The depreciation in the value of the Naira has been attributed to the effects of the COVID-19 pandemic on the economy.

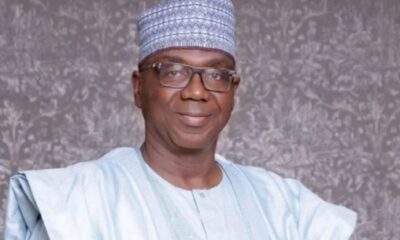

The deputy governor, Corporate Services Department of the Central Bank of Nigeria (CBN), Mr. Edward Adamu said this in Abuja on Monday.

He spoke at an interactive session with the House Committee on Finance on the 2022-2024 Medium-Term Expenditure Framework/Fiscal Strategy Paper (MTEF/FSP).

Adamu explained that the exchange rate was determined by the forces of demand and supply and that there were three main avenues by which Nigeria got its foreign exchange.

“We have proceeds from the sale of crude oil, we have foreign portfolio inflows and remittances; those are the three major ways that we get forex.

“Crude oil sale has not been as high as we all will want it to be and obviously in the aftermath of COVID-19, the global economy grounded to a halt and the use of crude oil was also halted.

“To the extent that sometimes in April last year, we had crude oil selling at a negative, which means that people were being paid to store what they bought and so that the avenue for forex inflows was significantly reduced.

“You go on to foreign portfolio inflows, you notice that investors also settled their affairs on the side of caution and so, once COVID-19 outbreak occurred, they moved out about $120 billion dollars from emerging markets to safe havens in America and Nigeria is one of those countries from where monies were withdrawn.

“On the side of remittances, once our brothers and sisters abroad were not working because of the situation they found themselves; they had very little to send to us here and so, we also saw remittances reduced.

“On the demand side, we saw speculative demand on the side of Nigerians, if you needed a truck of goods because you are not sure of the uncertainties of COVID, you wanted to get three trucks.

“All these pressures on both the demand and supply side, the availability of dollar became more difficult and we had a decline or depreciation in the value of the naira,’’ he said.

Adamu, however, said that a lot of efforts within the CBN and the recovering global economy were helping oil prices and remittances to recover.

”This is why we are happy that the exchange rate has stabilised somewhat; it is a moving target, but it has stabilised in the import and export window for a while”, he added.

However, the Chairman of the committee, Rep. James Faleke (APC-Lagos) directed the CBN to present its audited account to the Office of the Accountant General of the Federation (OAGF) for scrutiny.

Faleke said that information available to the committee showed that the apex bank was yet to turn in its audited accounts since 2010 and about N800 billion was yet to be remitted to the Federal Government.

Adamu responded by saying the apex bank would interface with the OAGF and reconcile any difference there was and report to the committee in two weeks, through the Minister of Finance.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Technology4 weeks ago

Technology4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Economy4 weeks ago

Economy4 weeks ago