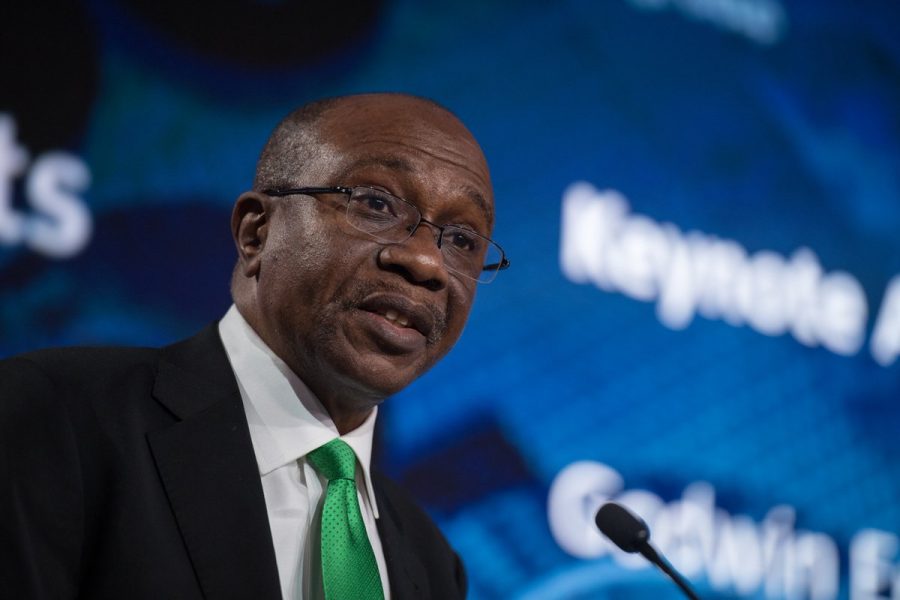

Central Bank Governor Olayemi Cardoso has aggressively raised interest rates in an attempt to curb inflation and stabilize the naira.

The benchmark borrowing rate now stands at 26.25%, following an increase of 14.75 percentage points since May 2022.

However, the currency has weakened by approximately 70% against the dollar since exchange-rate controls were eased last year.

“Restoring foreign exchange broad confidence is the last step, and the huge volatility in May delayed the return to normalcy,” Morelli added.

“Many foreign investors are still waiting for more evidence of stability before considering Nigeria investable.”

The naira’s decline makes it the second-worst performing currency tracked by Bloomberg in 2024, trailing only the Lebanese pound.

The recent depreciation has been fueled by both seasonal dollar demand and ongoing investor skepticism.

The central bank’s next policy decision, set for July 23, is expected to address these issues. Monday’s data showing annual inflation quickened to 34.2% in June suggests that another rate hike might be on the horizon.

In a bid to bolster the naira, the central bank has increased Nigeria’s foreign exchange reserves to $35 billion as of July 8, the highest level since May 30, 2023.

This boost is attributed to recent loans from the World Bank and the African Export-Import Bank.

Omobola Adu, an analyst at BancTrust & Co. Investment Bank, noted that recent pressure on the naira has also stemmed from corporates and individuals preparing for foreign vacations.

“Boosting the supply of FX into the country remains crucial for the government to alleviate pressure on the naira,” Adu stated.

He suggested that a eurobond or local dollar bond sale later this year, along with increased support from multilateral institutions, could help shore up reserves.

Despite these challenges, Central Bank Governor Cardoso remains optimistic, asserting that the worst of the currency’s volatility is over.

He reiterated this sentiment on Thursday in Lagos, addressing business leaders and highlighting improvements in crude output and capital inflows as positive signs.

Nigeria, Africa’s largest crude producer, relies heavily on oil sales, which account for at least 80% of its export earnings.

The country’s combined crude oil and condensate output rose to 1.5 million barrels per day in June, the highest since February, according to the upstream petroleum regulatory commission.

“While the naira may be undervalued, for the naira to stabilize and perhaps regain ground, large portfolio and capital inflows are needed,” said Samir Gadio, head of Africa strategy at Standard Chartered Plc in London.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago