Shares of African e-commerce giant Jumia (JMIA) surged to $8.67 on Monday, a significant milestone in the company’s remarkable recovery this year.

This price represents the highest the stock traded in 2024, starting at a modest $3.36. The gain highlights investor confidence following the company’s strong Q1 2024 results.

Despite not yet achieving a unicorn valuation, Jumia’s market capitalization has climbed to an impressive $872 million.

This turnaround is primarily attributed to the company’s strategic shift under the leadership of CEO Francis Dufay, who took over in 2023.

Dufay has focused on cost-cutting measures and driving revenue growth, a departure from Jumia’s previous struggles with profitability.

In Q1 2024, Jumia reported a 70% reduction in losses, thanks to significant cuts in advertising and sales expenses. Meanwhile, the company saw an 18.5% increase in revenue.

These results are particularly noteworthy given the economic challenges in some of Jumia’s major markets, including high inflation and currency devaluation.

“The impressive Q1 results have renewed investor confidence,” said an industry analyst. “Jumia’s ability to cut costs while growing revenue in such a challenging environment is a testament to their strategic realignment.”

Dufay’s leadership has been pivotal in this transformation. He has made bold moves, including shutting down the loss-making Jumia Food vertical and relocating UAE-based executives to Jumia’s key markets.

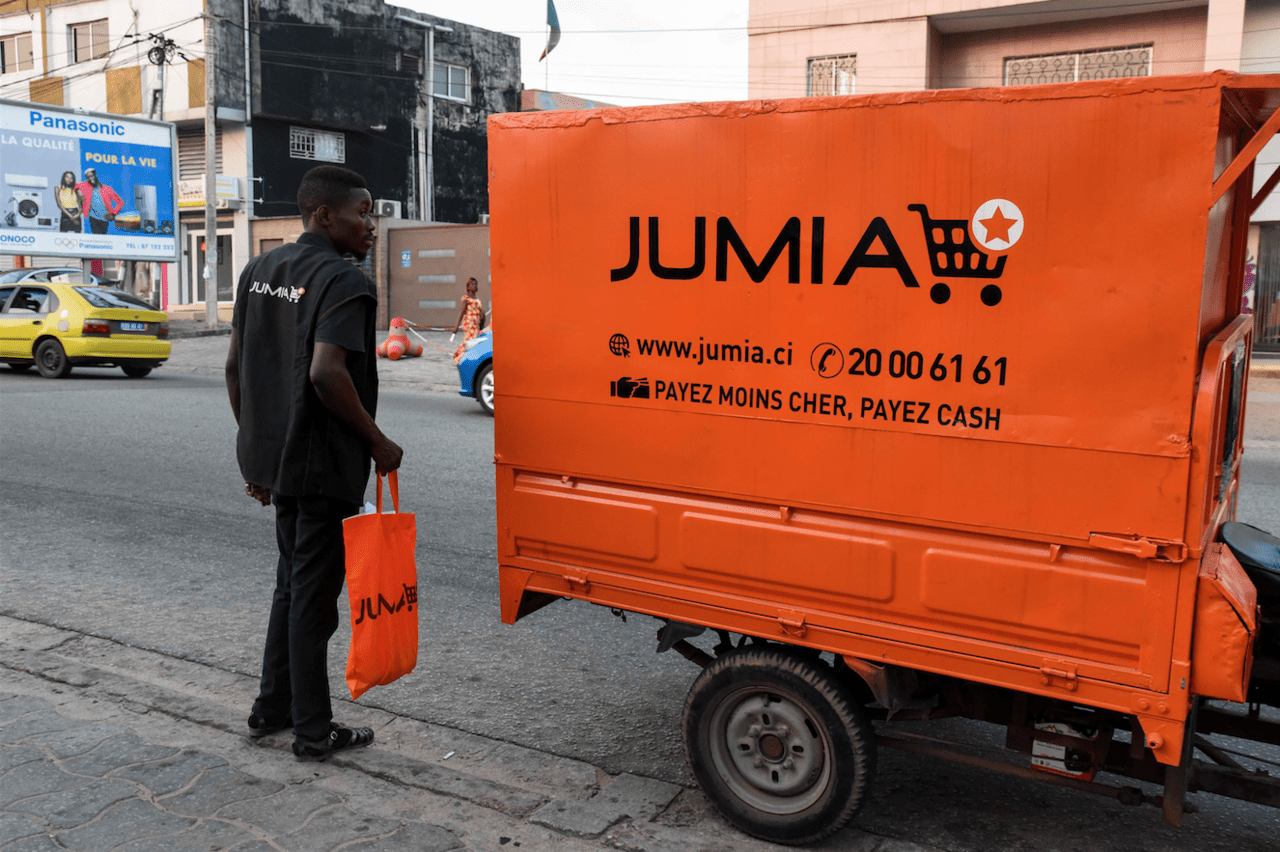

Also, the launch of a new 30,000 square meter integrated warehouse in Lagos has enhanced Jumia’s logistics capabilities, reducing delivery times and improving customer satisfaction.

“The shift in business model and operational focus is showing positive results,” commented Dufay. “We are committed to sustaining this growth trajectory and building a robust, profitable business.”

Jumia’s stock performance has drawn positive reactions from investors, particularly given the broader economic challenges in Africa.

The company’s turnaround is seen as a promising sign, especially as competitors like Amazon begin to make inroads into the African market with their launch in South Africa.

Jumia’s initial public offering in 2019, listed on the New York Stock Exchange (NYSE) at $14.50 per share, generated significant excitement.

However, the subsequent years were marked by fluctuating share prices and ongoing struggles with profitability. The recent surge in share price reflects a renewed optimism about Jumia’s future under Dufay’s leadership.

As Jumia continues to navigate the complexities of the African e-commerce landscape, it remains focused on achieving sustainable growth and profitability. The recent stock surge is a clear indication that investors believe in the company’s potential to thrive in a competitive market.

“Jumia’s journey has been challenging, but our commitment to innovation and operational excellence is unwavering,” Dufay stated. “We are excited about the opportunities ahead and remain focused on delivering value to our shareholders and customers.”

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago