Mondia Digital, a consolidation of the Mondia Group‘s digital content distribution business, an end-to-end, product-centric and data-driven company with a focus on opportunities in the B2B segment, and its digital payments company, Mondia Pay, are proud to have contributed their expertise and innovative payment, content and B2B platforms to Vodacom’s VodaPay “Super App”, which launched in South Africa in August 2021.

The VodaPay Super App, designed in collaboration with Alibaba Group-owned fintech services platform Alipay, allows consumers to do everything from paying bills to sending money, playing games and ordering takeaways. The VodaPay Super App offers consumers a single point of entry and payment platform, with no additional download required.

Mondia Digital has integrated all of its technology, content and services into the easy-to-use VodaPay Super App environment. It is also responsible for connecting third-party content providers into this ecosystem.

Mondia Digital will make a selection of its custom content platforms available through the Super App, including: Mum and Baby – a free-of-charge mobile health intervention that provides maternal, neonatal and child health information designed to encourage good health practices; Vodacom’s vLive app – a lifestyle and entertainment mini-ecosystem within the Super App that uses gamified elements to manage subscriptions to Mondia’s 123 Kaboodle kids content service; Playinc., a comprehensive gaming portal; and My Muze, a 360º music portal.

Mondia Digital has also co-created many of Vodacom’s key branded services on the Super App platform.

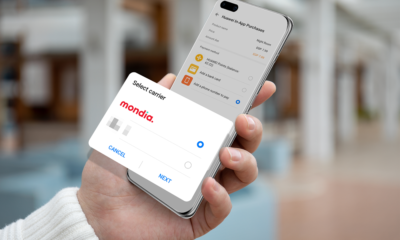

In addition to content integration, Mondia Pay has rolled out the provision of its seamless, contactless Direct Carrier Billing (DCB) payment service to the VodaPay Super App. DCB allows customers to make payments conveniently and securely by charging them to their mobile phone bill. Mondia Pay’s DCB service is used by tens of millions of customers across the Middle East and Africa, and provides a highly scalable payment gateway that both customers and merchants can trust.

DCB is seamless, with no need to sign up for any additional accounts or fill out any forms. Payments are completed in a matter of seconds and provide the best checkout experience on mobile devices, where filling out forms is time consuming and cumbersome. Making payments with DCB is secure. No personal data is transmitted during the payment process so there is no need to worry about identity theft.

Paolo Rizzardini, CEO of Mondia Digital, said, “We are committed to the continuing digitalisation of Africa, and the VodaPay Super App B2B ecosystem is an exciting opportunity in this regard. The future of digital content consumption is going to be driven by innovative partnerships that offer compelling and convenient consumer solutions. Our growth across Africa has been driven by our ability to create consumer-centric products with outstanding digital content, and secure long-term, fruitful partnerships with some of the most innovative and dynamic companies on the continent. Our enduring relationship with Vodacom continues to deliver value for consumers and a growing ecosystem of third-party businesses alike.”

Simon Rahmann, CEO of Mondia Pay, said, “The VodaPay Super App is an exciting environment in which to implement our DCB platform. All-in-one environments offering seamless access and seamless payment are the future of customer and business ecosystems. By offering consumers a simple, fast and secure way to pay for services using their mobile phone, we not only encourage financial inclusion, but we make it easier for local and global developers to offer their services to millions more people.”

Vodacom Group CEO Shameel Joosub said, “Our partnership with Mondia Digital and Mondia Pay strengthens our access to world-class technology and expertise, and leverages their experience across the MEA regions in developing strong, valuable partnerships and delivering seamless payment and content platforms. We want to drive financial inclusion, enhance the business-to-business ecosystem and transform the fintech environment in South Africa, by offering the capabilities of the VodaPay mini programs to as many businesses, of all sizes, across multiple industries as possible.”

While the Super App will be accessible to customers on any mobile network, it will be zero-rated for Vodacom users. The VodaPay Super App is set to be rolled out in other international Vodacom markets.

Developers and businesses are invited to join the VodaPay ecosystem by building their own “mini programs” – third-party, downloadable sub-applications run within the super app.

Some 70 businesses have already signed up or have committed to building their own mini programs in the app, including Big Blue, FlightSite, Dollar, Thrifty, West Pack, Petzone, NetFlorist, Kitkat Cash & Carry, Droppa, Planet54, Jacaranda FM, KFC, and Booking.com.

Mini programs can accept both physical and online payments from customers with the in-app VodaPay digital wallet. Customers can choose to pay upfront, with rewards, or with payment terms such as buy-now-pay-later and nano-credit offerings.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago