The First Bank in Nigeria

When discussing banks in Nigeria, it is virtually impossible to avoid mentioning the banking giant that is First Bank of Nigeria Limited, known as First Bank. It was the very first bank to be established in Nigeria. The bank is a force to be reckoned with across Nigeria, and has a solid reputation among citizens and residents of the country.

History of First Bank of Nigeria

The Bank was initially founded in 1894, by Sir Alfred Jones who was a shipping tycoon from Liverpool, England. The Bank had its first head office in Liverpool, but started business on a medium scale in Lagos, Nigeria under the name Bank of British West Africa (BBWA).

In 1912, the Bank obtained its first competitor, the Bank of Nigeria (previously known as the Anglo-African Bank) which was established by the Royal Niger Company in 1899. In 1957, the Bank of British West Africa (BBWA) became the Bank of West Africa (BWA). In 1966, the Bank underwent another name change after its merger with Standard Bank of the UK, adopting the name Standard Bank of West Africa Limited. In 1969, the Bank was also incorporated locally as the Standard Bank of Nigeria Limited, in accordance to the Companies Decree of 1968.

There were more changes to the name of the Bank in 1979 and 1991, with the 1979 change seeing the name turn to First Bank of Nigeria Limited and the 1991 change seeing the name become First Bank of Nigeria Plc. In 2012, the Bank went ahead to change its name once again to FirstBank of Nigeria Limited as part of a restructuring process which resulted in FBN Holdings Plc, after detaching its commercial business from other businesses in the FirstBank Group, in line with the new regulation established by the Central Bank of Nigeria (CBN).

In December 2012, First Bank had great leaps. It had 1.3 million shareholders around the world, was quoted on the Nigerian Stock Exchange (NSE) as one of the most capitalized companies, and also possessed an unlisted Global Depository Receipt (GDR) programme, all of which were transferred to the Bank’s Holding Company, FBN Holdings in December 2012.

The Growth and Operation of First Bank

The Bank built on its solid foundation and has consistently broken new ground in the local financial sector for over 120 years. FirstBank is currently present in the United Kingdom and France through its subsidiary, FBN Bank Limited with branches in the popular cities of London and Paris; and in Beijing with its Representative Offices there. In October 2011, the Bank purchased a new subsidiary, Banque International de Credit (BIC) which was one of the top banks in the Democratic Republic of Congo. In November 2013, the Bank went on to acquire ICB in countries like Sierra Leone, Ghana, Guinea and The Gambia before acquiring ICB in Senegal in 2014.

These acquisitions represented major landmarks in the Bank’s plan to grow its footprints in Sub-Saharan Africa, and all the African subsidiaries now carry the FBN Bank brand.

As the operating environment continues to evolve around the world, FirstBank keeps up with these changes as it continues to respond to the specific needs of its customers, investors, regulators, host communities, employees and other stakeholders. Through a balanced take on plan execution, the Bank has strengthened its leadership of the financial industry by maintaining an appeal which cuts across generations. This has made the Bank to further bolster its customer base which spans across different segments in terms of sectors, structure and size.

Through the usage of experience which spans across more than one hundred years of reliable service, FirstBank builds relationships and partnerships with vital sectors of the country’s economy which have been strategic building blocks for the growth, development and overall well-being of the country. With the Bank’s large asset base and wide branch network coupled with consistent reinvention, FirstBank is Nigeria’s strongest banking franchise, maintaining market leadership in all areas of the country’s financial services industry.

The Bank has more than 750 business locations across Nigeria, all of which operate online and in real time, the Bank possesses one of the biggest domestic sales networks in the country. As a leader of the market in the financial services sector, FirstBank led initiatives in international money transfer as well as electronic banking in the country, serving well over 14 million customer accounts.

The Bank’s strategy has been focused on restructuring the business to take proper advantage of growth opportunities within the financial services industry, following business line expansion across strategic business units, continuously implementing a systematic international expansion plan, and building synergies across the FirstBank Group.

In terms of international expansion, the Bank’s focus is the financial services markets in the Sub-Saharan region of Africa.

Important Milestones of First Bank

- 1894 – Incorporated and Headquartered in Marina, Lagos as the Bank of British West Africa (BBWA)

- 1912 – The second branch in Nigeria was opened by King Jaja of Opobo in Calabar, with a branch also opened in Zaria as the first branch in the northern part of the country

- 1947 – BBWA gave the first long-term loan to the colonial government at the time

- 1955 – Partnered with the government to expand railway lines

- 1957 – Became the Bank of West Africa

- 1966 – Became Standard Bank of West Africa Limited, after a merger with the Standard Bank of the UK

- 1969 – Became locally listed as Standard Bank of Nigeria Limited

- 1971 – Bank’s first listing on the Nigerian Stock Exchange

- 1979 – Became the First Bank of Nigeria Limited

- 1991 – Became First Bank of Nigeria Plc

- 1994 – Launched the first university endowment programme in Nigeria

- 2012 – Became a Subsidiary of FBN Holdings Plc.

- 2013 – Completed the acquisition of ICB assets in Guinea, Gambia, Sierra Leone and Ghana as part of an expansion program

Leadership of FirstBank

Chairman – Tunde Hassan-Odukale

Tunde Hassan-Odukale is a graduate of the University of London and City University, London. He joined the board of First Bank of Nigeria Limited as a Non-Executive Director in 2011, and is currently the Managing Director of Leadway Assurance Company Limited. His management experience spans over 22 years and includes asset management, finance, life insurance operations and IT.

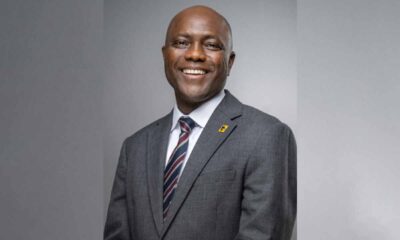

Managing Director/CEO – Adesola Adeduntan

Dr. Adesola Kazeem Adeduntan has been the Managing Director/CEO of First Bank of Nigeria Limited and its Subsidiaries since January 1 2016. Before this, he was the Executive Director and Chief Financial Officer of the Bank since 2014 when he was given an appointment on the Bank’s board. He was a Director and the pioneer Chief Financial Officer/Business Manager of Africa Finance Corporation.

He has also served as a Senior Vice-President & Chief Financial Officer at Citibank Nigeria Limited, a Manager at Arthur Andersen Nigeria and a Senior Manager in the Financial Services Group of KPMG Professional Services.

Deputy Managing Director – Olugbenga Francis Shobo

Olugbenga Francis Shobo joined the board of First Bank of Nigeria Limited in 2012. He was formerly the Executive Director overseeing the Retail Banking/Public Sector businesses in the Lagos, West and South Directorate before his appointment as the Deputy Managing Director of the Bank. He is the first person to be given an appointment as the Deputy Managing Director of FirstBank in the Bank’s history which spans over 120 years.

Executive Director, Public Sector Group – Abdullahi Ibrahim

Abdullahi Ibrahim was appointed as an Executive Director at First Bank back in 2017. Prior to his appointment as Executive Director, he served as Group Executive Retail banking north from December 2012 until he was appointed as Group Executive, Technology and Services. He was the first Group Head, Manufacturing Group in the Institutional Group of the Bank.

Executive Director, Corporate Banking – Remi Oni

Remi Oni was appointed as the Executive Director, Corporate Banking in April 2016. Prior to his appointment, he was the Executive Director, Corporate & Institutional Banking for Nigeria and West Africa at Standard Chartered Bank.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago