Payourse, a Nigerian-based blockchain startup has raised $600,000 pre-seed fund to hire more talents, expand operations into new markets and accelerate crypto adoption on the continent.

Investors who participated in the pre-seed funding are, Michael Ugwu, Flori Ventures, Voltron Capital, Allegory Capital, CELO Co-founders Marek Olszewski and Rene Reinsberg, Kola Aina, Ventures Platform; Angel Touch Holdings; and Oluwatobi Anisere.

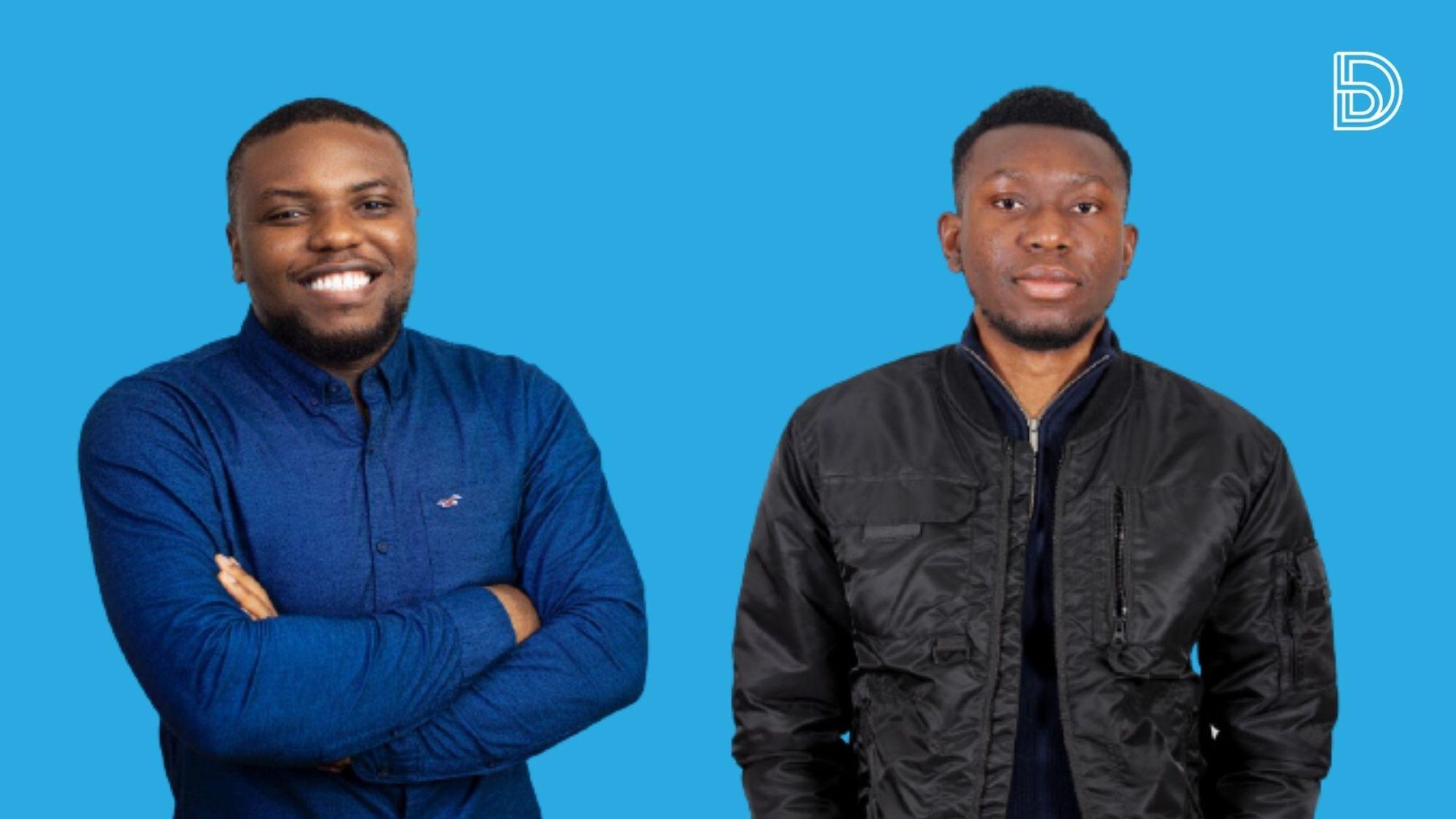

Payourse was founded in 2019 by Bashir Aminu (CEO) and John Anisere (CTO) to accelerate access to crypto for Africans by providing tools that make it easier, faster and cheaper for businesses to build user-friendly crypto products.

The company had earlier raised some funds in 2020 from Oluwatobi Anisere and subsequently $100,000 each from Ugwu in March and Flori ventures in July 2021. The $600,000 pre-seed fundraised is the company’s first official fundraising.

In an interview with Techpoint, Aminu revealed he had dropped out of a five-year degree program from the Federal University of Technology, Minna in 2017 and had co-founded two startups with his friend Orewole whom he met at an online crypto platform, however, the two businesses failed.

He started his career as a graphic designer, got a job with an Australian company before moving to Busha as Design Lead where he met Anisere. He had worked in different capacities across the fintech space, from product designer at TeamApt, Design lead at Yellow Card Financial, product designer at Interswitch, and finally Head of Africa at Binance P2P.

Payourse, the parent company has three core functionalities that power its infrastructure: wallets, remittances and liquidity.

Talking about the conception of Coinprofile, a subsidiary of Payourse, he said the idea struck him while working as a product designer in Busha. He saw the need to build a simple platform that collects wallet addresses and generates shareable links, this idea was shared with his colleague Anisere who was working as a front-end engineer at Busha. Anisere welcomed the idea and the project ‘Coinprofile’ was launched in 2019.

Coinprofile was launched to bring a seamless transaction experience to crypto traders. Aminu noticed the tedious process traders encountered while sending digital assets from one wallet to another.

He said, “I used to be an OTC (over-the-counter) trader, so anytime someone wants to send me crypto, and I always have to go to my wallet address and copy wallet address and send it to them. It was a very tedious process”. Coinprofile created a platform for traders to create an account and store all their wallet addresses, creating unique links leading to a landing page.

“In May 2020, after acquiring a handful of users and considering the feedback and requests we’ve pulled, we added a remittance functionality that allows users to make payment with their wallets,” Aminu said.

When asked about the sudden emergence of Payourse, he revealed that the company has been in existence the same year Coinprofile was founded. He said, “well, we actually created Payourse, a long time ago, in 2019 as a parent company, but we never really announced it to the world. But it’s always been the parent company. And we’ve always had this long term vision of a company which would build user-friendly products on top of crypto”

Speaking on the new investment, Bashiru Aminu said the team is proud of the quality of their investors. “This new funding will help us improve our existing use-cases and then build more as we extend into new markets and accelerate crypto adoption on the continent.”

“I worked closely with Bashir as a visiting Partner at Flori Ventures. I’ve spent 4 batches at YC and rarely do I see a company with this kind of knockout performance and a founder who is willing to put in the hard work to continue to nurture it. Bashir is capable of meeting the demands of a crazy growth startup and also ramp up fundraising”. Holly Liu, Visiting Partner at Flori Ventures, said.

Also speaking about Payourse, Olumide Soyombo, Managing Partner at Voltron Capital, said: “We are excited to back the Payourse mission as we believe this team is a super technical team with subject matter expertise. The team is solving an important problem by providing the key infrastructure for Africans and African businesses to adopt crypto”.

Payourse believes the future of finance in Africa will be defined by crypto and its positionig itself to help more African businesses and individuals get on board. The company is targeting Ghana and Kenya market as it expands its operations.

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Jobs4 weeks ago

Jobs4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Travel4 weeks ago

Travel4 weeks ago