Telecommunication companies have recovered from the losses they suffered following the Federal Government’s policy of linking of National Identity Numbers with SIM cards.

It could be recalled that the industry statistics released by the Nigerian Communications Commission had disclosed that the telecom giants including MTN Nigeria, Airtel, Globacom, and 9mobile had lost 20.83 million subscribers since the linking of NIN-SIM cards link began.

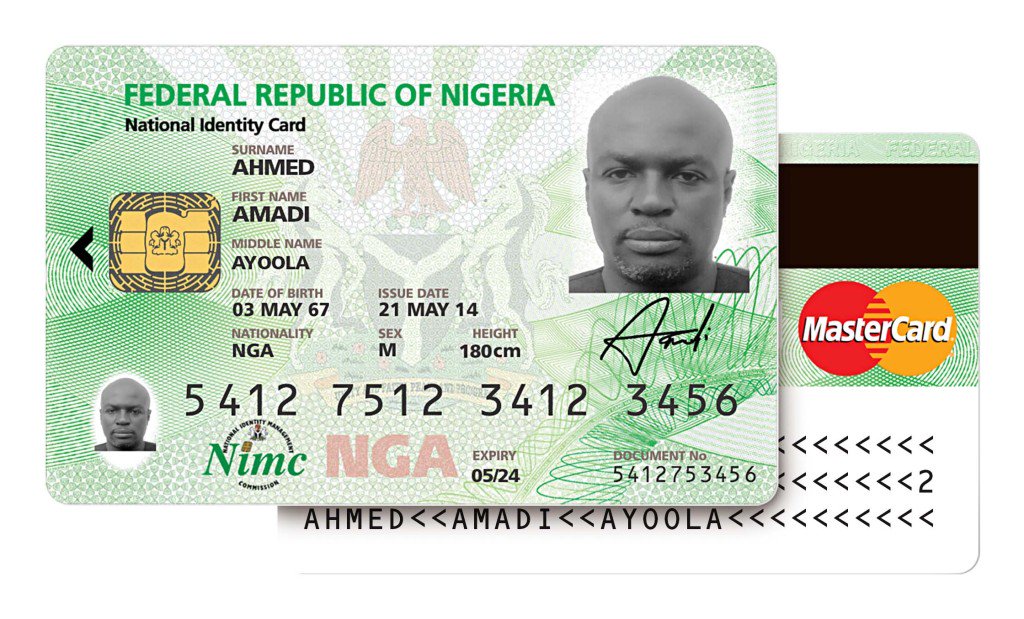

The Federal Government had in 2021 set a deadline for citizens to link their NIN with their SIM cards and had banned the sales of new SIM cards in December of same year in a view to tackling insecurity and identifying fraudulent individuals easily.

However, during the period of the ban and having lifted the ban in April of the same year, telcos had lost subscribers numbering 20.83 million which amounted to N29.58bn in lost revenue.

After the policy fully kicked off in April last year, over 72.77 million active telecommunication subscriptions that didn’t link up were denied access to make calls.

Meanwhile, new data from the Nigerian Communications Commission (NCC) has revealed that the telecommunications industries are shaking off the loss and recording higher subscriptions from Nigerians.

The data put the number of mobile subscriptions in the country to 222.23 million in 2022 despite the implementation of the NIN-Subscriber Identity Module policy.

The companies, according to the data, grew by 13.89 percent in 2022 as against 4.42 percent from 204.15 million as of December 2020 to 195.13 million as of December 2021.

Subscriptions total number increased from 195.13 million as of December 2021 to 222.23 million as of December 2022, the data revealed.

MTN Nigeria, within the period captured by the data, grew by 20.96 per cent from 73.59 million to 89.02 million; Airtel increased by 11.38 per cent from 53.93 million to 60.07 million; Globacom grew by 9.98 per cent from 54.82 million to 60.29 million; and 9mobile grew by 0.49 per cent from 12.85 million to 12.79 million.

Also in 2022, teledensity, the number of active telephone connections per 100 inhabitants living within an area, recorded growth amounting to 116.60 per cent, which is said to be the highest on record.

Reacting to the development, the Chief Operating Officer, Association of Telecommunications Companies of Nigeria, Ajibola Olude, said the mobile subscriptions’ growth in 2022, was due to the increased usage of Internet and active participation of Nigerians on social media.

Olude also linked the growth to efforts of the federal government through it awareness creation on the importance of embracing Information Communication Technology, saying that most Nigerians need SIM cards to carryout out their daily activities.

He said many Nigerians now operate their businesses and services online and that the cashless police of the Central Bank of Nigeria also motivated Nigerians to get more SIMs and get more Internet-enabled phones.

It is on record that Nigeria’s mobile population is the largest in Africa and is expected to continue to grow because of its increasing population of youngsters who are internet-savvy.

GSMA, the global body representing telcos, has disclosed that 18 million new Nigerians will become unique mobile subscribers by 2025.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago