Technology

Microsoft Invests in Rubrik, Partners to Protect Customers from Ransomware

Telecommunications

Telecom Tariffs Set to Rise as FG Proposes 12.5% Tax Hike

Fintech

US Continues to dominate Global FinTech Landscape in Q3 2024, Witnesses Funding of $2.7B

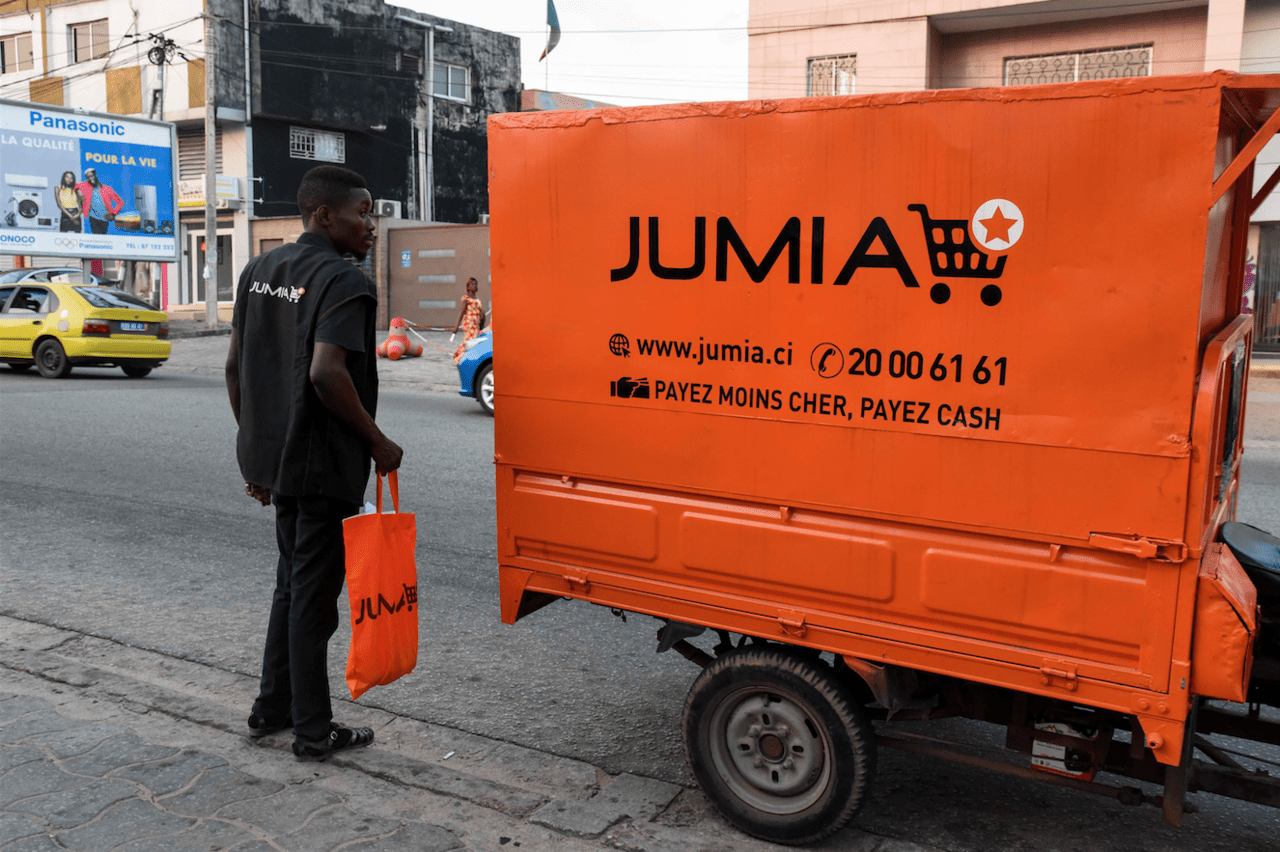

E-commerce

South Africa, Tunisia Record Job Losses as Jumia Shuts Down Outlets Over Diminishing Returns, Hopes on Nigeria, Others

-

Education4 weeks ago

Education4 weeks agoFederal Government Approves 133% Allowance Boost for NYSC Members, Now ₦77,000

-

News3 weeks ago

News3 weeks agoBbnaija’s Wanni Wins Innoson Car Challenge, Secures First Vehicle with Twin Sister

-

Business3 weeks ago

Business3 weeks agoNigerian Businesses Slash Dollar Exposure as Naira Depreciation Deepens

-

Technology3 weeks ago

Technology3 weeks agoOpenAI’s Valuation Soars to $157 Billion After $6.6 Billion Funding Round

-

Investment4 weeks ago

Investment4 weeks agoVice President Shettima Calls on Global Investors to Trust Nigeria’s Economic Reforms at UNGA

-

Investment3 weeks ago

Investment3 weeks agoFG Secures $200m Afreximbank Investment For Creative Industry

-

Telecommunications4 weeks ago

Telecommunications4 weeks agoTelecom Firms Face N56 Billion Monthly Diesel Bill Amid Power Woes

-

Banking Sector3 weeks ago

Banking Sector3 weeks agoUnity Bank, Anwbn Empower Women Entrepreneurs With Ai, Digital Marketing Skills