Stock Market

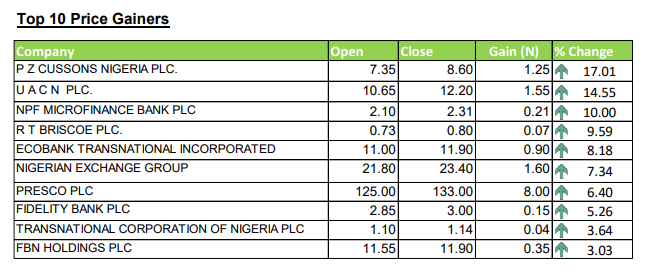

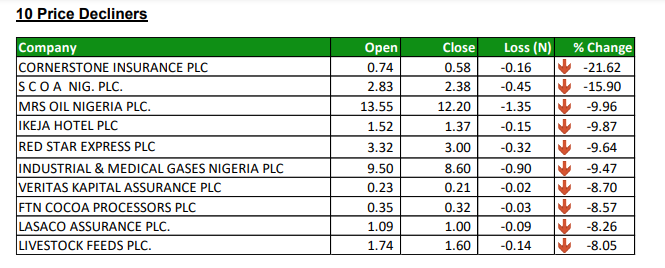

Economic Uncertainty Plunges Stock Market, Investors Lose N83 Billion in 7 Days

Nigerian Exchange Limited

Nigerian Stock Market Sinks as Benchmark Index Hits January Levels

Bonds

Investor Appetite Wanes as FG Bond Auction Sees Lowest Participation of the Year

Stock Market

Retail Traders Revive Meme-Stock Craze with GameStop and AMC Rally

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 24th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 22nd, 2024

-

Travel4 weeks ago

Travel4 weeks agoSaudi Arabia Breaks 70-Year Alcohol Ban, Opening Shop for Diplomats

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 30th, 2024

-

Jobs4 weeks ago

Jobs4 weeks agoJob Cuts Hit Tesla: More Than 6,000 Positions Axed Across Texas and California

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 25th, 2024

-

Investment4 weeks ago

Investment4 weeks agoMinister Accuses Past NCDMB Leadership of Squandering $500m on Unproductive Projects

-

Travel4 weeks ago

Travel4 weeks agoDelta Air Lines Flight Diverts to Togo After Passenger Dies Midair